There are many reasons to invest in Malta, some of which were outlined earlier this week. Here we continue to dig into the hard figures to explore whether the stability of Malta’s economy is built on solid ground.

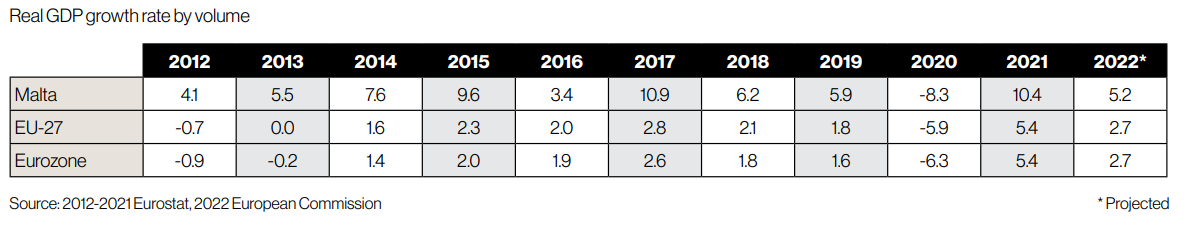

Malta exercises a prudential fiscal policy, with low budget deficits and even surpluses characterising the last decade of rapid economic development. During this period, the country has seen its GDP more than double to €14.5 billion as at the end of 2021, continually outperforming the European Union and Eurozone averages since 2007.

Significantly, Malta was capable of maintaining healthy economic growth even during the Great Financial Crisis, testifying to the local economy’s sound structural foundations.

The restrictions imposed on travel and social activities during the COVID-19 pandemic effected a severe downturn in 2020, but economic activity rebounded strongly in 2021 and is posed to grow by 5.2 per cent in 2022, 4.5 per cent in 2023 and 3.7 per cent in 2024, according to the Central Bank of Malta.

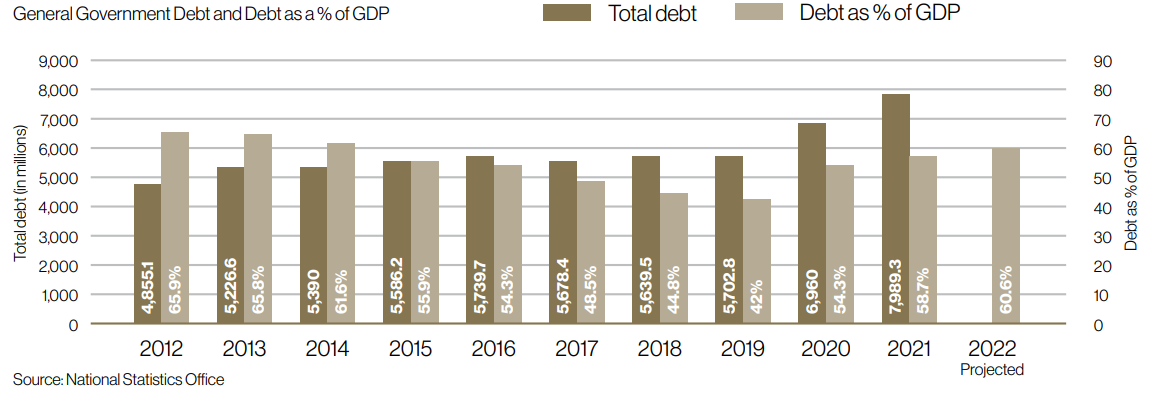

Government debt stands at around 58 per cent of GDP, and is largely domestic, with over 80 per cent held by local institutions and the Maltese investing public.

This solid fiscal context allowed for timely state intervention to mitigate the global inflationary pressures on food and energy prices felt throughout 2022, resulting in the lowest inflation rate in Europe.

Meanwhile, unemployment is also the lowest in the EU, while the proportion of employed individuals has continued to rise as female participation in the workforce has increased.

These favourable macroeconomic conditions have also been recognised through consistently positive credit ratings certifying Malta as a safe yet competitive jurisdiction for investment.

