The interest rates Maltese banks charge for home loans have tended to be more stable than is the case across the Eurozone. They have been higher over the last years of extremely low interest rates, but remained stable over the last year, while those in the Eurozone have rocketed upwards in response to the European Central Bank’s repeated interest rate hikes.

When it comes to business loans, on the other hand, the cost of borrowing can be described as more stable than in the Eurozone – but more importantly, it is more expensive, with Maltese corporate lending rates increasing in response to the prevailing interest environment at a far quicker rate than is the case for home loans.

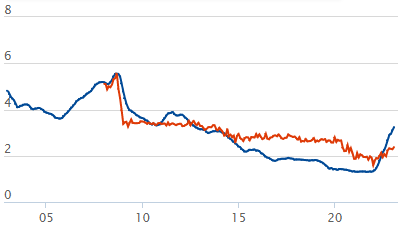

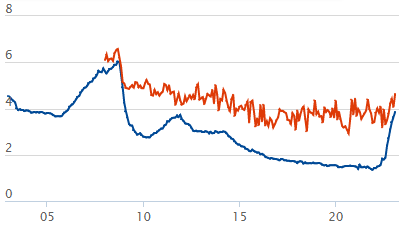

The Central Bank of Malta’s graphs clearly show the interplay between local and Eurozone interest rates for households and businesses.

The phenomenon was recently the subject of a webinar hosted by the Malta Association of Credit Management, with APS chief risk officer Giovanni Bartolotta presenting the data to those present.

“The cost of borrowing for new business in Malta has tended to be considerably higher than in the rest of the euro area,” he said.

“While there was some decline compared to 2008, this was nowhere near what happened in other countries. Despite the recent rise in the euro area, borrowing rates for businesses remain lower than in Malta.”

As for home loans, Mr Bartolotta pointed out that “the cost of borrowing tended to be like that in the euro area up to 2013.

“Then while rates fell in the euro area, the drop in Malta occurred later and was relatively more muted. On the other hand, rates in the euro area are now higher than those in Malta, a situation last seen in 2010/11.”

In terms of property, a major sector of investment in the local economy, and one in which much of Malta’s household wealth is tied up, stable interest rates arguably allow investors – many of them small-scale – to plan better for the medium term without having to worry about sudden shocks and the threat of possible foreclosure.

Businesses, on the other hand, seem to bear the brunt either way – paying higher rates when the cost of borrowing is otherwise cheap, but also responding more quickly and increasing more quickly when the cost of borrowing, as set by the ECB, increases.

Malta’s core banks boast a loan-to-deposit ratio of 56.6 per cent (as at end of 2021), as compared to 104.8 per cent for significant banks in the euro area.

This allows Maltese banks to avoid turning to the ECB for financing, since they can rely on their own customer deposit base to fund their loan book.

European Parliament adopts regulation making it easier for companies to be paid on time

The maximum credit term under the new Late Payment Regulation is to up to 120 days, for some sectors

French ATC strike forces Ryanair to cancel over 300 flights, affecting 50,000 passengers

The low-cost carrier is demanding the EU carries out reforms to ensure travel continues undisrupted

Valletta ranks 8th most expensive European capital city to live in – study

While London is the most expensive, Bucharest is the most affordable