While the financial developments in recent weeks were dominated by constant updates related to the US trade policies and heightened volatility across the equity and bond markets, it is also worth noting the remarkable currency movements across major economies. For many investors in the euro area, the other key currencies of interest are typically the US Dollar and the British Pound reflecting exposures to the US and UK stock markets.

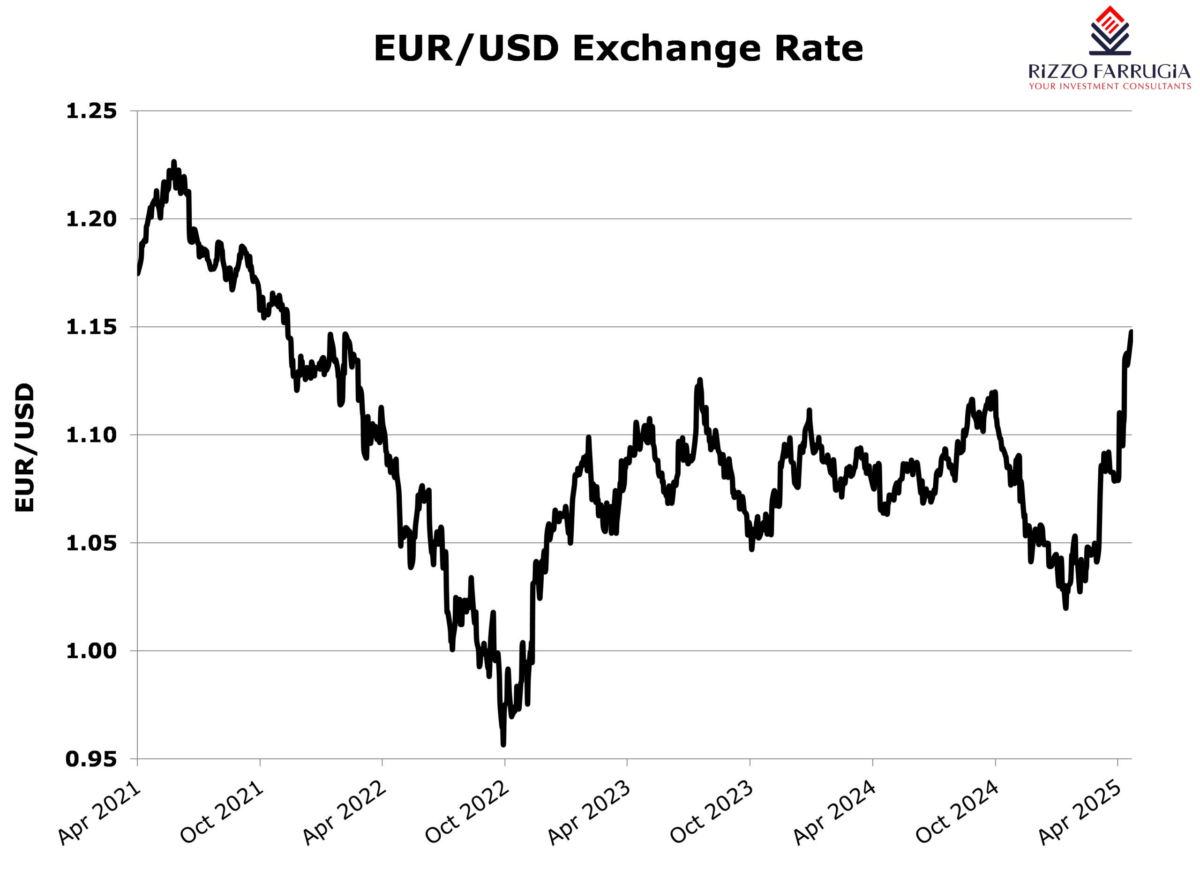

Earlier this week, the EUR/USD exchange rate reached $1.15, the highest level since November 2021 and representing a meaningful 10 per cent change since the start of the year.

The euro had dropped meaningfully following Russia’s invasion of Ukraine to a low of $0.96 following this major development in view of the substantial economic implications that this brought about.

In recent days, it is also worth noting that the EUR/GBP exchange rate increased to the £0.866 level, which is the highest since the end of 2023. The euro appreciated nearly 4 per cent against the British Pound in 2025.

The strengthening of the euro against both the US Dollar and the British Pound can be partly attributed to several positive developments in the euro area. In particular, the European Commission’s ambitious ReArm Europe Plan to boost defense investments amounting to €800 billion by 2030 is expected to boost economic activity and support sectors such as industrial production, aerospace, cybersecurity and technology, which historically lagged those in the US and the UK. Germany, the largest economy in the euro area, already approved its own €500 billion infrastructure fund to address these priorities.

