In last week’s article, I provided details on the background behind the very painful year for bond investors with the RF MGS Index closing 2022 with a decline of 19.7 per cent. This reflected similar very weak performances across the international bond markets in the US and Europe as bond yields surged and prices declined sharply.

Meanwhile, the Maltese corporate bond market fared much better with an overall resilient performance. The RF Malta Corporate Bond Index declined by 4.7 per cent during the year compared to much steeper declines in the Malta Government Stock market and across international sovereign and corporate bonds.

Prices of several Maltese corporate bonds dropped below their par value during the second half of 2022 as international and local bond yields rallied as explained in last week’s article. On a total return basis (i.e. including the income generated from the bonds), the RF Malta Corporate Bond Total Return Index ended the year at -0.8%, the first year in which a negative performance was registered.

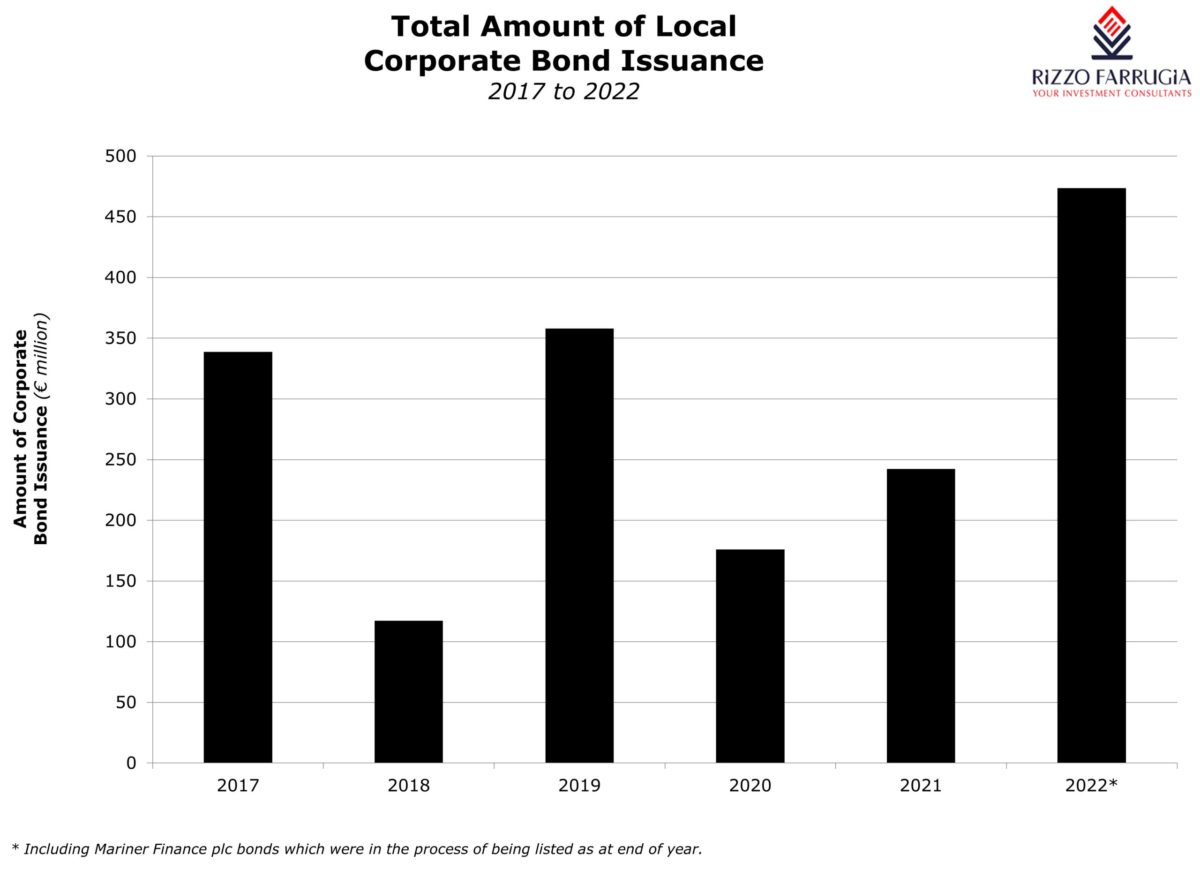

Although corporate bonds generated a slightly negative performance during 2022, it was a milestone year for the market. In total, just over €470 million were raised on the primary market across 20 issues. There were a number of new offerings from existing issuers (apart from roll-overs of existing bonds) as well as several other companies tapping the bond market for the first time.

