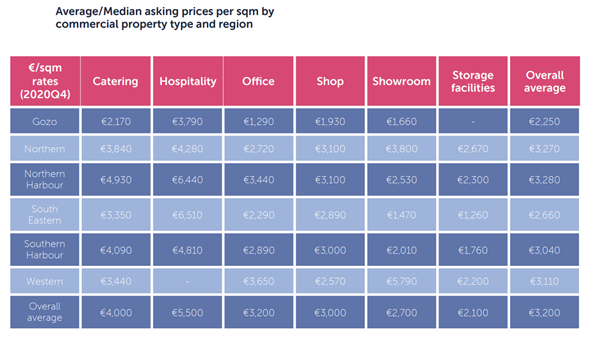

In an exclusive study conducted by big four audit firm EY and Djar, an independent property portal providing detailed market analysis of the local property market, a notable eight per cent drop in average price/sqm rates of commercial properties in the hospitality market since Q3 2020 was observed.

On average, prices for commercial properties in hospitality went down from €6,000/sqm to €5,500sqm. A fall in prices for offices in Q2 2020 was also noted, however Djar reports that this was recovered in subsequent quarters.

Average prices/sqm for other commercial property categories have remained mostly stable.

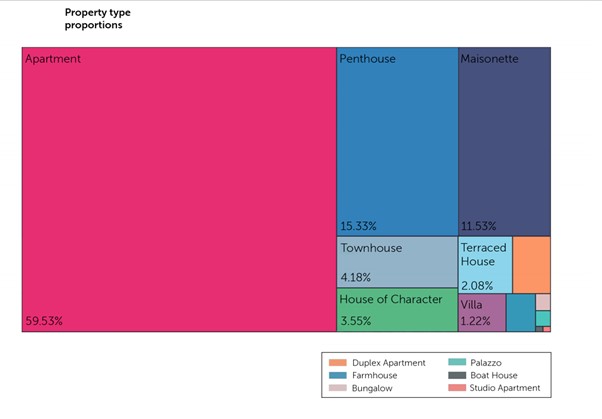

In its study, the supply of Palazzos compared to other property categories was analysed.

This niche category statistic standing at 0.49 per cent, is the first of its kind ever published in Malta, and fractional when compared to the apartment supply at 59.53 per cent.

The data compiled by Djar and EY Malta reports an increase in market supply and a slowdown in price growth of Palazzos since mid-2019, recording a median price of €2,500,000 in Q1 2021 so far.

“Djar’s in-depth findings result from analysing property prices with machine learning techniques and manual crosschecks to increase accuracy, thereby bringing about more transparency to the market.

“What sets Djar apart from other data sources such as the National Statistics Office and the Central Bank of Malta, is the ability to provide the latest and most insightful data on what’s happening in the real estate market, allowing buyers, sellers and real estate stakeholders at large to make the most informed decisions,” Djar CTO Keith Galdies stated.

Djar’s findings, when analysing properties under €1.5 million, show that like the global property market, the local real estate market demonstrates resilience with regards the pandemic. Gozo’s real estate prices registered the highest marginal increase with a positive average growth of two per cent.

Gozitan localities, together with Manikata, Kalkara and Santa Lucija in Malta, registered the highest average listing price increases over the previous year. At the other end, Madliena, Mtarfa, Valletta, Senglea and Cospicua had the largest average price reductions:

More detailed insights, including granular data into locality analysis, property types and market segments, as well as monthly and quarterly price changes are available upon enquiry or by signing up to the portal’s newsletter at www.djar.com.

Finance Minister: Average restaurant pays just €4,500 in Corporate Tax annually

Minister Caruana addressed calls from the catering industry to reduce the VAT rate on restaurant services from 18% to 7%

Malta records Q2 deficit as Government debt surpasses €11 billion

Between April and June, the Government recorded a €170.4 million deficit, compared to a €55.2 million surplus a year earlier

MDA calls for unity and urgency in passing Malta’s long-delayed planning reform

The association calls for a balanced framework that protects the environment while ensuring predictability for investment