The Maltese Government’s wage bill has increased by more than a third over the course of the last legislature, while spending on “intermediate consumption” has shot up by a staggering 90 per cent.

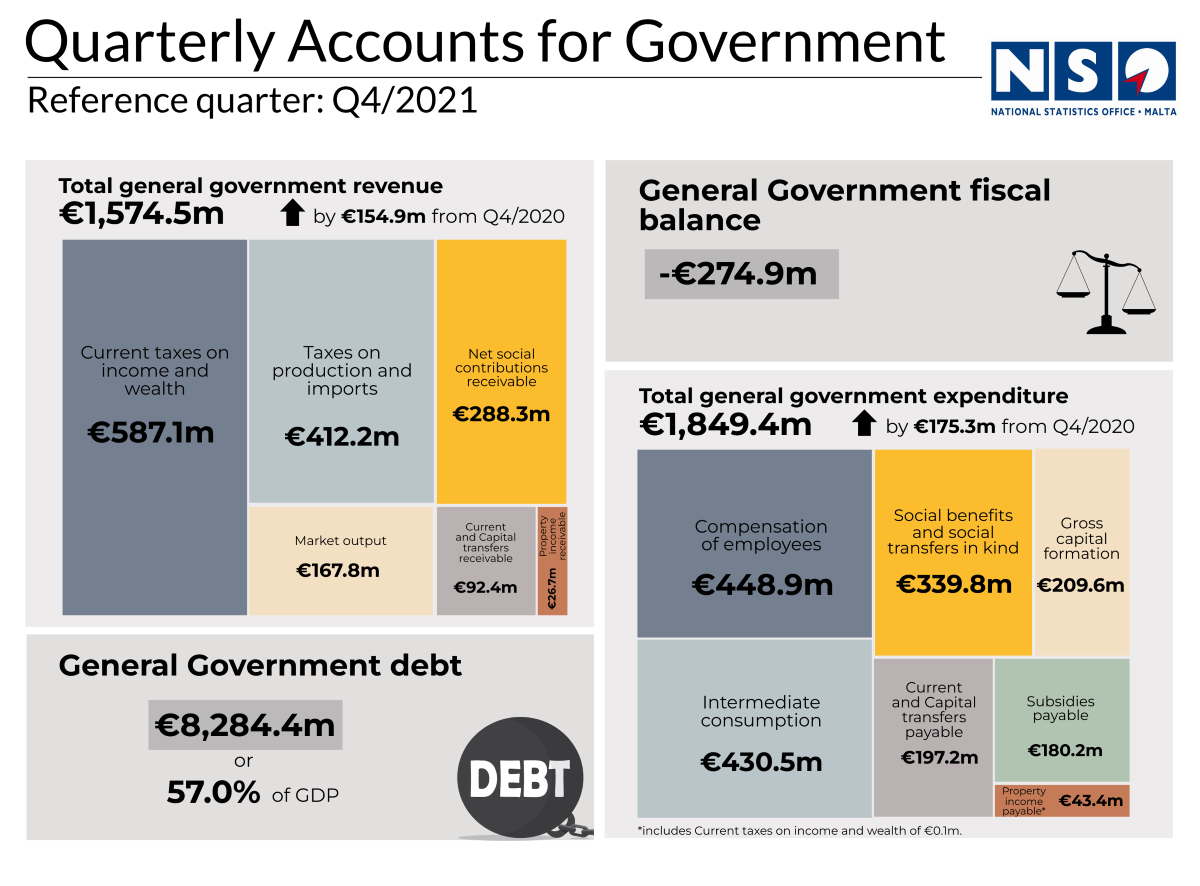

These were the two line items that saw the largest increase over the last year, as revealed in a National Statistics Office (NSO) news release which showed that although Government revenue in the last three months of 2021 increased by €154.9 million when compared to the corresponding quarter in 2020, to reach €1,574.5 million, total expenditure increased even more, by €175.3 million, for a total spend of €1,849.4 million.

Thus, the partial recovery in Government income during the last quarter of 2021 was eclipsed by increases in expenditure, especially in employee compensation and intermediate consumption, to continue the pandemic trend of significant deficits largely attributed to social and economic measures mitigating its worst effects.

The expense related to employee compensation saw the largest increase of €52.9 million, followed by intermediate consumption (€51.0 million).

