Maltese beer has become a staple of regular social life and events in Malta. Be it a social gathering among friends, a wedding, or even a trip to the beach in summer, you’d most definitely come across someone sipping a locally-made cold one.

At first glance, the consumer market may seem small relative to other countries, however tourists have effectively been integrated into the market. Not only that, but they take home their experience, or a six-pack to share with their peers back home, fostering international demand.

Homegrown companies can be found distributing their products to most retailers locally, and increasingly, internationally. The past few years have also seen a boom in microbreweries successfully making their mark in the local market with their unique selection of craft beers.

Economists argue that beer is also a recession-proof product, meaning that, during a recession, the product does not see a decline in consumption. Some even argue that beer consumption increases during a recession since consumers opt for cheaper alternatives for alcohol, replacing wine with beer.

The market leader

The most recognisable brand of beer in Malta is without a doubt, Cisk. Launched in 1929, the distinct yellow-gold branding has been a hallmark of the local beer scene ever since. It belongs to Simon Farsons Cisk plc (part of the Farsons Group of companies), the country’s predominant market leader in beer. and is Malta’s first independent brewery.

Over the years its portfolio of beer has expanded to accommodate different styles and tastes, and has earned a number of awards. In the 1980s, Cisk received its first award and was granted gold and dual championship recognition for both the best lager and best overall categories at the Brewex competition held in the UK. Since then it has grown from strength to strength winning many more prestigious international awards.

With its long history in the market, this brewery has witnessed consumer habits change and evolve over the years. A spokesperson informed this newsroom that, “we continue to notice a shift in consumption from ‘out-of-home’ to ‘home’ consumption.”

When it came to the current geopolitical situation, the spokesperson informed that the brewing industry has not been spared from the increase in prices for raw materials and packaging, as has been seen on the global level. They indicated that such increases have had a direct impact on the cost of production which impacted both trade and consumer prices.

On the subject of whether beer is recession-proof, the company had a nuanced point of view, “the notion of beer being a recession-proof good is generally a popular one. However, whilst overall beer consumption may be seen as ‘resistant’ to inflationary and recessionary periods when such conditions persist, it is not uncommon to see consumers opting for more ‘value for money’ brands over their regular ‘go-to’ favourites as their purchasing power is negatively affected.”

Microbreweries and the growing presence of local craft beer

Malta has a budding microbrewery scene which has seen a number of brands set-up-shop in recent years, developing a range of craft beers sought out by many looking to try something new and local. These breweries tend to produce less volume but also a broader range of flavours. It is their novelty and quality that helps them carve out a market for themselves both with locals and tourists.

One of the the more recognisable brands is Lord Chambray, Malta’s first craft beer brewery, situated in the sister island of Gozo. Another is Stretta Beer, an up-and-coming local brand named after the infamous Strada Stretta (Strait Street) from Valletta.

The brewery shares many of the same challenges as Farsons when it comes to the supply side in this turbulent geopolitical situation, Stretta Beer owner and brewer John Borg Barthet confirms. “Through careful diversification of our suppliers and planning ahead we’ve managed to keep up with demand without too many hiccups. The main pain points have been the price of grain, energy and transport which have led to increased prices,” he explained.

He added, “We’re so far doing brisk business locally with a lot more room for growth.” Indeed Stretta Beer is only a few years old, having established in 2016.

Despite the company’s young age, it has already experienced a turbulent era. Mr Barthet explained that, despite the global events of recent yearas, “I can’t speak for all of the beer industry, however, we haven’t seen any decline in demand apart from the usual seasonality. Beer as a category can be a substitute product for more expensive wine and cocktails in the on-trade sector, this proves it to be more resilient during economic downturns.”

Evolving consumer habits

Consumer habits are known to change, and there are several factors which may influence them. Malta’s market is mainly composed of residents who lived and grew up in the country, tourists who effectively double the population during peak seasons (at least during pre-COVID times), and a growing number of expats living in the country, bringing with them their flavour preferences.

With Malta’s foreign-born population reaching 22 per cent of the total, the market is ripe for disruption, and local brewers have already taken note.

The spokesperson from Farsons said that “lagers have been the preferred style of beers enjoyed locally for a number of years, with easier-to-drink lagers remaining the most popular. The recent growth in popularity and availability of craft beers has also resulted in a growing interest in the beer market in general, with IPA’s taking the lead here.”

The growing expat community was also acknowledged by the spokesperson who noted that it, “has also led to some shifts in demand for specific beer types, resulting in a nice mix of consumption trends in certain areas.”

The owner of Stretta Beer took a more generational view on the subject, saying, “it’s the newer generations of consumers that are the main drivers of this change, Millennials and Gen-Z are no longer as tied in or satisfied with the products and brands that Baby Boomers once held in such high regard.”

Mr Barthet also commented that “consumers have become ever more demanding in terms of quality across the food and beverage sector, this is driven by both local as well as international consumers.”

It’s not just about the alcohol

Drinking beer is not just about its alcohol content, flavour is what truly separates them. Growing social awareness of the effects of alcohol has led to a selection of non-alcohol local beers becoming increasingly available from local retailers. The spokesperson from Farsons noted that not only has the population reverted to their pre-pandemic lifestyles, but that there is also “an increase and growing demand for ‘low’ or no-alcohol beer, with consumers actively opting to reduce alcohol consumption in general as they opt for a healthier, more responsible and active lifestyle.”

Indeed, unfortunately, consumption above recommended levels of alcohol does cause an adverse effect on public health. Recent OECD data shows that for every person in Malta, around 3.1 litres of alcoholic beer per week per person were consumed by those aged 15 and over.

