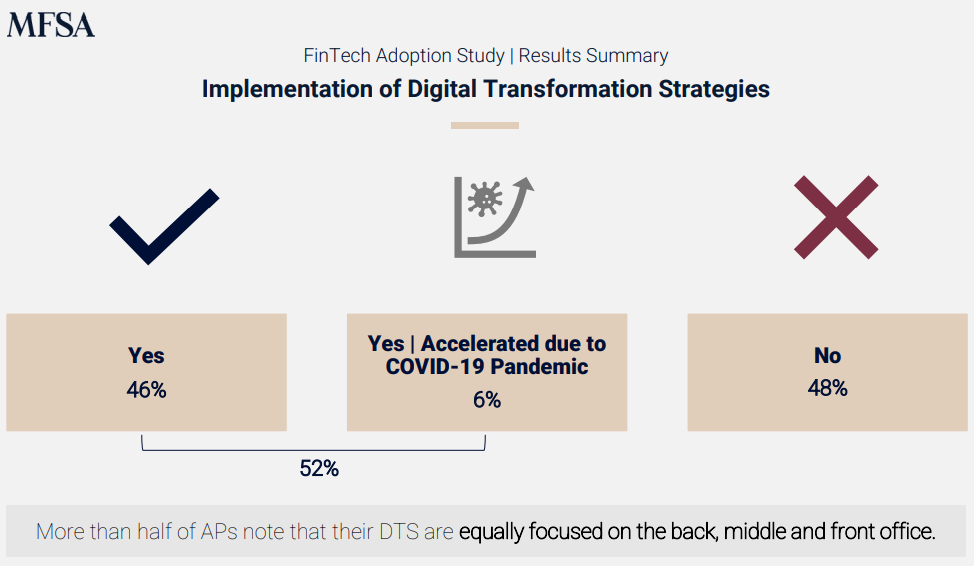

A study conducted by the Malta Financial Services Authority (MFSA) in 2022 provided encouraging results in the field of digitalisation, as it demonstrated that more than 52 per cent out of 390 authorised entities/persons surveyed have implemented digital transformation strategies (DTS).

The study, which sought to shed light on the state of digital transformation and fintech adoption in the Maltese financial services sector, was marked by a high response rate of 95 per cent.

Out of the 52 per cent who indicated that they have implemented DTSs, six per cent had accelerated adoption due to the COVID-19 pandemic.

The pandemic had triggered a wave of digitalisation across global economies, pushing firms to adopt novel solutions so they could still operate remotely, and engage with their clients amidst the various physical distancing restrictions which were implemented at the time.

Out of all the entities with a DTS, 64 per cent of firms had adopted them prior to 2022, 12 per cent during 2022 and 19 per cent in 2021.

However, 31 per cent of firms with a DTS did not have an explicit strategy document in place, while the latter had a range of implicit, explicit, or mixed strategy documentation.

The top three objectives with the highest degree of significance toward the development and implementation of a DTS were: enhanced efficiencies, enhanced customer experience, and the reduction of operational risks associated with information and cybersecurity.

Meanwhile reduction of real estate costs, monetisation of client data and reduction of regulatory costs were of the least significance.

As for the benefits, the top three were enhanced efficiencies, reduction of money laundering/terrorist financing risk, and enhanced customer engagement.

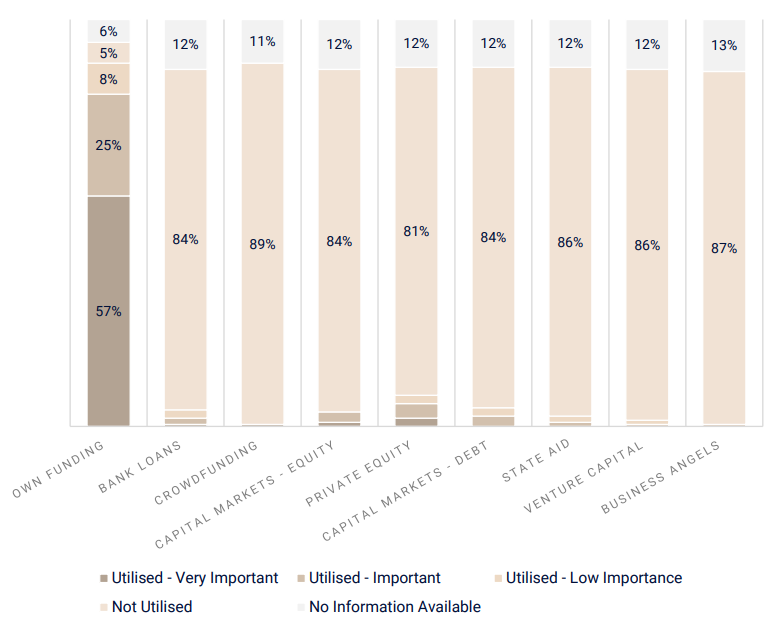

The survey found that firms largely preferred funding the DTS with their own funds, with 82 per cent indicated to have utilised the method.

