The European Central Bank (ECB) is expected to keep interest rates unchanged at its September meeting, but discussions on further cuts could return later in the year if economic conditions worsen, according to sources familiar with the matter.

The Governing Council left its key rate at two per cent in July, with ECB President Christine Lagarde stating that the euro zone’s central bank was “in a good place.” That decision effectively ended a year-long cycle of rate reductions and prompted investors to anticipate a prolonged pause in monetary policy changes.

Since then, euro zone economic data has shown greater resilience than anticipated, while inflation has held steady at the ECB’s medium-term target of two per cent. Speaking at the Federal Reserve’s Jackson Hole Symposium, several central bank officials noted that this performance, combined with contained US tariffs, reduced the immediate pressure for another rate cut.

Earlier this month, the administration of US President Donald Trump introduced tariffs of 15 per cent on most European Union imports. ECB sources, however, indicated that the impact was broadly in line with expectations and avoided the worst-case scenarios, lessening the need for urgent monetary policy easing.

As a result, the 11th September meeting is now widely expected to see no change in rates, unless incoming data reveals a sharp deterioration in the outlook.

Nevertheless, the ECB’s latest projections already factor in the possibility of further cuts, with inflation forecast to dip below the two per cent target next year before returning to it. Insiders suggest that rate cut discussions could re-emerge at the Governing Council’s October and December meetings, particularly if US tariffs weigh on euro zone exports or if prospects for peace in Ukraine fade.

Some market participants believe any additional reduction in borrowing costs is unlikely before spring 2025. Even so, optimism has grown about the euro area economy after surveys showed business activity accelerating over the summer, with new orders rising in August for the first time since May 2024.

Policymakers cautioned, however, that part of this increase may stem from US importers rushing to place orders ahead of tariffs, raising the risk of a slowdown in subsequent months.

At its July meeting, the ECB confirmed that its deposit facility rate remains at two per cent, the main refinancing rate at 2.15 per cent, and the marginal lending facility rate at 2.40 per cent. The Governing Council reiterated its meeting-by-meeting, data-driven approach, stressing that it remains committed to ensuring inflation stabilises at its two per cent target in the medium term.

Final deeds of sale rise 8.4%, promise of sale agreements up 6.8% in November

Malta’s residential property market strengthened again last month

Employment rises 4.8% as labour market continues to expand

66.8% of the population aged 15 and above are employed

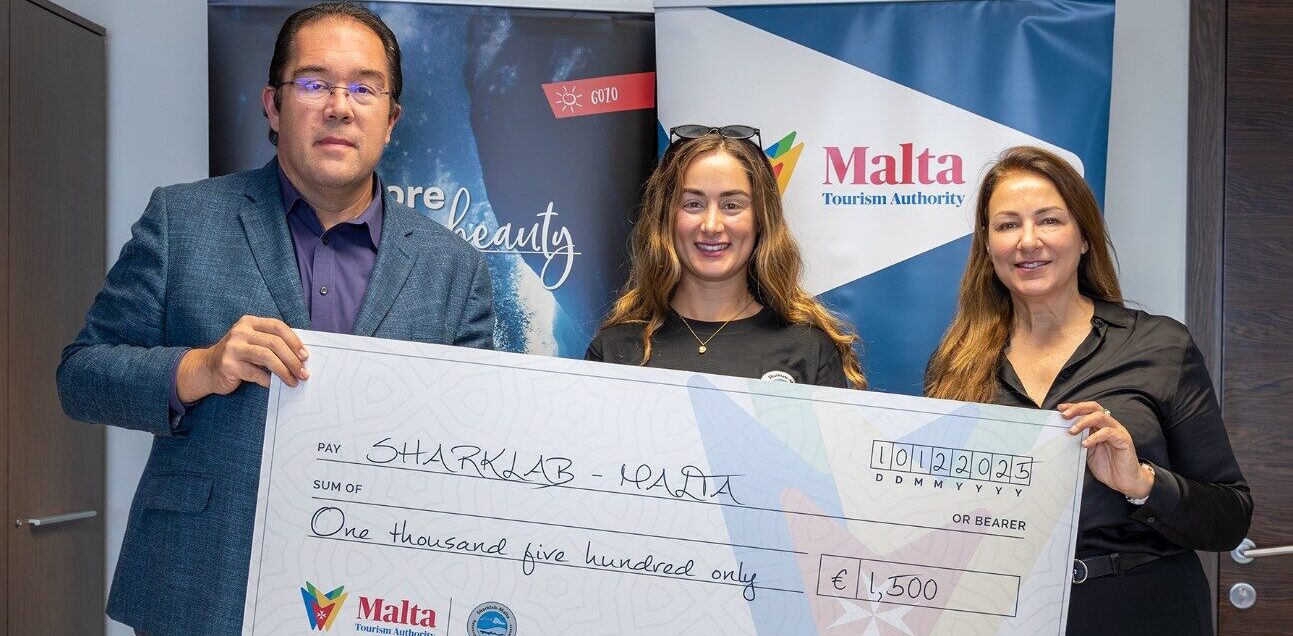

MTA donates €3,000 award to marine conservation NGOs Sharklab Malta and Nature Trust

'Sharklab Malta and Nature Trust have been instrumental in supporting our marine environment'