Malta’s restaurants pay an average of only €4,500 a year in corporate income tax, according to Finance Minister Clyde Caruana, a figure he says is lower than what many individuals contribute.

Speaking at a Times of Malta business breakfast ahead of next Monday’s Budget, Minister Caruana addressed calls from the catering industry to reduce the VAT rate on restaurant services from 18 to seven per cent.

The Minister, however, dismissed the idea, stressing that such a cut would cost the Government around €80 million annually.

“When you look at corporate tax paid per restaurant, the average is about €4,500 per year,” Minister Caruana said, noting that both he and interviewer Herman Grech likely pay more tax than the typical restaurant.

The Minister’s comments sparked mixed reactions on social media. Some welcomed the idea, saying it would be great if it were true. Others questioned the calculations, arguing that the numbers don’t seem to add up, while some users expressed confusion over the figures.

Msida Creek curve is ‘only temporary’, Infrastructure Malta CEO reassures

Concerns were raised after a video was published showing large vehicles struggling to navigate the curve

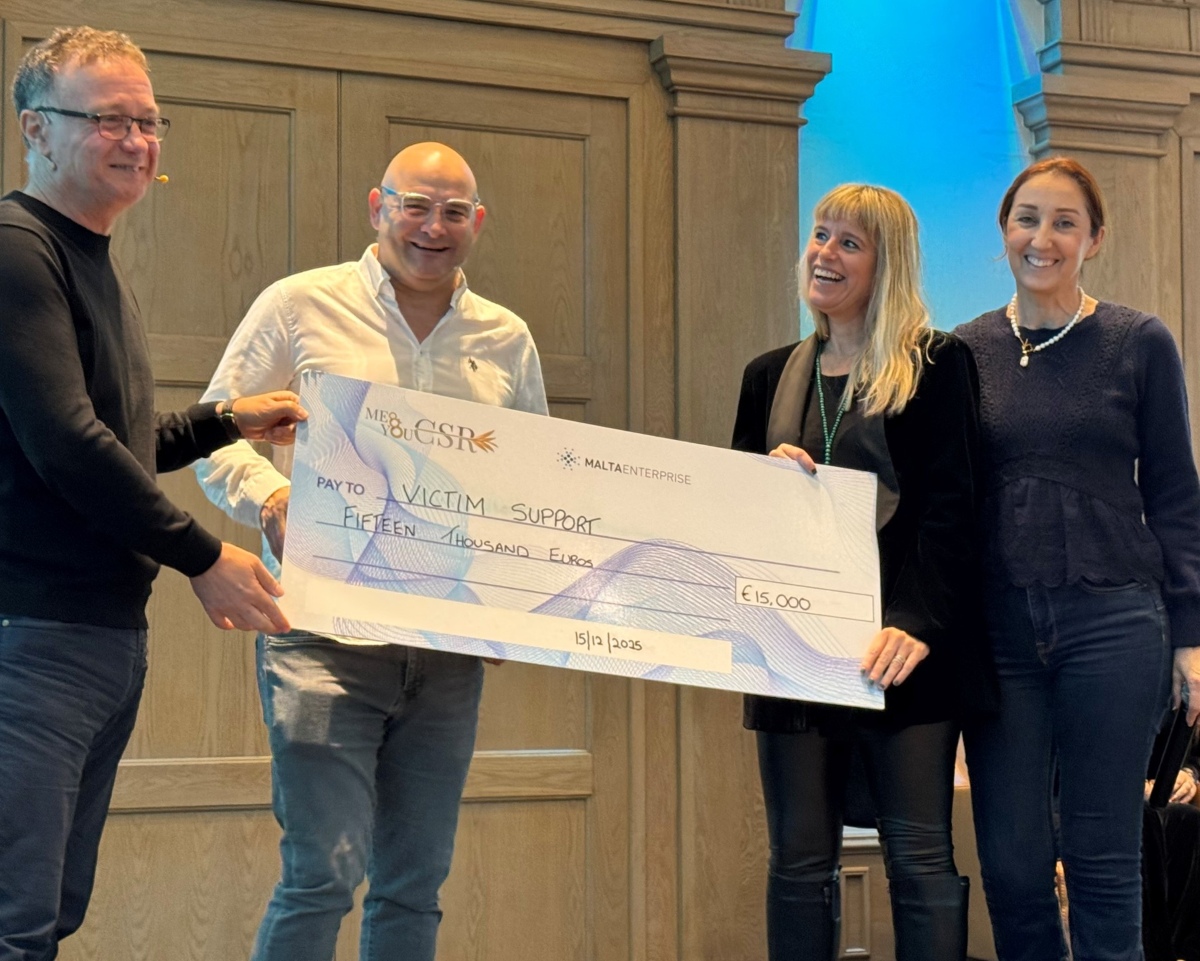

Malta Enterprise donates €15,000 to Victim Support Malta

Every year, Malta Enterprise delivers a distinctive project aimed at raising awareness and fostering positive social change

Rain or not, Malta dines out: How bars and restaurants fared on New Year’s Eve

Rain on New Year’s Eve led to cancellations, but deposits helped stabilise bookings