The Government has come in for criticism in recent months for what is widely perceived to be a ballooning public service that is starving the private sector of much needed talent.

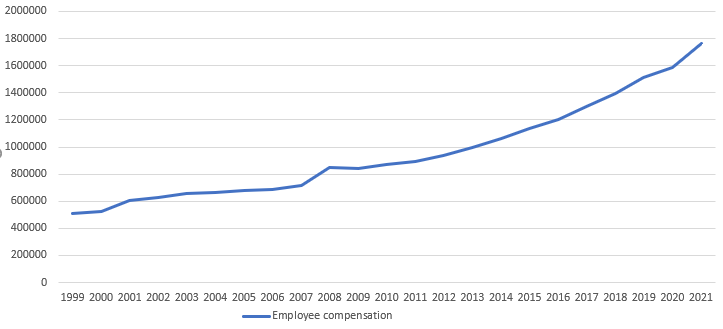

A look at the NSO’s database going as far back as 1999 lends weight to business concerns, showing an acceleration in public expenditure tied to salaries.

In fact, salaries amounted to €1.77 billion in 2021 – a 36 per cent increase over the €1.3 billion registered in 2017 and 94 per cent more than that registered in 2012, the last full year of the previous administration.

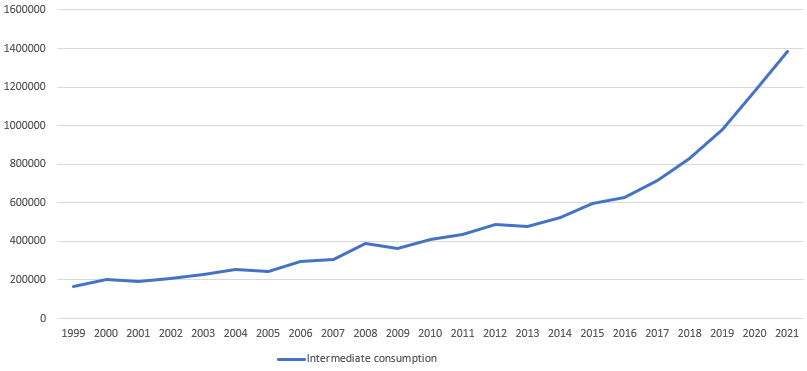

A similar yet even more distinct trend can be seen when it comes to expenditure on intermediate consumption, which represents “the value of almost all goods and services used as inputs in the production process”.

It is not immediately clear whether this figure includes spending on things like direct orders for consultancies, and outsourced services like security, cleaning and public service provision – all of which have been criticised as ways for Government to put workers on the public payroll without appearing as a salary expense.

Spending on intermediate consumption stood at €1.36 billion as at the end of 2021 – an increase of 89.6 per cent over the spend in 2017, and 179 per cent over the spend in 2012, that is, approaching three times the amount.

Questions sent to the NSO were not replied to by the time of writing.

