As a persistently high rate of inflation continues biting the public’s purchasing power, prospective homeowners are becoming warier of the costs involved.

PwC’s Real Estate Survey 2023 was conducted through an online survey between Q4 2022 and Q1 2023 and involved 405 participants. The respondents were representative of Malta’s population, stratified by age, gender, and nationality.

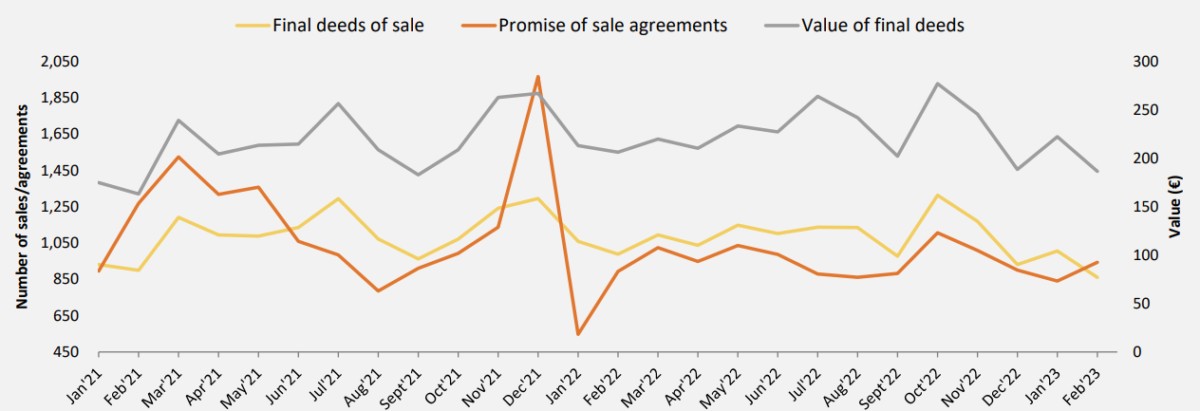

The study found that the value of final deeds of sale increased by four per cent over the previous year, totalling €2.7 million in 2022. Whereas an increase was observed in values of residential property sales to individual buyers in January 2023 compared to the same month the previous year, a decline of 2.5 per cent was registered in February 2023.

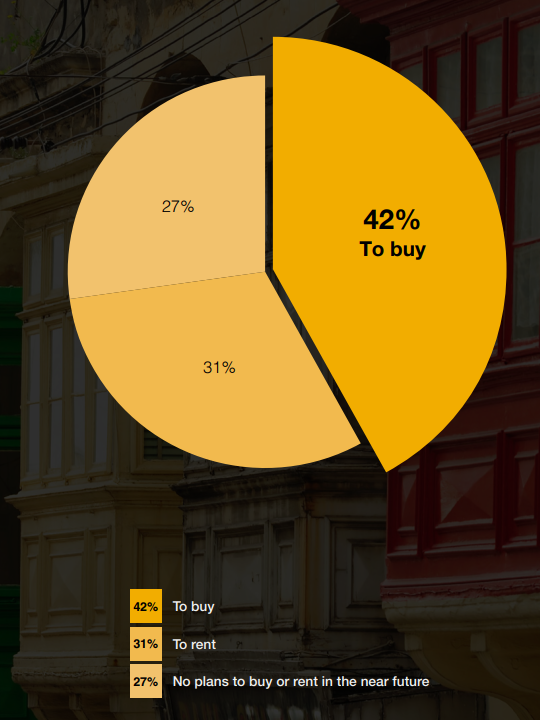

During the first quarter of 2023, almost a third of all respondents said that they were making plans to rent property, almost thrice the number recorded the previous year, a record high.

This was coupled with a decrease in the share of the population looking to purchase property falling below 50 per cent. The study noted that this was very likely due to inflationary pressures denting consumer purchasing power.

Regardless, the share of people with no plans to buy or rent property actually dropped by 10 per cent compared to the previous year.

Among those looking to purchase property, the main motivation for more than half (53 per cent) of them is that they want to move out and are first-time buyers, an increase from 34 per cent the previous year.

Meanwhile, the number of respondents looking to buy property for investment purposes dropped. According to the study, this suggests that lower consumer confidence is at play, due to uncertainty surrounding the economy.

The majority of respondents (52 per cent) looking to buy property said they are interested in property within the €100,000 and €200,000 bracket, a slight increase compared to the previous year (48 per cent). This contrasts with secondary data made available by the National Statistics Office which shows that the average value of final deeds of sale constantly exceeded €200,000.

