Last week Malta International Airport plc (MIA) convened a press conference to provide details about the annual traffic statistics published on 11th January and to also disclose its traffic and financial forecasts for 2023. However, the main highlight of the press conference was the announcement of a five-year investment plan by the company totalling €175 million which includes the first phase of the terminal expansion project. The entire terminal expansion project had first been temporarily launched in early 2020 prior to the onset of the COVID-19 pandemic.

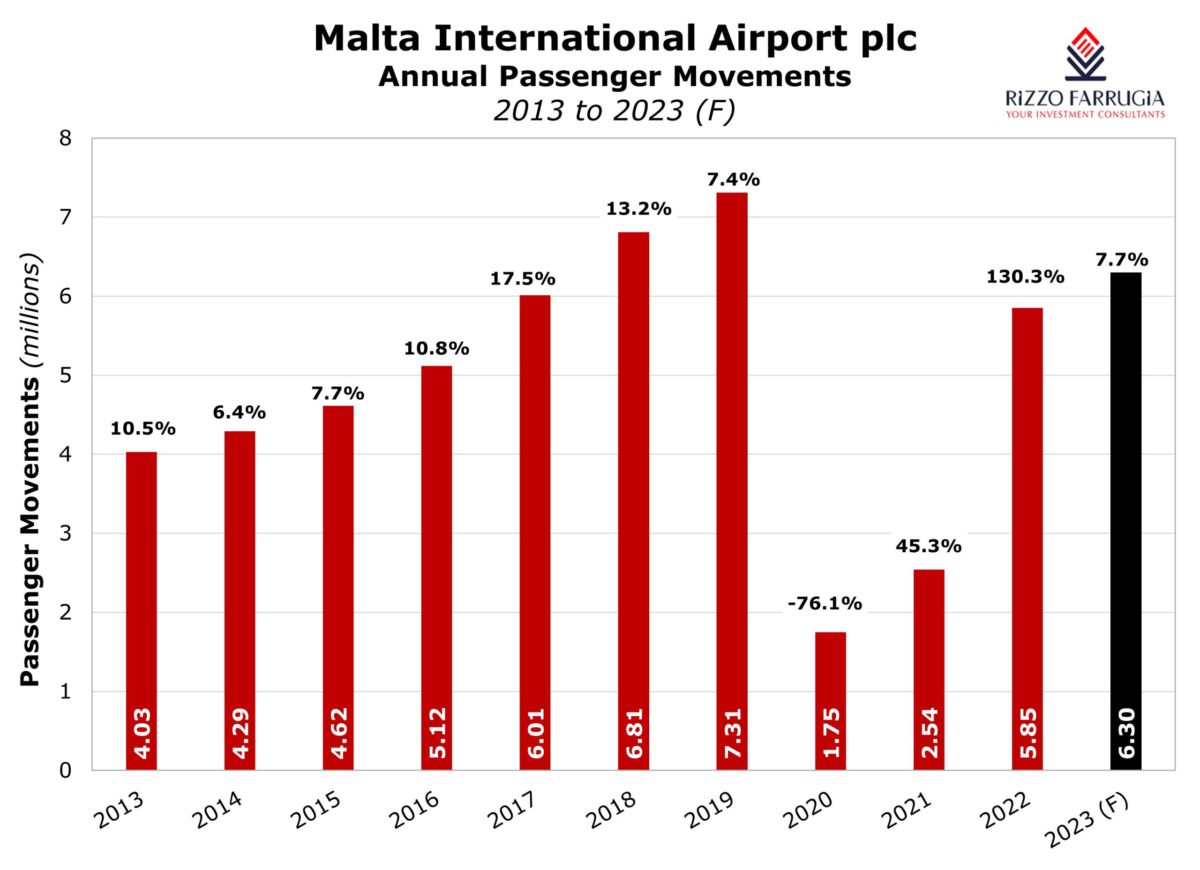

The traffic statistics published by MIA on 11th January 2023 confirmed that passenger movements during the entire 12-month period of 2022 amounted to 5.85 million. This is higher than the 2022 full-year target of 5.7 million passenger movements which was revised upwards in early November and represents a growth of over 130 per cent compared to the passenger traffic in 2021. The actual results achieved in 2022 should be considered as a major feat given the COVID-19 restrictions that had been in place during the first few months of the year and the uncertainty on the demand for air travel in a post-COVID environment. However, it is also fair to state that the level of passenger movements in 2022 is still 20 per cent below the 2019 figure of 7.31 million passenger movements.

