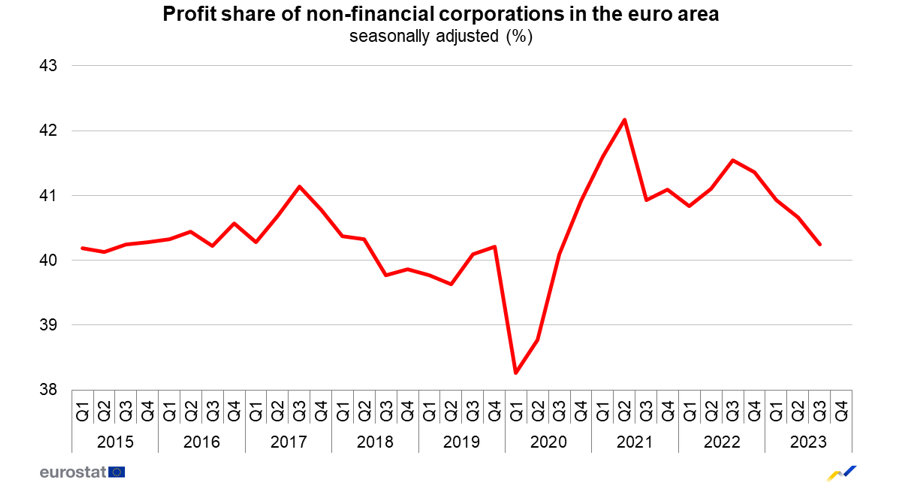

The profit share of European companies in the euro area continued to fall in the period from July to September 2023, and now stands in line with its long term average after the markedly high profits seen in 2021 and 2022 – the highest since the Great Financial Crisis – subside in the face of higher wage pressures.

Eurostat, the European statistics agency publishing the findings, explains that the profit share of non-financial corporations is defined as the gross operating surplus divided by the gross value added.

This indicator shows the share of the value added created during the production process which goes to remunerating capital. It is the complement of the share of wage costs (plus other taxes less other subsidies on production) in value added.

The figure represents a 0.5 percentage point decrease over the preceding quarter, bringing it to 40.2 per cent – the lowest in three years.

This decrease of business profit share in the euro area is explained by the increase of business compensation of employees (wages and social contributions) plus taxes less subsidies on production by 1.5 per cent, at a faster rate than gross value added at 0.8 per cent.

The business investment rate in the euro area decreased to 22.9 per cent, compared with 23.1 per cent in the second quarter of 2023.

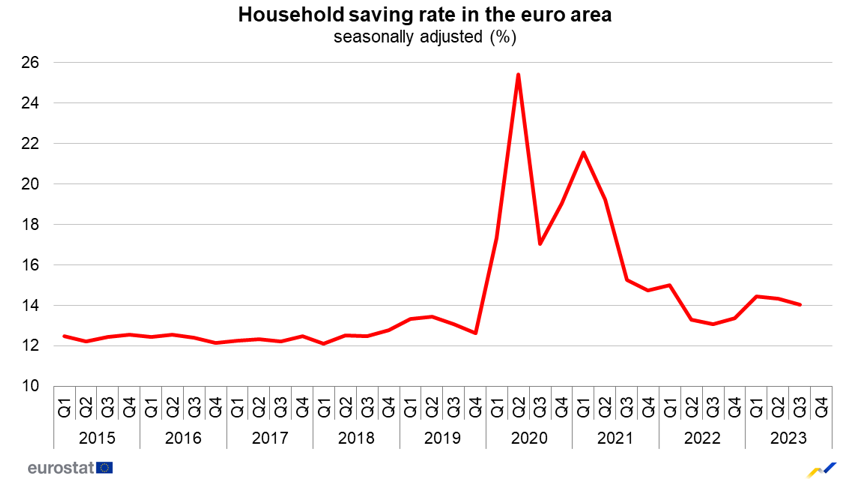

Meanwhile, the household saving rate stands at 14 per cent, a decrease from the 14.3 per cent registered the previous quarter.

This is still above the long term average of just over 12 per cent, but represents a sharp contraction from the 18 to 25 per cent rates seen during 2020 and the first half of 2021, when spending opportunities were limited.

Housing Authority doubles vacant dwelling restoration grant to €50,000

Eligibility criteria also widened to include properties built 20 years ago

Workplace accidents remain high in Malta despite slight decline – construction still tops risk list

High-risk sectors continue to dominate injury statistics

Five and four star hotel occupancy edges up in 2025, MHRA survey finds

Five-star occupancy levels stood at 71 per cent in 2025, up slightly from 2024 levels