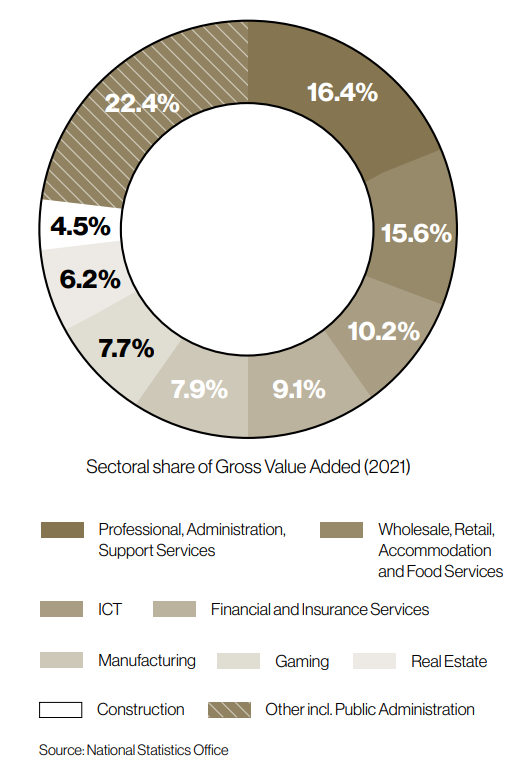

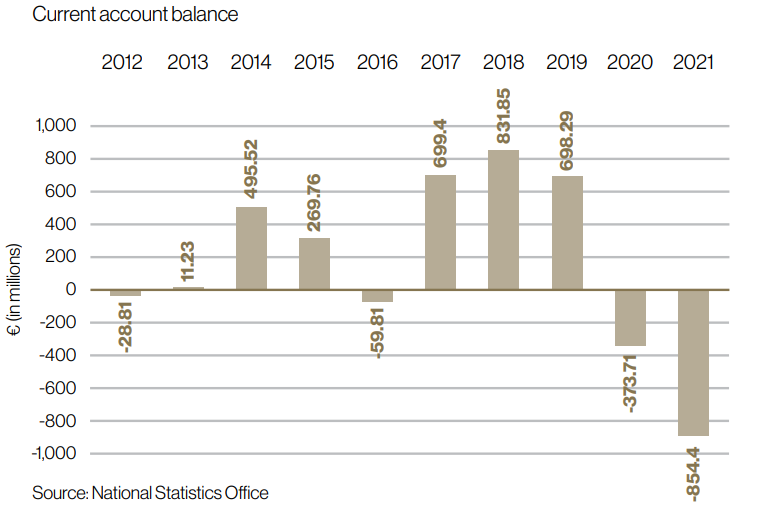

A net creditor in the global economy, Malta holds €269 billion in foreign assets as compared to €261 billion in foreign liabilities. The overwhelming majority of foreign investment in Malta is direct, at 83.2 per cent of the total, and includes activity by global players in both traditional sectors like high value-added manufacturing as well as in others which have developed more recently, like aviation.

Broadly speaking, Malta is a net importer of goods and a net exporter of services. Its top material exports include petroleum products, pharmaceuticals, electronics, and fish, while its main services exports are related to the tourism and travel, remote gaming, financial services, and professional and technical consulting sectors.

International economic and social assessments position the country among the top global performers. The United Nations Human Development Index puts Malta in the highest category, while the Social Progress Index, which determines how countries provide basic human needs, well-being, and opportunity for their citizens, lists Malta as a Tier 2 country, indicating a high level of social progress, a ranking shared with highly developed countries like the US, the UK, France, Austria and Singapore.

Malta has also obtained favourable ratings from the most trusted credit rating agencies in the world:

This feature was first carried in the Malta Invest 2023 edition. Malta Invest is the first-ever comprehensive international investment guide focusing on Malta as a destination. It is produced by Content House Group.

db Foundation raises €8,419 for Karl Vella Foundation with MasterChef Malta Charity Dinner

These events form part of the db Foundation's ongoing commitment to supporting vulnerable members of society through impactful initiatives

Residential property prices rise by 5.7% in first quarter of 2025

The new figures show continued growth in Malta’s property sector

Youth4Entrepreneurship Gozo 2025: Youth invited to propose innovative digital solutions

The initiative aims to empower youth to become active contributors to Gozo’s development by addressing local challenges