The Central Bank of Malta commissioned a survey among Maltese households to obtain a view of their knowledge about the planned Digital Euro, and whether they would be willing to embrace it. The fieldwork was conducted in November 2024 among 1178 persons aged 16 years or more.

In a nutshell, the survey shows that although most Maltese have very little awareness of the Digital Euro, nevertheless there is a willingness to use it.

The survey reveals that around 85 per cent of respondents have no awareness of the planned Digital Euro, and such awareness does not vary significantly across different age groups, with males being slightly better informed than females, while Gozo recorded the least awareness.

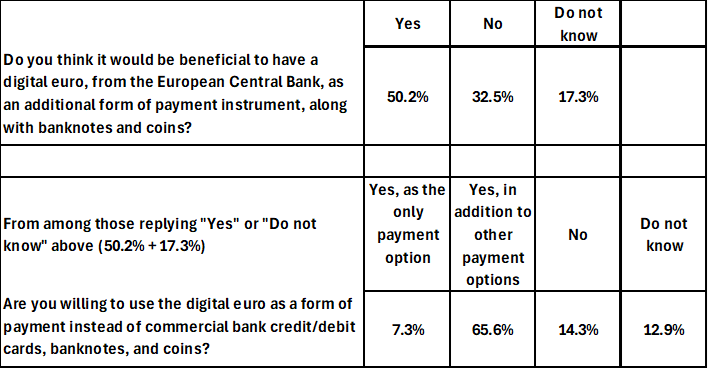

However, half of respondents believed that it would be beneficial to have the Digital Euro alongside with banknotes and coins, while almost a third saw no benefit. The response varies among different age groups where those believing it to be of benefit decreases with age, while those who do not see it beneficial increases with age. No significant differences in replies were observed between males and females, or across districts.

More significantly, almost three quarters of those who saw benefits from using the Digital Euro and those who replied that they did not know whether it would be beneficial are willing to use the Digital Euro, with a few even indicating that they would use it as the only means of payment. This would amount to around half of the whole sample, which decreases with age, though there were no significant differences in replies between males and females. The Southern Eastern district was the least prone to make the switch to the Digital euro, and the Southern Harbour most willing to do so.

When asked why they would make such a switch to the Digital Euro, around 70 per cent think that the Digital euro would facilitate payments in retail shops, online, and between people, with the second most popular response being that it would be more secure against loss and fraud than cash. Replies were consistent across age groups, sex, and district.

Meanwhile, almost 70 per cent of those not willing to use the Digital Euro still prefer the use of cash, where such replies increase with the age of respondents, with no significant differences among males and females, or across districts. Around 28 per cent of those not willing to use the Digital Euro indicated that they prefer commercial bank cards, though such replies decrease with the age of respondents. Only nine per cent of those not willing to use the Digital Euro indicated that this was due to privacy concerns.

Finally, when respondents were asked which features of the planned Digital Euro were most important to them, almost half considered that the Digital Euro would offer more privacy than commercial bank’s digital payment options, while the second most important attribute, with a score of almost 40 per cent was the offline feature. Just over 20 per cent signalled that the Digital Euro was important to them because it is a European means of payment issued by the ECB. The privacy feature was mostly important for those aged over 55 and those hailing from Gozo, while the importance of the offline feature decreases with age. No material differences in replies could be discerned between males and females.

The lessons drawn from this survey are that there is a strong need to increase awareness about the Digital Euro and its features among the public, with those aged less than 55 years more inclined to use social media, while those aged over 55 are more prone to obtain information from TV programmes.

Although the consultation process on the legislative proposal of the Digital Euro is still ongoing at the European level, and therefore the final design of the Digital Euro could differ for some aspects from the legislative proposal of the European Commission published in June 2023, nevertheless there is scope for shifting gear in increasing awareness of the benefits of a Digital Euro given the willingness of the Maltese to use it.

There are clear benefits from the Digital Euro to the public, businesses, domestic banks and payment service providers, as well as to Malta and the Euro Area to strengthen their strategic autonomy, especially in times of heightened global trade and geo-political fragmentation. In the coming months, the Central Bank of Malta will be stepping up its efforts to increase such awareness.

Featured Image:

Alexander Demarco / centralbankmalta.org

Women-led startups secure just 12% of venture capital funding in EU

Data from a new study was announced recently at high-level event in Brussels

Debating spin-offs

Stockbroker Edward Rizzo discusses the announced sale of Trident Estates’ second-largest asset, Qormi’s Trident House

Malta’s growing debt servicing requirements

While the 2026 Budget outlines ambitious fiscal targets, its continued silence on capital market development poses a setback