The main measures being proposed in the 2026 Budget Speech were given ample media coverage over the past 10 days. The initial part of today’s article will not delve into the merits of any of these recommendations but will focus on the state of the Government’s finances and the forecasts for Government’s fiscal position for the next three years. This is very important for the investor community since the Government remains, by a wide margin, the largest bond issuer across the Maltese capital market.

As in prior years, the Budget Document provides detailed forecasts for the Government’s fiscal position as well as its funding requirements. The 2026 Budget gives updated forecasts until 2027 and estimates also for 2028.

The Government now expects a deficit of approximately €820 million for 2025, slightly lower than the €850 million previously forecasted, primarily due to lower-than-anticipated spending on energy subsidies. As a result, the budget deficit is expected to decline to 3.3 per cent of GDP (estimated at €24.7 billion in 2025) compared to the earlier estimate of 3.5 per cent. The Government expects to continue to reduce the budget deficit in the coming years to €615 million in 2028. Given the anticipated strong growth in GDP to €30 billion by 2028, the budget deficit will however ease to two per cent of GDP.

In order to finance the ongoing budget deficit and also to refinance the annual amounts of maturing debt (mainly via Malta Government Stocks), an important topic following the recent discussion on similar refinancing methods of corporate bond issuers, new issuance of Malta Government Stocks (MGS) will remain elevated in the coming years.

In fact, MGS issuance in 2026 is forecasted at a new record of €1.9 billion, of which around €1 billion is for refinancing existing MGS’s maturing next year while the balance largely represents new borrowings to finance the projected deficit of €751 million. In 2027, MGS issuance will remain elevated at a further €1.8 billion.

The total amount of MGS in issue is expected to increase from €8.5 billion as at the end of 2024 to €11.95 billion by the end of 2028, accounting for 85 per centof the Government’s forecasted overall debt of €14.0 billion. The debt to GDP ratio will remain very comforting at circa 47 per cent.

