FinanceMalta, a public-private entity that works to “promote Malta as an international financial centre”, issued a terse reply when asked for a reaction to the latest EY Attractiveness Survey, which found that 46 per cent of foreign investors surveyed view Malta as ‘not attractive’.

In view of the organisation’s role to promote investment in Malta in the realm of financial services, BusinessNow.mt reached out for a reaction regarding the all-time-low results from EY’s survey.

“FinanceMalta is cognisant of the data presented in the latest EY’s Attractiveness Survey. We will continue to pursue our remit to promote Malta as a jurisdiction of choice for financial services”, a spokesperson told this newsroom.

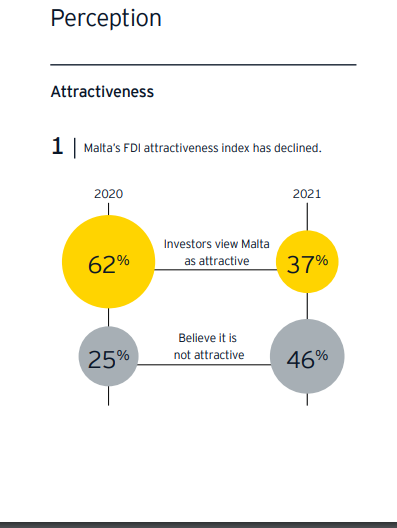

The EY survey found that the proportion of foreign investors who view Malta to be an attractive place to do business plummeted from 62 per cent in 2020 to just 37 per cent in 2021, and gives a damning indictment of the reputational damage suffered by the country when it became greylisted by the Financial Action Task Force (FATF) in June of this year.

For context, Malta received an attractiveness score by the same survey of 91 per cent in 2011, which went down to 79 per cent in 2014, and was back up to 86 per cent in 2016.

Indeed, on greylisting, a large majority of businesses (84 per cent) of this latest 2021 survey believe it will lead to reputational damage, and over half (55 per cent) predict it would make doing business in Malta more difficult.

Notwithstanding these difficulties, three quarters (77 per cent) of businesses surveyed believe their long-term future is in Malta.

In a foreword, to the report, Ronald Attard, EY Malta country managing partner, stated: “For the first time since we have been conducting our survey, a significant part of the investors interviewed are telling us that Malta is currently unattractive for FDI.

“This might not be easy to digest as we are accustomed to better results. This outcome is not necessarily only due to the greylisting, but it has certainly played a big part. It would be foolish to bury our heads in the sand and not act immediately.”

Why Malta

FinanceMalta’s website dedicates an entire section to why interested parties should consider Malta as a place to do business due to its position as an ‘international business centre’, and reads:

“Invest in Malta and gain access to the EU’s single market and the high-growth markets of the region. Grow and expand your business on the back of moderate operating costs”

It even includes a ‘Doing Business in Malta’ guide, available in English, Mandarin Chinese, Italian and Arabic.

Malta Enterprise CEO Kurt Farrugia reacts

BusinessNow.mt also turned to Malta Enterprise for its reaction to the poor survey results. Malta Enterprise is a Government economic development agency, tasked with attracting new foreign direct investment, assist indigenous entrepreneurs set up operations and facilitate the growth of existing operations of both foreign and local companies.

It’s CEO, Kurt Farrugia, said that 2021 compares well to previous years. He revealed that a total of 32 projects have been approved by ME between January and October 2021, including both new FDI and the expansion of current operations.

Last year, a total of 39 new projects were approved, he shared, and qualified that in 2020 it was harder for companies to take decisions on relocation or setting up new facilities in other countries, such as Malta, because travel was limited and executives were unable to visit prospective jurisdictions.

He said when considering that the survey was conducted shortly after the June announcement that Malta had been greylisted, together with the numbers coming out for this year, from the perspective of Malta Enterprise, a slow down of interest or activity has not been observed and is not expected.

Indeed, Mr Farrugia’s experience tallies with the nature of projects typically aided by Malta Enterprise, as it generally liaises with companies looking to invest in Malta in manufacturing, technology and gaming (not to be confused with iGaming) industries, which are less likely to be impacted by the fall out of grelisting.

Companies in the financial services sector, on the other hand, are far more dependent on the jurisdiction they are operating in being viewed by the global community as reputable and credible.

General fear of travelling doesn’t justify free holiday cancellation, MCCAA warns

Malta Competition and Consumer Affairs Authority clarifies rights for travellers amidst concern over the Middle East war

Malta to host first Mediterranean forum on accessible hospitality

One panel will examine Malta’s potential role as a regional focal point for promoting accessibility in the hospitality sector

Merchant Shipping Directorate ‘providing full support’ to Malta-flagged vessels in Middle East

Malta committed to ensuring that its flag continues to represent safety and stability ‘even in challenging circumstances’