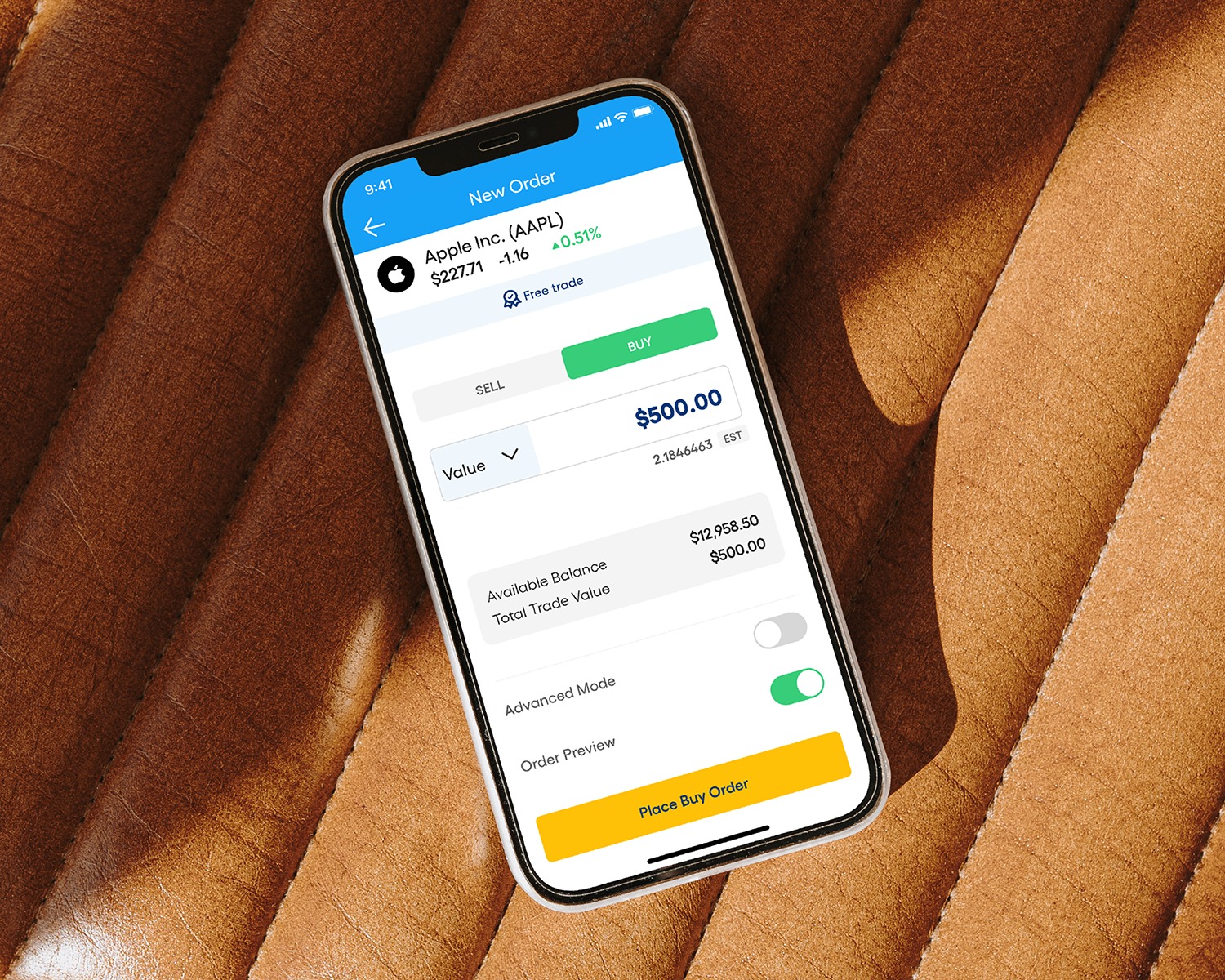

Moneybase announces the launch of its new Free Trade per month, which is being offered to all individual and joint account holders. This initiative provides moneybase customers a fee free trade per month.

The benefit is available immediately and grants all its retail clients one free trade each calendar month going forward. The new feature applies for all US Stock trades made with a maximum order value of $1,000.

Moneybase customers can invest in a wide range of Stocks, Exchange-traded funds (ETFs), Bonds, Treasury Bills and Funds, ensuring a broad selection of investment opportunities. This also includes the ability to invest in Cash Funds which currently return up to 4.85% APY in Dollar and 3.35% APY in EUR, at no cost. The new benefit is automatic, the first trade of the month that meets the criteria is automatically marked as free when the order is placed, with no commission charged. Once the free trade has been used, any additional trades made within the same month enjoy ultra-low brokerage fees, which have been launched a few weeks ago.

“The free trade allows our customers to invest their savings regularly at no cost. This year Moneybase has launched several new exciting features and benefits whilst providing seven day a week customer support across four branches. We’re excited with this new offering and there is even more coming soon” said Alan Cuschieri, Founder of Moneybase.

The Fee-Free Trade is another key feature, as to why investors should opt to invest on Moneybase. With over 20,000 different investment instruments across 40 international exchanges, including the Malta Stock Exchange.

For more information visit the Moneybase website or log in to the Moneybase mobile app.

Investment Services are provided by Calamatta Cuschieri Investment Services Ltd which is a member of the Maltese Investor Compensation Scheme. Investments entrusted with Calamatta Cuschieri are covered under the Scheme in line with the Investor Compensation Scheme Regulations.

Card payments now drive Malta’s consumer economy as supermarket usage hits 60%

In 2024, card payments accounted for 60% of all supermarket sales, making them the dominant payment method in the industry

Could a 50-year mortgage work in Malta? Experts weigh in on feasibility and risks

Donald Trump’s recent proposal for a 50-year mortgage has stirred controversy, but could this work in Malta?

‘If the Maltese had a connection to their land, it would change absolutely everything’ – Malcolm Borg

'“Generation renewal is one of the biggest problems — not just in the EU, but in the world'