The Central Bank of Malta (CBM) has published its first climate-related financial disclosures report for its euro and foreign currency-denominated non-monetary policy portfolio (NMPPs).

Publication of the report is in line with the recommendations made by the Task Force on Climate-related Financial Disclosures (TCFD) adopted by the European Central Bank (ECB) and Eurosystem national banks. It seeks to demonstrate the risks the investments have coming from the transition to lower carbon-intensive economies and their impact on the environment.

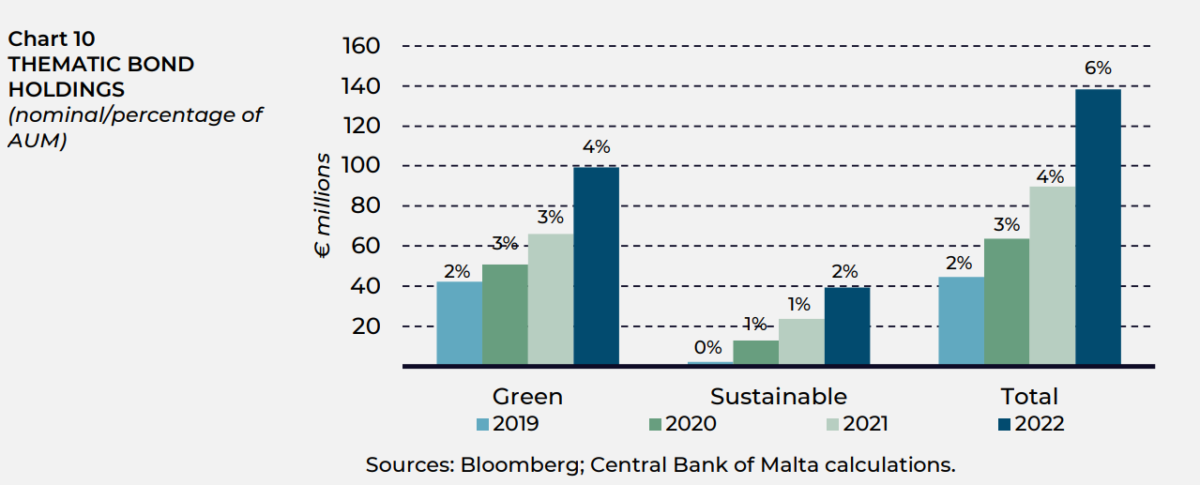

The report shows that the share of green and sustainable bond holding in its NMPP grew from 2 per cent in 2019 to six per cent in 2022, with a majority of being investments being in green bonds.

Green and sustainable bonds are debt instruments issued by firms or other entities looking to raise funds for new or existing projects focused on environmental benefits and economic sustainability.

The report does note that, investment in green and sustainable bonds for the NMPPs does not necessarily directly imply lower emissions because the underlying projects do not automatically translate into comparatively low or falling carbon emissions at the issuer firm level. However, the climate mitigation projects financed by the capital raised by the issuer firm, result in “avoided emissions” that would have otherwise occurred.

The CBM aims to align its NMPPs with the EU’s target of achieving carbon neutrality by 2050 and will therefore seek to intensify its efforts to ensure gradual progress is made towards this target while maintaining traditional investment objectives of capital preservation, liquidity and return.

“Climate change is the greatest challenge humankind is facing this century, and its impact is becoming increasingly evident. To secure a liveable future, urgent decisions need to be taken. They need to be taken now,” said CBM Governor Edward Scicluna, in the report’s foreword.

In addition to its mandatory Eurosystem disclosures, the CBM has also published additional metrics to improve its assessment of the climate-related profiles of their NMPPs.

As a member of the Central Banks and Supervisors Network for Greening the Financial System (NGFS), the CBM will continue to actively participate in its meetings and work streams and the Eurosystem network covering climate-related climate risks and disclosures.

Top 5% of taxpayers responsible for one-third of all income tax paid in Malta

On the other hand, the bottom third of income earners pay just 1.7% of all income tax generated

The Malta Institute of Accountants prepares for its 2024 Anti-Money Laundering Conference

Held at the Radisson Blu, St Julians, this latest AML Conference promises to bring exclusive insights on new procedures

Eurozone interest rates to remain unchanged

The European Central Bank noted that price pressures remain persistent