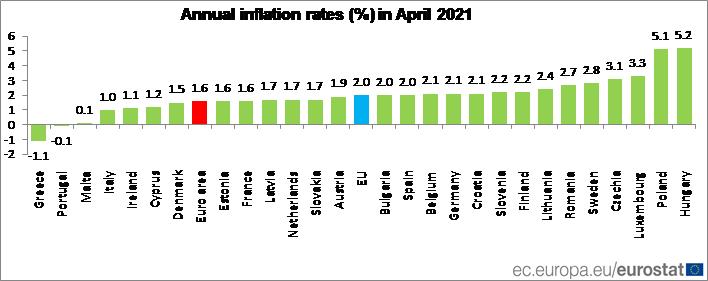

Malta’s inflation rate for April has remained stable at 0.1 per cent, the same rate recorded in February and March, while European Union inflation reached two per cent, up from 1.7 per cent in March and close to three times the rate recorded a year prior in April 2020 (0.7 per cent).

In a statement released by the National Statistics Office (NSO) on the latest measure of the Harmonised Index of Consumer Prices (HICP), it emerges that the largest upward impact on local annual inflation was measured in the Education Index (+0.29 percentage points), while the largest downward impact was recorded in the Restaurants and Hotels Index (-0.62 percentage points).

Malta’s 12-month moving average rate for April stood at 0.4 per cent.

When compared to European counterparts, Malta reported one of the lowest rates of inflation, with only Greece (-1.1 per cent) and Portugal (-0.1 per cent) recording lower inflation in the EU.

Meanwhile, the highest annual rates were recorded in Hungary (5.2 per cent), Poland (5.1 per cent) and Luxembourg (3.3 per cent).

Compared with March, annual inflation fell in three Member States, remained stable in one and rose in twenty-three.

In March, the Organisation for Economic Cooperation and Development (OECD) noted that signs of inflation had begun to emerge, after a decade of record low rates.

It said that “headline inflation has recently risen in many advanced economies, and remains high in some emerging-market economies, in part due to jumps in commodity prices and past currency depreciation”.

Nonetheless, a day later, European Central Bank president Christine Lagarde announced that the eurozone’s central bank would be speeding up its bond-buying programme in a bid to contain the cost of credit, which has been slowly but steadily increasing, threatening European recovery.

What is the Harmonised Index of Consumer Prices?

The HICP measures monthly price changes in the cost of purchasing a representative basket of consumer goods and services. The HICP is calculated according to rules specified in a series of EU regulations that were developed by Eurostat in conjunction with the EU Member States.

The HICP is used to compare inflation rates across the EU.

The HCIP has been criticised for not accurately capturing the cost of housing since it only measures rental costs, leaving out mortgage costs for the 60 per cent of Europeans who own their own home (the rate is even higher locally).

Other central banks, like the USA’s Federal Reserve, measure ‘owners’ equivalent rent of primary residence’, which is the rent homeowners would likely pay if they were to rent their own house.

Meanwhile, although Eurostat estimates that Europeans spend 24 per cent of their income on housing, the HICP only gives it a weighting of 6.5 per cent.

Self-employed, employees and companies contribute €2.1 billion in 2023

Parliamentary data reveals five-year growth trends in fiscal contributions

MFSA concludes review of Crypto-Asset Service Providers following MiCA implementation

The Authority provided clear expectations and guidance to address certain concerns.

Malta Development Bank to launch schemes supporting sustainable development and creative sector

In 2024, the MDB launched the SME Guarantee Scheme and the Guaranteed Co-Lending Scheme