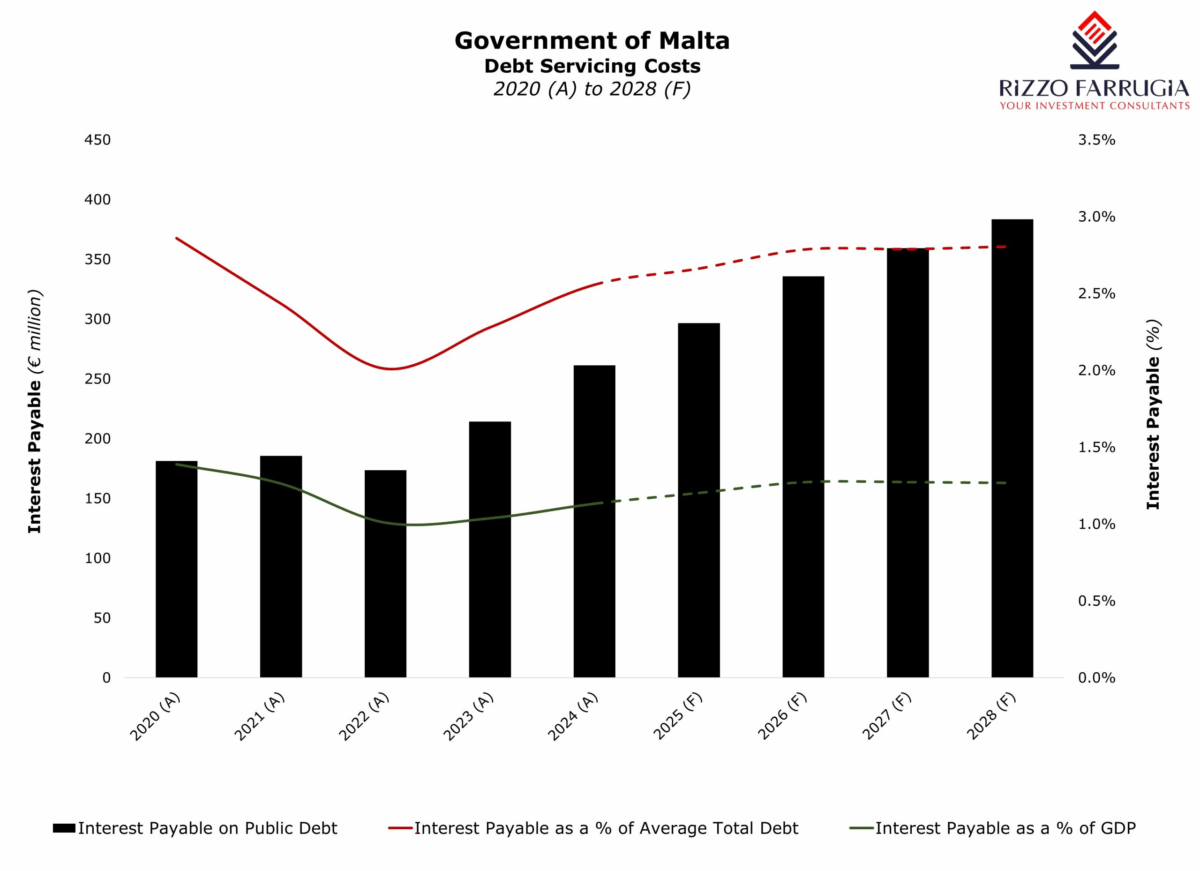

Given the continued rise in the absolute amount of Government debt, interest expenses are also naturally rising significantly. This is also partly driven by the refinancing of existing MGS’s which were originally issued at lower rates of interest some years ago reflecting the historically low-interest rate environment at the time.

Interest payable on total Government debt is expected to increase from €261 million in 2024 to a record of €384 million in 2028, which would be equivalent of 1.27 per cent of anticipated GDP of €30 billion compared to 1.13 per cent in 2024. Essentially, annual interest payments would have almost doubled between 2022 and 2028. Within three years, the Government’s budget would need to account for an additional amount of circa €200 million annually merely to finance interest payments to holders of MGS.

By the end of 2026, the average interest rate payable on the total debt is projected to reach 2.79 per cent, up from just over two per cent in 2022. This is then expected to stabilize at approximately 2.8 per cent over the subsequent two years (2027 and 2028). This is very much dependent on the interest rate environment across the eurozone as well as the planned maturity schedule of the elevated MGS issuance required over the next three years.

Yet again, the Budget Speech did not include any initiatives for the capital market. In fact, this area of economic activity was not even mentioned across the lengthy document presented to Parliament on 27 October. As the sole shareholder of Malta Stock Exchange plc, one would have expected an overview of the Government’s plans for the Borza and the wider capital market especially at a time of extensive coverage of the corporate bond market and the timely intervention in Parliament just over a month ago by the Minister of Finance explaining the role of the Malta Financial Services Authority (MFSA) as the regulator that authorises applications for admissibility to listing on a regulated market.

The absence of the capital market within the Budget Speech confirms my views publicly aired that the government lacks a clear strategy for the capital market. This is truly unfortunate and disheartening especially given the strict focus and increased efforts by the European Commission on advancing the development of a Savings and Investment Union (SIU) with the main aim “to create better financial opportunities for EU citizens, while enhancing our financial system’s capability to connect savings with productive investments”.

Moreover, the lack of any focus on the capital market by the Government of Malta is also most surprising given the EU Commission Recommendation just over a month ago on increasing the availability of Savings and Investment Accounts (SIA) with simplified and advantageous tax treatment. This recommendation provides countries in the euro area with a ‘blueprint’ for SIAs, outlining the key characteristics that SIAs should have to maximise their uptake and help achieve the objective of boosting retail participation in capital markets.

The document published by the EU Commission outlines suggestions to develop and strengthen domestic capital markets across the euro area, focusing on retail investor participation and the creation of SIA’s.

Ironically, the European Commissioner for Financial Services and the Savings and Investments Union, Maria Luís Albuquerque, also had her opinion piece published in the Times of Malta some weeks ago. In this excellent article, the Commission correctly states that “too often, money simply sits in current or savings accounts – safe, yes, but losing value to inflation. Investing may sound complex or risky but, when done wisely, over the medium and long term, it can protect your savings, make them grow and help you achieve life goals. At the same time, your money helps finance European companies, fuelling innovation, job creation and growth”.

Incidentally, the importance of channelling idle savings into the capital markets was one of the points mentioned by the Chairman of Bank of Valletta plc Dr. Gordon Cordina during this intervention at a presentation to financial analysts last week in connection with the publication of BOV’s Q3 financial statements. The Chairman explained the high exposure to the housing/property market within overall ‘household wealth’ with much lower allocations to deposits and other financial instruments. Dr Gordina remarked on the responsibility and duty for the benefits of the wider economy for the real estate exposure of individuals to be reduced and have a greater proportion into long-term investments.

Similar to my appeals in the past years, there truly needs to be concerted and coordinated efforts by various stakeholders in the industry to give added impetus to the appropriate development of the Maltese capital market at a time of specific focus by the European Commission to truly mobilise idle savings in order to help finance companies across the euro area including Malta as explained in the recent media article by the European Commissioner. As this same article succinctly stated, “citizens deserve the chance to see their hard work rewarded with greater financial security and wealth over time”. Malta’s capital markets practitioners and policymakers need to devote sufficient time and effort to bring this important recommendation into action.

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

From stability to strategy – The 2025 banking reset and the 2026 roadmap

Global markets closed 2025 on a strong note as AI-led equity gains

Strong year for European equities

European equity markets capped off 2025 with strong double-digit gains

S&P 500: Another year of strong gains

The S&P 500 index has rallied nearly 17% so far in 2025