The new issuers were BNF Bank plc, Ferratum Bank plc (renamed Multitude Bank plc), G3 Finance plc, IZI Finance plc, St Anthony Co plc and The Ona plc. Meanwhile, JD Capital plc is also a newcomer to the Regulated Main Market of the Malta Stock Exchange although the company had previously issued debt via Prospects MTF.

When reviewing the developments across the Maltese corporate bond market in 2022, one can mention that there were three banks that issued subordinated debt during the year. While two of these, namely BNF Bank plc and Ferratum Bank plc (renamed Multitude Bank plc), are newcomers to the Maltese capital market, Izola Bank plc carried out its third bond issue over the past 12 years. As indicated in some of my articles over recent months and years, the application procedure for bonds of banking institutions is somewhat different since these are classified as ‘complex’ financial instruments. I also mentioned this more recently in the context of the large bond issue by Bank of Valletta plc listed on the Irish Stock Exchange at a coupon of 10 per cent per annum. Not only are these bonds classified as ‘complex’ financial instruments, but the target market established by BOV precluded participation by the retail market. Instead, such bonds could only be subscribed for, and subsequently traded on the secondary market, by professional investors and eligible counterparties for a minimum of €100,000 (nominal).

Once the indicative terms of the €350 million issue by BOV started becoming available via international pricing channels, as expected this immediately impacted the price of the other BOV bonds on the secondary market. In fact, the price of one of the tranches of the 3.5 per cent BOV plc 2030 bonds on the MSE initially dropped to just below 93 per cent but subsequently slid to 82 per cent in recent weeks. At this price, the yield to maturity of this bond is equivalent to 6.54 per cent per annum.

The high coupon of BOV which was officially confirmed upon listing date on 6th December via a company announcement on the MSE may have also somewhat impacted investor sentiment towards new bond issues on the primary market during the month of December. In fact, it may have been a surprise to many that unfortunately, Mariner Finance plc did not manage to raise the full €44 million which was available to both existing bondholders via an exchange offer of the existing bonds in issue and also to the general public.

As the year progressed, yields on new bond issues increased as a result of the official hikes by the European Central Bank and the upward movement in yields across the secondary market. While in the first half of the year, most issuers priced their bonds at or around the four per cent level, the most recent bond issues were at or around the five per cent level. Moreover, the latest bond approved by the Malta Financial Services Authority during the month of December but whose public offer opens in the coming days, has a coupon of 5.25 per cent. Qawra Palace plc is a newcomer for the investing public and the company is issuing a €25 million secured bond over the coming weeks.

Hopefully, the heightened activity across the primary market will continue throughout the coming months since the silver lining of recent developments for investors is the notable increase in yields from both the local as well as the international bond markets.

While no indication is currently available of the number of bond issues that may be offered throughout the course of 2023, there are a few issuers whose bonds are due to mature in the second half of the year and who may decide to refinance through the issue of new offerings. Following the series of interest rate hikes by the European Central Bank in the past few months and the subsequent rise in yields, the public’s response to the new bond offerings in 2023 would be important to be monitored following the recent developments that took place.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers)

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Will the rally last?

This week marks the 3rd anniversary of the current bull market in US equities

More than 70,000 active rental contracts with the Housing Authority in the first half of 2025

This figure marks an increase of 7.5% compared to the same period in 2024

Unprecedented issuance in Q4

Malta’s bond market is seeing record issuance in the final quarter of the year