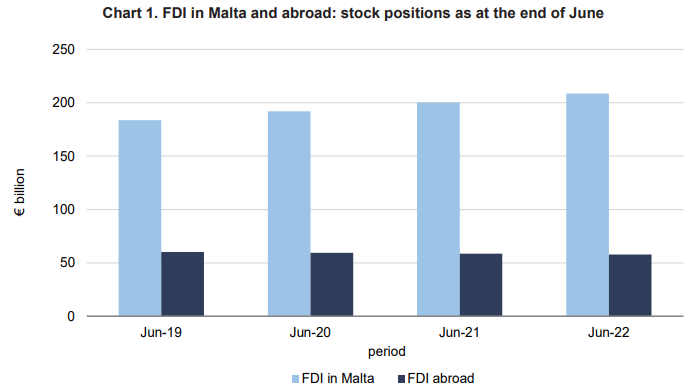

Foreign Direct Investment (FDI) flows in Malta increased by two billion euros during the first half of 2022 as the overall stock position increased to €208.6 billion, according to data released by the National Statistics Office.

The main contributors to this increase in total FDI flows were financial and insurance activities, with a total contribution of 97.6 per cent.

In June 2022, the stock position of FDI amounted to €8.3 billion more than the corresponding period a year earlier.

In terms of direct investment abroad (referring to investments made by Maltese investors in foreign economies), the stock position stood at €57.8 billion in June 2022, down by €0.748 billion compared to June 2021.

Financial and insurance activities made up 98.9 per cent of total FDI abroad, as flows totalled €3.2 billion, mainly in the form of claims by direct investors.

According to the OECD, FDI has continued its upward trend that started in 2021 after a significant low in 2020.

Malta, along with the rest of the European Union, is expected to avoid a recession, with inflation expected to continue declining to 5.6 per cent and 2.5 per cent in the Eurozone in 2023 and 2024 respectively, there are signs of a challenging but positive economic outlook.

Malta’s inflation edges up to 2.7% in October as food and services lead price pressures

The October RPI reading indicates some re-acceleration in consumer-facing sectors after a period of summer stabilisation

db Group reports turnover of almost €100 million and record profit as it opens bond issue to public investors

This coincides with the launch of a €60 million bond programme to support the Group’s continued expansion

Celebrating success: stories from the team behind Finco Trust

The stories of Lee-Anne Abela, Kris Vella, and Maria Mamo reflect the values that continue to guide the firm forward