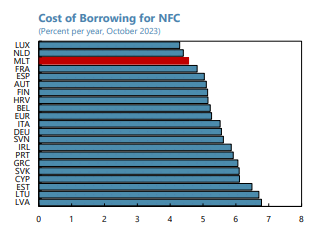

Companies taking out commercial loans from Maltese banks are enjoying the third-lowest rates in the eurozone, with only Luxembourg and the Netherlands offering lower interest rates.

This marks a remarkable turnaround, since Malta’s cost of borrowing for corporations had been among the highest in Europe ever since the country adopted the euro, consistently being a couple of percentage points higher than the eurozone average.

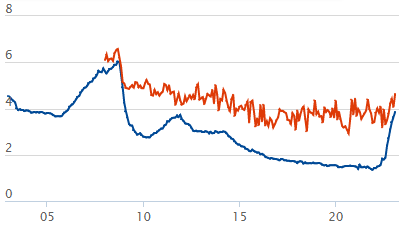

The change has come about because banks abroad are more exposed to changes in the European Central Bank’s (ECB) interest rates, which increased at record speeds over the 18 months as the continent grappled with high inflation.

However, those in Malta are shielded from the ECB’s monetary policy, thanks to significantly high deposits and relatively low loan-to-deposit ratios.

These characteristics have allowed local banks to maintain their lending rates at only slightly above pre-pandemic levels, while those in the rest of the eurozone have been forced to increase them significantly.

The result is that firms obtaining financing from Maltese banks can enjoy, for the first time, a lower cost of financing than their competitors abroad.

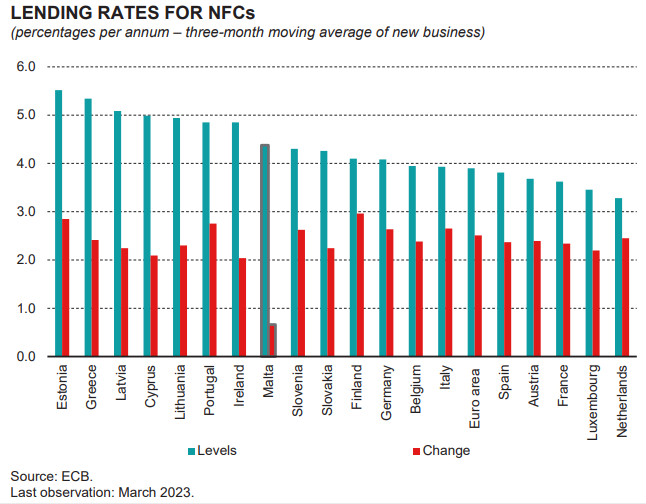

The change has been swift. As recently as 2022, commercial loans from local banks were among the highest in the eurozone.

By March 2023, as the ECB’s interest rate increases worked their way through the European economy, Maltese companies’ cost of borrowing was no longer quite so markedly expensive, but remained a far cry from being described as cheap, being eighth most expensive in the eurozone.

However, six months later, in October 2023, the same loan carrying much the same rate was the third-lowest in the currency union, as banks in other countries passed the ECB’s rate hikes through to their own customers.

Much the same is true for household lending, but Maltese property buyers already enjoyed the lowest rates in Europe in March 2023, with the position only confirmed in October 2023 – the date of the latest observation.

Government introduces mandatory physical inspection for vintage vehicle classification

From 1st September 2025, vehicles seeking vintage status must undergo a physical inspection by the official classification committee

Local filmmakers paid just €250 to screen at Mediterrane Film

The figure stands in stark contrast to the estimated €5 million total spend

Malta International Airport closes in on one million passengers in June

Meanwhile, aircraft traffic movement rose by 4.5 per cent year on year