The Financial Intelligence Analysis Unit (FIAU) saw the scrutiny applied by the Financial Action Task Force (FATF) on Malta in general and on its practices in particular as an “opportunity to improve and become more effective in meeting its obligations”, according to its chairman Jesmond Gatt.

In his introduction to the unit’s annual report for 2021, Mr Gatt said the biggest challenge of the year was the “extraordinary effort required to implement the improvements expected by the FATF”, and lauded the approach taken by the unit and all other stakeholders in Malta’s jurisdictional reputation as a positive one.

Kenneth Farrugia, the FIAU’s director, meanwhile said the unit believes that “failure is not the opposite of success, but a stepping stone to success”.

Mr Farrugia described the FIAU as “a strong and operationally independent financial intelligence agency with a forward-looking approach”, saying that the last few years have seen it develop its structures, policies and procedures, build capacity, address operational weaknesses and become more effective.

“Our aim and commitment for the future is to continue playing our part to combat crime while safeguarding Malta’s financial system and reputation.”

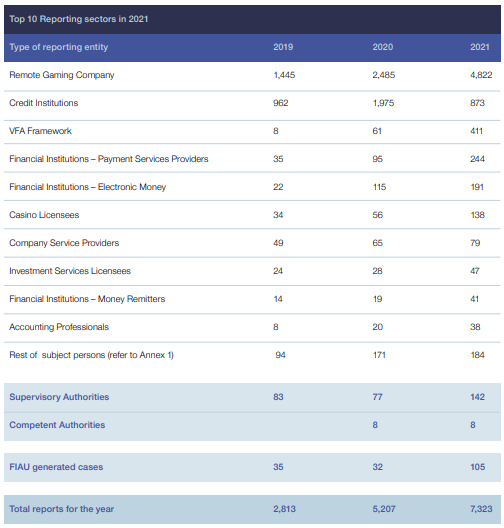

In 2021, the FIAU dealt with a record number of Suspicious Transaction Reports (STRs), which increased from 5,175 in 2020 to 7,218 in 2021.

The significant increase in reports was noted across most sectors in 2021, with remote gaming operators submitting almost double the number of 2020 suspicious reports, and topping the chart once again as the sector that submitted the most suspicious reports, accounting for 68 per cent of reports submitted by subject persons. Credit institutions and Virtual Financial Asset providers ranked behind.

The Intelligence Section of the unit also set up a dedicated team to handle tax-related money-laundering cases – ostensibly a response to the FATF’s observation of the FIAU’s prior weakness in investigating such cases.

The Intelligence Section also continued sharing intelligence on a regular basis with the Malta Police Force in 2021, as well as other domestic supervisory and competent authorities.

In addition to responding to over 3,600 requests for assistance, submitted by national supervisory and other competent authorities, the FIAU also shared 328 disseminations with the police.

The most common failures noted across all sectors were those related to:

• Deficiencies in the customer risk assessment (CRA) methodology.

• Not obtaining all the information necessary in relation to the purposes and intended nature of the business relationship.

• Not carrying out the necessary enhanced due diligence (EDD) measures for high-risk customers.

• Non comprehensive policies and procedures.

• Non comprehensive customer verification measures.

• Failure to carry out effective scrutiny of transactions.

• Deficiencies in the business risk assessment (BRA) methodology, including in the effective assessment of risks posed by jurisdictions.

Its efforts resulted in 139 fines issued for a total of €11,805,169 to various subject persons for a broad spectrum of infringements and breaches.

Passenger traffic between Malta and Gozo grew by nearly 8% in Q2 2025

Vehicle crossings and fast ferry usage also surged

New Malta-backed incubator to fuel Europe’s semiconductor startups

The ChipStart EU program provides a one-year, no-cost incubation opportunity for semiconductor startups in the European Economic Area

Government renews scholarship scheme for tech postgrads

In 2024 the Pathfinder Digital Scholarship issued €125,000 in funding, supporting 13 Master’s and 3 PhD students