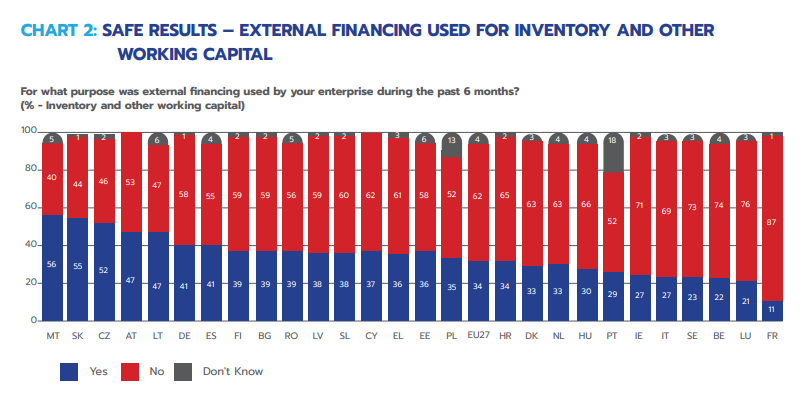

When compared to SMEs operating in other European Union countries, Maltese ones are most likely to depend on external finance, primarily loans, for their working capital.

Working capital is the operating liquidity of a firm, used to pay its short-term obligations like inventory, salaries and taxes.

In its annual report, the Malta Development Bank (MDB) referred to the Survey on Access to Finance of Enterprises (SAFE), conducted by the European Central Bank and the European Commission.

The MDB pointed out that the economic sentiment among local SMEs registered the third lowest decline among all EU member states, describing this as a “net positive” and highlighting the possible role played by MDB loans that facilitated access to working capital.

Another possible factor behind this result, the MDB noted, was the Government’s intervention in buffering fuel-related inflationary pressures.

The bank’s COVID-19 Guarantee Scheme was availed of by over 600 businesses for an amount of over €500 million.

Over 40 per cent was used by businesses in tourism-related sectors which were most adversely impacted by the pandemic.

In view of the rapid rise in inflation, the MDB also issued two Liquidity Support Guarantee Schemes, also facilitaing access to working capital.

The new SME Guarantee Scheme, launched in late 2022, will also enhance SME access to bank credit for new investment as well as other purposes, including for working capital related to new investment and business transfers.

Featured Image:

Malta Development Bank

The unpaid civil servants: Local programmers building what the Government hasn’t

Citizen-built tools – from permit and pollution trackers to grant portals – are helping solve everyday frustrations

Melita expands VoLTE roaming to eight countries

The rollout extends Melita’s existing VoLTE service, which is already available across Malta and Gozo

db Group reports turnover of almost €100 million and record profit as it opens bond issue to public investors

This coincides with the launch of a €60 million bond programme to support the Group’s continued expansion