Nonetheless, the relative strength of the euro when compared to the US Dollar also reflects the weakening of the US Dollar relative to all other major currencies in view of the recent unclear direction in the US trade policies that have negatively impacted on the appeal that the US Dollar typically enjoyed in volatile times. In fact, the sovereign bond markets signalled a clear shift of funds from US Treasury bonds to euro area sovereign bonds, particularly German bunds which are regarded as the safest government bonds in the euro area.

Earlier this week the renewed weakening of the US Dollar came in response to President Donald Trump’s hostile messages directed at the Chairman of the Federal Reserve Jerome Powell. Late last week, National Economic Council Director Kevin Hassett said Trump was studying the possibility on ousting the Fed Chairman before his term expires in May 2026 following criticism by the US President that the central bank is not moving fast enough to slash interest rates despite falling oil prices and easing inflation concerns.

Essentially, President Trump is advocating for lowering interest rates to hopefully enable the government to issue the debt required at more advantageous levels and reduce the cost of borrowing. The Treasury is expected to issue $2 trillion of new debt to finance the fiscal deficit this year and roll over an additional $8 trillion of maturing notes.

Moreover, last Monday, President Trump said Powell, whom he called “Mr Too Late”, should lower interest rates “NOW” to stimulate the economy. Many commentators opined that the President’s recent remarks and pressure on the Fed Chairman are undermining the independence of the central bank. Various financial analysts believe that if the US administration ultimately takes control of the central bank, then the impact on market confidence would be unprecedented.

Other key contributors to the weakening of the US Dollar include the expectations of an inflationary environment in the US due to trade tariffs and the rising government deficit at a time when the US economy is expected to slow, with some even expecting a recession. The results of the US major banks published last week showed that until the end of March consumer spending and the labour market remained strong, but some analysts noted that the high spending patterns were also linked to pre-purchasing of products due to inflationary fears of tariffs.

Meanwhile, the recent narrative of a global economic slowdown led to the price of oil to hover around the $60 per barrel level for the first time since 2021, which in itself is also positive for the eurozone economy which is typically very susceptible to high energy prices due to the lack of major fossil fuel reserves within the region and thus is a substantial net importer of energy products.

While the strength of the euro may sound as a positive development for the euro area, a strong euro is unfavourable for European exporters or companies that hold subsidiaries in the US and the UK since income and profits denominated in US Dollar or the British Pound will appear weaker when translated into euro. Likewise, it might also impact tourism activity since the region will be more expensive to visitors from outside the euro area.

Exchange rate movements are important to be monitored by investors since they impact the overall performance of an investment portfolio. In this context, it is important to highlight that when considering fixed-income securities (namely sovereign or corporate bonds) denominated in a foreign currency, one ought to take into consideration that any additional income obtained through the better yield of the currency, may be completely eroded by the currency movements from time to time.

Likewise, the performance of the equity component of a portfolio should be adjusted to the base currency for a comprehensive assessment. For example, while the annual performance of the S&P 500 index in 2024 stood at 23.3 per cent, it was even better in euro terms at 30.5 per cent since the US Dollar strengthened during the year. In contrast, while the year-to-date performance of the S&P 500 index stands at around -12 per cent, the performance in euro terms is over -20 per cent reflecting the decline in value of US Dollar compared to the euro.

The performances of currencies in the months ahead is likely to be impacted by monetary policy decisions of the respective central banks, with the European Central Bank expected to continue with its monetary policy easing while the Federal Reserve is not expected to reduce rates in the first half of this year with the target rate standing at the 4.25-4.50 per cent level since December 2024. Since the start of the year, the ECB has cut its interest rates by 25 basis points three times, with the deposit rate facility now at a two-year low of 2.25 per cent. The decision partly reflects higher confidence that inflation is easing, amidst a slowdown in core and services inflation, but was naturally influenced by weakening prospects for economic growth, as trade tensions are likely to have a tightening impact on financing conditions.

Read more of Mr Falzon’s insights at Rizzo Farrugia (Stockbrokers).

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Mobilising savings into investments

Malta’s equity market needs to grow in size and depth if it is to embrace the EU’s Savings and Investments ...

Reduction in free float

Lowering Malta’s minimum free float requirement to 10% could unlock new opportunities for the local capital market

A golden age for GO plc

GO plc’s Annual General Meeting revealed a bold shift beyond traditional telecoms, stronger-than-ever financials, and possible share buy-backs