Going international

Whether there is demand for Maltese beer abroad must also be met by the question of which breweries currently have the capacity to internationalise. Malta’s craft beer microbreweries are still growing, and are now settling into the domestic market.

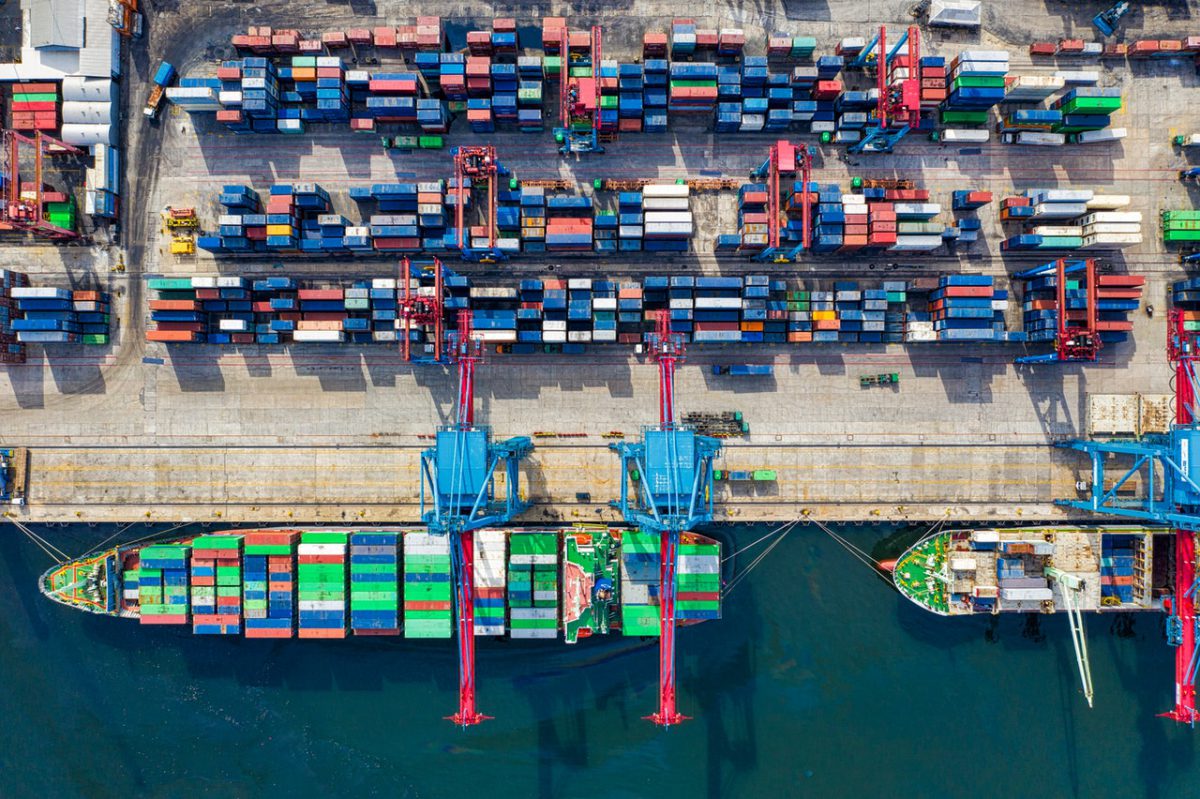

Meanwhile, Farsons has been around for much longer. In 1997, just under 70 years of since the launch of Cisk, the company developed ‘Cisk Export’. An award-winning export-orientated brew of beer, with Italy being its primary destination.

Following an expected slump during the COVID-19 pandemic, the company said it is back on course. The spokesperson shared that the demand is at such as height that it prompted “significant investment in our brewery plant and human resources to ensure we have enough capacity to meet any increase in demand for our beers.”

With Farsons making a name for itself and Maltese beer abroad in international markets, it would not be a surprise if other local brewers followed suit once they reorient their ambitions beyond Malta’s shores.

Training in the beer brewing business

As the industry grows, so does the need for skilled individuals. Recently there was an event by the Malta Business Bureau called TAPROOM, to promote craft beer production. Held at the Farsons Brewhouse, it was supported by European Union funding and sought to strengthen the local niche industry of craft and organic beer.

The project’s primary output was the manual for trainers, a tailor-made approach to train trainers on how to educate people and entrepreneurs using ten training modules which deal with the entire process of getting craft beer from farm to glass.

There is also a guidebook for national certification developed by the project partners, with step-by-step instructions for emerging enterprises on obtaining certified legal labelling for their products, tailor-made for each of the countries who participated, and EU standards.

Future of the industry

The future of the Maltese beer industry seems bright. With a strong domestic market, growing competition, professionalisation and internationalisation, Maltese beer is here to stay. The Government also seems keen to ensure that the market’s needs are met.

Stretta Beer’s Mr Barthet said, “there are always things that can be simplified and streamlined. However, it must be mentioned that Government customer care departments have come a long way in recent years.”

Whereas the spokesperson for Farsons emphasised, “whilst rules and regulations are necessary to maintain law and order in any market category, even more importantly is the fair and consistent enforcement of such regulations to ensure a level playing field for all.”

ICT sector makes up 10.3% of Malta’s economy, most in EU

Malta was also in the top spots for value added from ICT services and ICT manufacturing

Building and Construction Authority CEO resigns days after fatal construction incident

Jesmond Muscat quits after less than two years in the role

Government launches portal for temping agencies to apply for a licence, following regulations

New regulations, aimed at regulating the sector and diminishing abuse, came into force on 1st April