This may indicate that the average value of property is outside the price range for the majority of the population.

Apartments and penthouses remained the preferred choice of property since they tend to be in the lower end of the price spectrum, while the share of people looking to buy higher end properties such as farmhouses, villas, bungalows, and palazzos dropped from six per cent in Q1 2022 to one per cent in Q1 2023.

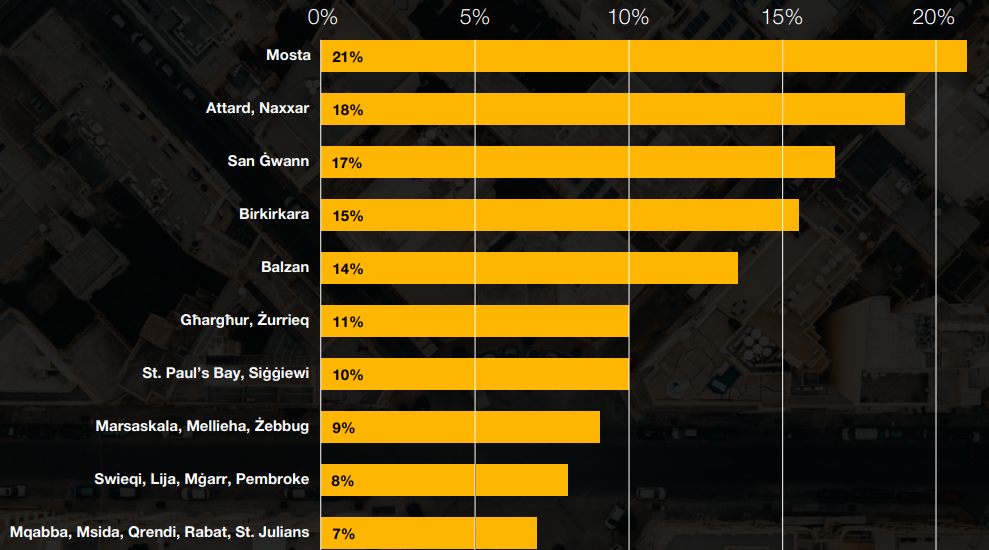

Malta’s Central Region continued to be the dominant area where people preferred to buy and rent property.

Mosta was the most popular choice for prospective homeowners, with more than a fifth indicating it as their preferred locality, while Birkirkara was the most popular choice for prospective renters, capturing the preference of a quarter of those surveyed.

When it came to financing their property purchases, 70 per cent indicated they would use bank loans. The study noted that younger cohorts were more likely to rely on bank loans to facilitate property purchases, while older cohorts resorted to personal savings or inheritance.

Among those relying on bank loans, the most influential factor when it came to choosing which bank to take a loan from was the interest rate offered (78 per cent).

This was followed by banks which offer loan packages that include attractive features for energy-efficient development, being influential for 20 per cent of respondents, a significant increase from eight per cent the previous year.

When respondents who were not first-time buyers were asked if they were aware of additional restrictions imposed on local banks by the Central Bank of Malta (CBM) in connection to the issuance of loans for property purchases, the majority of respondents (53 per cent) said they were not.

As for those who were aware of them, just under half (49 per cent) indicated that it impacted their decision to purchase property.

With regards to real estate agents, 49 per cent said they would use an agent to buy, sell or rent a property, however for the 51 per cent who would not, the main reason was their high commission fees.

Lastly, almost half of all respondents (49 per cent) said that there is not enough information in the market for them to make an informed decision when acquiring or renting property. Therefore, most respondents indicate that they would carry out their own research on property and rental rates rather than engaging agents or other services to guide them in their decision-making.

Furthermore, respondents indicated that they do not think that the extent and nature of construction in Malta is coordinated in a way to direct (or encourage) development of property in sectors which are economically viable, sustainable and which do not impinge on the quality of life.

On a scale from one to five, with five being the highest score, the average rating given by respondents was an abysmal 2.36.

European Parliament adopts regulation making it easier for companies to be paid on time

The maximum credit term under the new Late Payment Regulation is to up to 120 days, for some sectors

French ATC strike forces Ryanair to cancel over 300 flights, affecting 50,000 passengers

The low-cost carrier is demanding the EU carries out reforms to ensure travel continues undisrupted

Valletta ranks 8th most expensive European capital city to live in – study

While London is the most expensive, Bucharest is the most affordable