Crypto’s crash can seem expected, deserved, or even humorous to outsiders, but to the people who bought into the dream, it is fast becoming a nightmare.

New information emerging from bankruptcy proceedings by one of the leading operators in the space shows the devastating extent of the crash’s impacts on regular people.

Celsius is a US-based crypto lending company where users could park their virtual assets in return for promised annual returns of “up to 17 per cent”. It touts its “military-grade security” and “next-level transparency”.

After suspending all customer withdrawals in June, Celsius filed for Chapter 11 bankruptcy in New York.

This has left thousands of users with their funds frozen, and potentially used to pay the company managements’ salaries (which run into the tens of thousands each month).

Submissions to the court by Celsius users to have their funds unfrozen make for disturbing reading.

“I cannot begin to tell you the level of devastation and horror I felt when Celsius froze withdrawals,” wrote Andrew Dochterman, who had his entire life savings and retirement funds invested with the company, a total of $205,001.

Another, Kevin Montford, had placed his crypto in a custodial account, effectively a simple storage space that would not see the funds lent or invested, with no interest accrued. Mr Montford warned: “If the funds are not returned, my business would go bankrupt, my 15 employees would be let go, and 14 years of my life’s work lost and at the age of 49 years old, I would have to start over with nothing.”

His closing words are simply desperate: “The thought of losing this money has left me depressed, suicidal, and without words. Please return our money.”

Celsius offered its services all over the world, and the impact on those outside the US are just as, if not more, devastating, with investors lured in by the United States’ stellar reputation.

A person from India, who did not disclose his name, explained that: “Celsius is a company registered in the USA. Now USA being the frontrunner in almost every aspect from big businesses to new technological innovations, everyone would expect that if Celsius got its registration license in the USA, they must be running a legitimate operation, as USA is known to be strict with legal compliances related to businesses.”

Unfortunately, his $14,000 stuck with Celsius, amounting to “years of savings”, left him “very stressed and suicidal”.

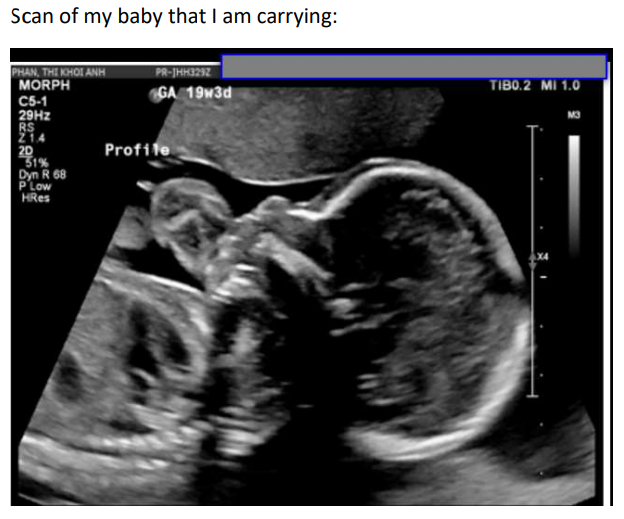

A female customer from Australia, Ann Phan, went so far as to send an ultrasound of her baby, saying that she needs the money locked up in Celsius to pay the doctor, hospital and other natal expenses.

“I was planning to withdraw from Celsius to fund my birth and my aunt’s operation in late June, but due to the withdrawal halt, I don’t have access to any funds and my life has become so miserable now. I am worried that my stress due to Celsius’s situation will affect the health of my unborn child.”

Ed Zitron, founder of EZPR, a leading PR firm and frequent commentator on the crypto market, observed: “Whatever “noble” goals Bitcoin and cryptocurrency allegedly has or had are irrelevant – cryptocurrency does not generate freedom, it does not democratize finance, it does not create wealth for the majority of people that interact with it, and it has – this is not a “might” – led to billions of dollars of regular people’s money getting burned so that wealthy people can extract liquidity from them.”

Malta’s youth population down by 15,000 in 10 years: What does this mean for the labour market?

'The challenge today goes beyond attracting talent – it’s about retaining it'

Self-employed, employees and companies contribute €2.1 billion in 2023

Parliamentary data reveals five-year growth trends in fiscal contributions

MBB urges caution over EU’s 2040 climate targets, citing risks for Maltese businesses

'The proposed target presents both opportunities and challenges'