As for the implementation of the DTS, 70 per cent of firms made use of third-party providers.

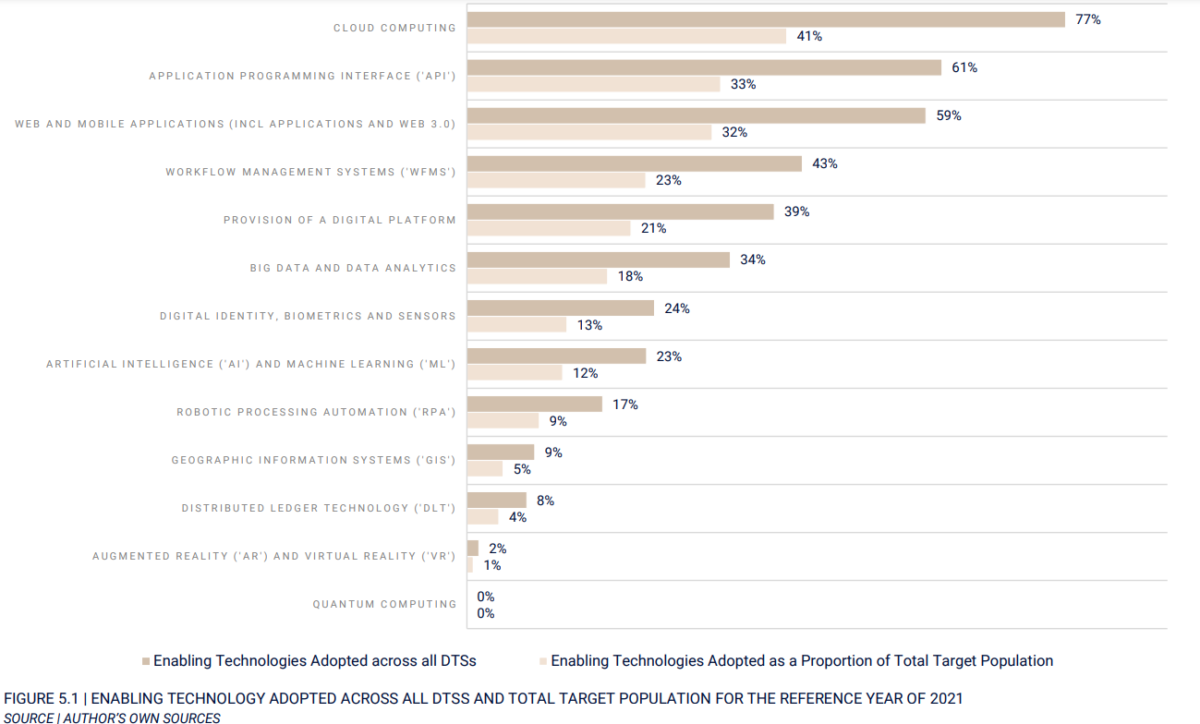

With regard to what types of technologies were adopted by the firms, the survey found that the top three were cloud computing, APIs and web and mobile applications.

Meanwhile, no firm has adopted quantum computing, and only two per cent adopted augmented reality/virtual reality.

Herman Ciappara, head of fintech supervision at the MFSA noted: “the findings of this study will provide the Authority with the necessary insight to carry out further initiatives and supervisory engagement in this area going forward. We look forward to continue working with the industry to monitor, understand, and assess the developments and implications of the use of innovative technology and digital transformation in financial services.”

Malta’s youth population down by 15,000 in 10 years: What does this mean for the labour market?

'The challenge today goes beyond attracting talent – it’s about retaining it'

MBB urges caution over EU’s 2040 climate targets, citing risks for Maltese businesses

'The proposed target presents both opportunities and challenges'

db Foundation raises €8,419 for Karl Vella Foundation with MasterChef Malta Charity Dinner

These events form part of the db Foundation's ongoing commitment to supporting vulnerable members of society through impactful initiatives