Government debt

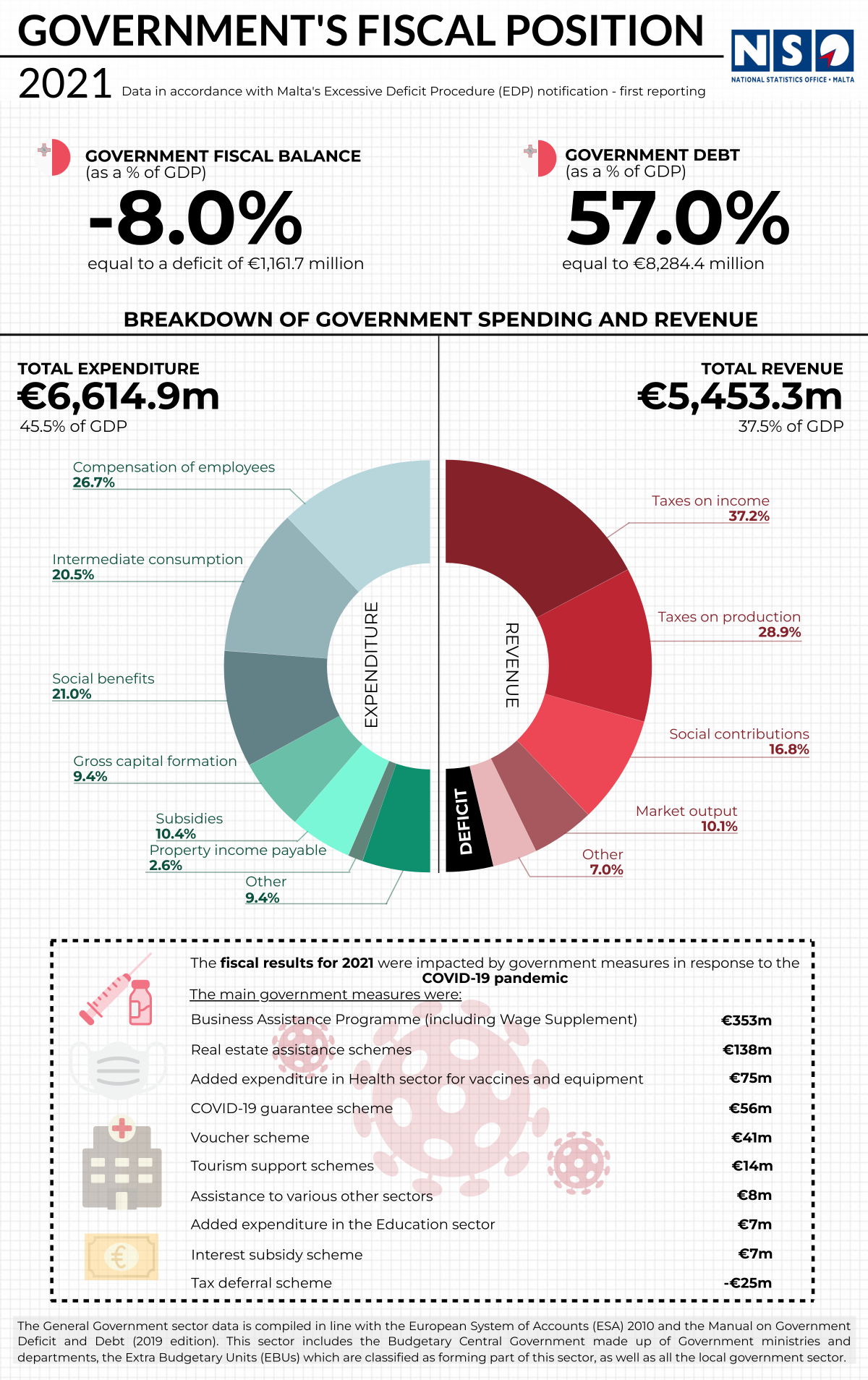

Malta registered a deficit of €1,161.7 million in 2021, equivalent to eight per cent of GDP. The General Government debt amounted to €8,284.4 million or 57 per cent of GDP.

Prior to the pandemic, European Union governments had to comply with rules limiting annual deficits to below three per cent of GDP, while total Government debt could not go over 60 per cent of GDP.

That Malta remains compliant with the second of these conditions after two successive years with a very high deficit (2020’s deficit stood at 9.5 per cent of GDP) is testament to the strong economic growth and large Government surpluses in previous years.

October-December 2021

Almost all components of General Government revenue recorded an increase during Q4 of 2021, with current taxes on income and wealth registering an increase of €112.4 million over the same period in 2020. This was followed by net social contributions receivable (€69.4 million), market output (€36.5 million), taxes on production and imports (€21.1 million), crrent transfers receivable (€4.8 million) and property income receivable (€2.5 million). In contrast, capital transfers receivable decreased by €91.9 million.

Total expenditure in the fourth quarter of 2021 amounted to €1,849.4 million, an increase of €175.3 million over the corresponding quarter in 2020. The largest increase was recorded in compensation of employees (€52.9 million), followed by intermediate consumption (€51 million), current transfers payable (€30.9 million) and gross capital formation (€22.2 million).

Other increases were registered in capital transfers payable (€21.9 million) and social benefits and social transfers in kind (€4.0 million). These increases were partially offset by decreases in subsidies payable (€4.8 million), property income payable (€1.5 million) and current taxes on income and wealth (€1.3 million).

ECB holds interest rates steady as inflation nears 2% target

The three key interest rates remain unchanged

Tourist spending surges 21.3% in September as inbound arrivals exceed 393,000

Meanwhile total nights spent increased by 8.9% to reach 2.7 million

Malta Food Agency CEO: Agriculture has a future and demand for Maltese food will keep growing

Brian Vella speaks to this BusinessNow.mt about some recent developments in the agricultural sector