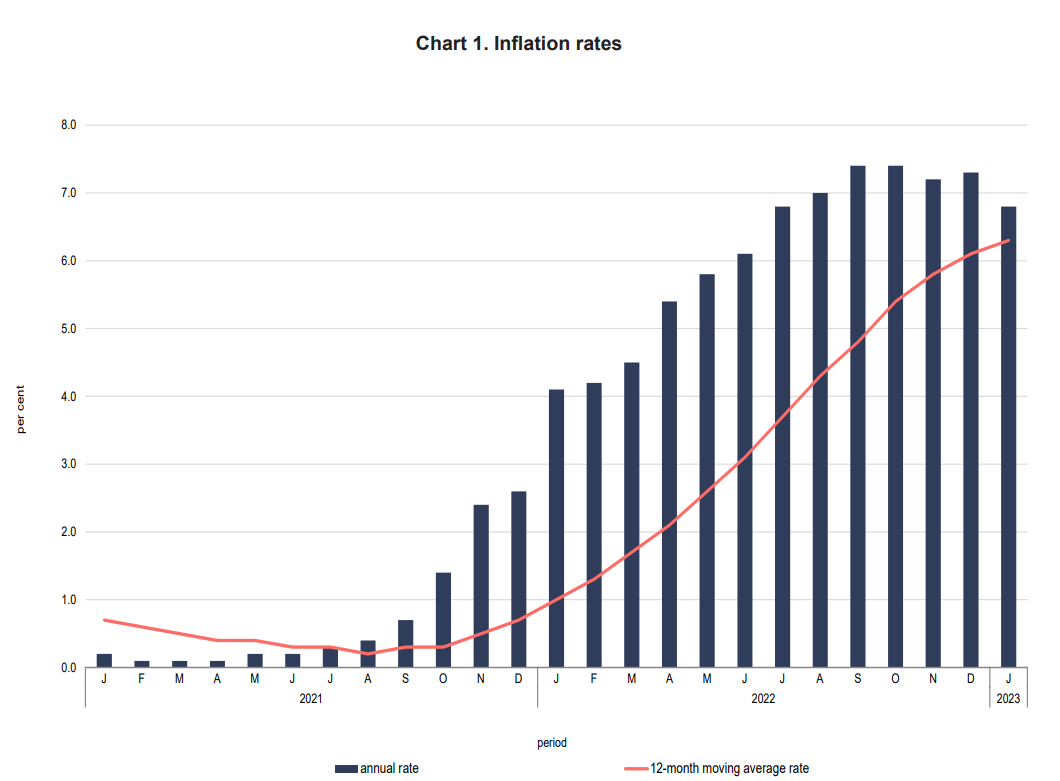

Malta’s rate of inflation dropped by 0.5 per cent from 7.3 per cent to 6.8 per cent in January 2023, marking the first time inflation has been below 7 per cent since August 2022, and the largest month-to-month drop since 2018.

The 12-month moving average for inflation stood at 6.3 per cent for January, up 0.2 per cent from December 2022.

Food and non-alcoholic beverages continue to be the main drivers of upward annual inflation, notching up 11.7 per cent, followed by clothing and footwear (9.5 per cent) and housing, water, energy and fuels (9.1 per cent).

The main reason why the cost of food has continued becoming more expensive, is due to the rising cost of meat, according to the NSO.

Although clothing and footwear is the second largest category to have contributed to the annual rate of inflation, it also saw the largest drop in its monthly inflation rate, down 11.6 per cent.

On the other hand, the lowest annual inflation rates were registered in communication (1.3 per cent) and alcoholic beverages and tobacco (2.4 per cent).

While inflation is still below the eurozone average, the gap between Malta and the rest of the euro area is getting smaller. As of January 2023, the eurozone’s rate of inflation was 8.6 per cent, just two percentage points more than Malta’s. This is a stark contrast compared to October 2022 when the gap between Malta and the eurozone was 3.5 per cent.

Overall, the gap between Malta’s and the eurozone’s annual rate of inflation shrunk by 42.8 since October 2022 and is trending to continue doing so.

Transport Malta launches €1 million assistance scheme for Storm Harry damage

The scheme will be financed through money collected from traffic fines

The Remarkable Collective announces strategic partnership with digital transformation leader Zenah Hemedan

The partnership strengthens TRC’s execution capability in project governance, ERP delivery and digital transformation

Malta’s economic confidence reaches record levels

The services sector had a very positive assessment of the business situation over the past three months