Maltese consumers are cutting back on non-essential purchases and switching brands more frequently, according to retail leaders who warn that businesses may need to consider sharing resources and making difficult strategic choices.

These insights emerged during the latest Malta Business Network (MBN) panel event, organised in collaboration with EY Malta, which examined the findings of the EY Future Consumer Index. The survey showed that nearly half of Maltese consumers are delaying or reducing spending on non-essential items, while brand loyalty is continuing to decline across most categories.

Rising price sensitivity is at the heart of this shift, with 81 per cent of respondents ranking price as their main purchase driver. More than half (56 per cent) also said they would be willing to switch away from their preferred brands if products became unavailable.

Business leaders participating in the discussion said companies could no longer rely solely on short-term marketing strategies, but should instead consider longer-term solutions such as strategic partnerships, supply chain consolidation, and even mergers in order to remain competitive.

The panel was moderated by Gilbert Guillaumier, EY Malta Partner for Strategy & Transactions, and featured Nick Spiteri Paris, CEO of Bigbon Group; Edwin Borg, CEO of Tigné Mall; and David Shone, Country GM of Hudson Holdings.

“Shopping centres must rethink their role in people’s lives – it’s no longer just about retail, but about relevance. Today’s consumer is value-driven, digitally empowered, and constantly evolving. We must evolve with them,” said Tigné Mall’s Edwin Borg.

Nick Spiteri Paris echoed this point, stating: “Retail is in a state of recalibration, not recovery. We’ve moved beyond post-pandemic transitions into a structural shift where consumers are value-maximisers, not just deal-hunters. The future belongs to brands that blend digital agility with physical experience. One without the other is no longer enough.”

The panel also noted that tourists are increasingly seeking out unique and local retail experiences, though this trend is developing against a backdrop of declining overall spend, oversupply in retail real estate, and challenges in staff recruitment, particularly due to complex and costly visa requirements.

Speakers highlighted potential opportunities for collaboration within the sector, including shared warehousing and logistics, as businesses attempt to improve efficiency while maintaining customer experience.

From pricing pressures and new definitions of value, to the growing importance of wellness, convenience, and tech-enabled retail, the discussion emphasised the need for businesses to stay closely attuned to changing consumer behaviours and respond accordingly.

The event, supported by Tigné Mall, attracted business owners, marketers, and decision-makers seeking to assess how shifting trends may impact the local retail sector.

Final deeds of sale rise 8.4%, promise of sale agreements up 6.8% in November

Malta’s residential property market strengthened again last month

Employment rises 4.8% as labour market continues to expand

66.8% of the population aged 15 and above are employed

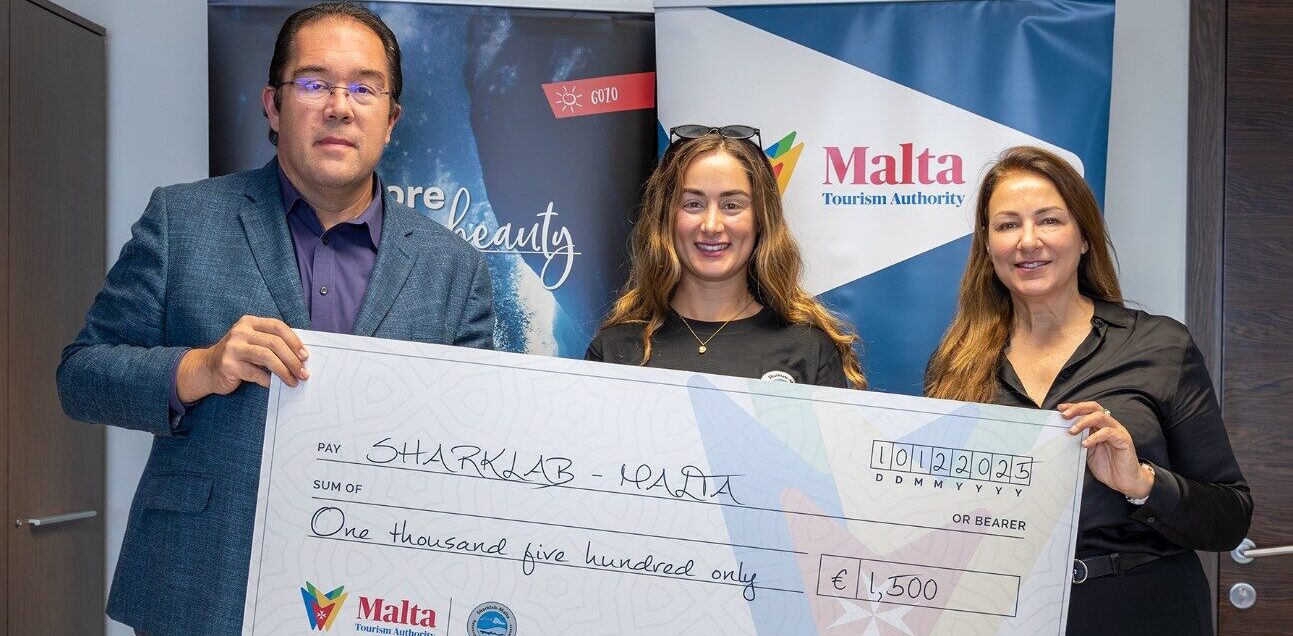

MTA donates €3,000 award to marine conservation NGOs Sharklab Malta and Nature Trust

'Sharklab Malta and Nature Trust have been instrumental in supporting our marine environment'