MIA’s CEO Mr Alan Borg explained that during the fourth quarter of 2022, the seat load factor was exceptionally high indicating the pent-up demand for travel and the recovery in capacity. However, he also mentioned the uneven recovery across various markets with Italy performing very strongly and the UK and Germany exhibiting a slower recovery. In fact, Italy was the top market in 2022 with 1.32 million passenger movements which represents a decline of only nine per cent from the 2019 passenger traffic. On the other hand, passenger movements to and from the UK at 1.06 million represent a decline of 38 per cent from the pre-pandemic performance. Likewise, the German market accounted for 557,000 passenger movements, also showing a 38 per cent decline from the 2019 passenger traffic.

Ryanair was once again the top airline in 2022 with 2.6 million passenger movements (minus seven per cent from the 2019 figures) followed by Air Malta at 1.5 million passengers. This represents a decline of 28 per cent from the 2019 figures but the national carrier is currently operating eight aircraft compared to 11 aircraft in 2019.

During last week’s press conference and in the company announcement published shortly afterwards, MIA stated that it expects passenger movements of 6.3 million in 2023. This would represent a further 7.7 per cent growth over the 5.85 million passenger movements during 2022 and translates into an 86 per cent recovery of the record pre-pandemic traffic in 2019. MIA’s CEO hinted at the ‘promising winter ahead’ which is already evident during the first two weeks of January with passenger volumes exceeding those in the comparative period of 2019.

Based on the traffic projections being envisaged for 2023, MIA announced that it is expecting to generate revenues of €97 million during the current financial year ending 31 December 2023, leading to an EBITDA of €59 million and a net profit of €29 million. In 2019, MIA had achieved a record financial performance with revenue of €100.2 million, EBITDA of €63.2 million and a net profit of €33.9 million.

With respect to the five-year capital investment programme, MIA’s CEO explained that this is aimed towards ensuring that “the airport is infrastructurally equipped to return to 2019 levels and aim for further growth”.

Mr Borg explained that the investment plan covers four main areas, namely (i) operational, (ii) airport experience, (iii) sustainability and (iv) retail & property. The most notable investments in the coming years will include the first phase of the Terminal Expansion Project (the extension of the existing building on the arrivals area), the customs area expansion, construction of Apron X, a covered walkway from Park East to the air terminal, new outlets and outlet refurbishment, a new PV farm, the construction of SkyParks 2 and the Business Hotel as well as the Cargo Village project.

Prior to the onset of the pandemic in early 2020, the airport operator consistently distributed semi-annual dividends to shareholders. MIA last distributed a dividend to shareholders in September 2019 which related to the 2019 interim dividend. Following the severe disruptions to the travel sector caused by the pandemic, MIA did not distribute any dividends in order to maintain a strong financial position.

Incidentally, this strategy was also replicated by the company’s major shareholder, Flughafen Wien AG (Vienna Airport). It is interesting to note that last week, Vienna Airport confirmed that after three years of not paying any dividends, a dividend for the 2022 financial year will be distributed to its shareholders shortly. Vienna Airport also confirmed that it will also maintain its dividend payout ratio of “at least 60 per cent of the net profit”.

In view of this clear intention by MIA’s major shareholder, the numerous shareholders of MIA should be eagerly awaiting the upcoming meeting of the board of directors when the 2022 annual financial statements will be approved and published and when the final dividend is recommended for approval at the forthcoming annual general meeting.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers)

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Vision 2030 & 2050: A strategic lens on Malta’s tourism, hospitality, and leisure industries

Malta’s next challenge is not growth – but quality

From stability to strategy – The 2025 banking reset and the 2026 roadmap

Global markets closed 2025 on a strong note as AI-led equity gains

Strong year for European equities

European equity markets capped off 2025 with strong double-digit gains