Maltese households’ private consumption levels will continue to be adversely affected by travel disruptions, forecasted the Central Bank of Malta (CBM) in its report “Economic Projections 2020 – 2023”, released on Wednesday.

The problem, however, is not just the lack of tourist coming to Malta, but also the precipitous decline in Maltese tourists spending money elsewhere.

This is because Maltese tourists spending money abroad is counted towards Malta’s GDP, meaning that the country’s “final consumption expenditure is partly linked to the expenditure of Maltese residents in foreign countries”.

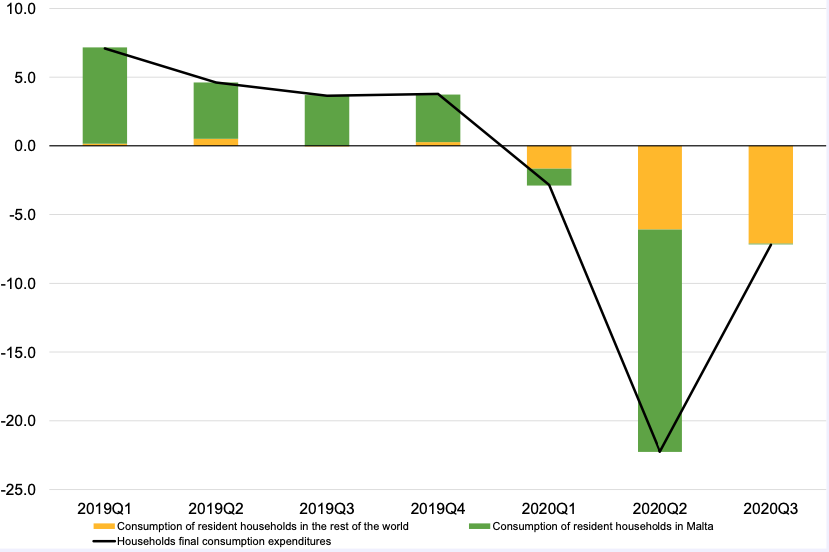

The severe impact of this can be seen in the following chart, which shows that in Q3 2020, the decline in the consumption of Maltese resident households abroad was by far the main contributor to the fall in consumption.

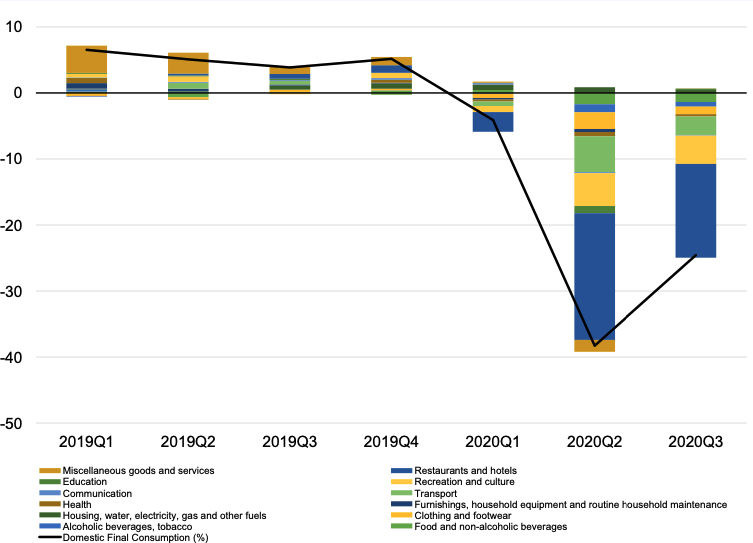

For an impression of the impact of the decline in tourism on Malta’s local economy, one must look to the following chart, which counts all consumption that occurs in Malta.

The report details a fairly major increase in domestic tourism, as during Q3 2020 twice as many Maltese residents stayed in collective accommodations (including hotels and other resorts), but says this will not be sufficient to mitigate the sharp drop in consumption.

Indeed, due to Malta’s size, the bank believes the country will benefit less from a transition to domestic tourism, saying, “while in larger countries the substitution effect in favour of domestic tourism is likely to be sizeable, this will remain limited in Malta”.

Looking to the future, CBM warned that “given the possible international travel constraints in the years ahead, it is unlikely for private consumption to return to its 2019 patterns soon”.

These statistics show an alarming state of affairs, where in Q3 2020 year-on-year consumption was down 24.6 per cent, led by a year-on-year decrease of more than 15 per cent spent at restaurants and hotels.

For context, during Q3 2008, when the world was in the throes of the Global Financial Crisis, Malta’s total domestic consumption decreased by 4.5 per cent.

The negative contribution of residents’ decreased expenditure abroad has been dramatic. In Q2 and Q3 2020, domestic households spent €85.6 million and €111.8 million less abroad (year-on-year) respectively.

These declines, the bank said, account for a negative contribution of 6.1 per cent and 7.1 per cent (year-on-year) to private consumption.

Looking to the future, the CBM identifies that “several forward-looking indicators continue to signal unfavourable conditions for the tourism sector.

“Confidence in the services sector and in retail trade, as well as consumer confidence, although significantly better than in the second quarter of 2020, remains low.

“Both Government response and stringency measures remain elevated, and coupled with limited improvements to flight capacity towards Malta, indicate significant weakness for tourism ahead.

“Based on this assessment, the latest forecast for private consumption is built on the premise that confidence and the expenditures of households resident in Malta will be the main driver of growth in private consumption over the medium term”, the bank concludes.

CHARTS: Malta Central Bank, Economic Projections 2020 – 2023 report.

Featured Image:

Central Bank of Malta – southeusummit.com

ICT sector makes up 10.3% of Malta’s economy, most in EU

Malta was also in the top spots for value added from ICT services and ICT manufacturing

Building and Construction Authority CEO resigns days after fatal construction incident

Jesmond Muscat quits after less than two years in the role

Government launches portal for temping agencies to apply for a licence, following regulations

New regulations, aimed at regulating the sector and diminishing abuse, came into force on 1st April