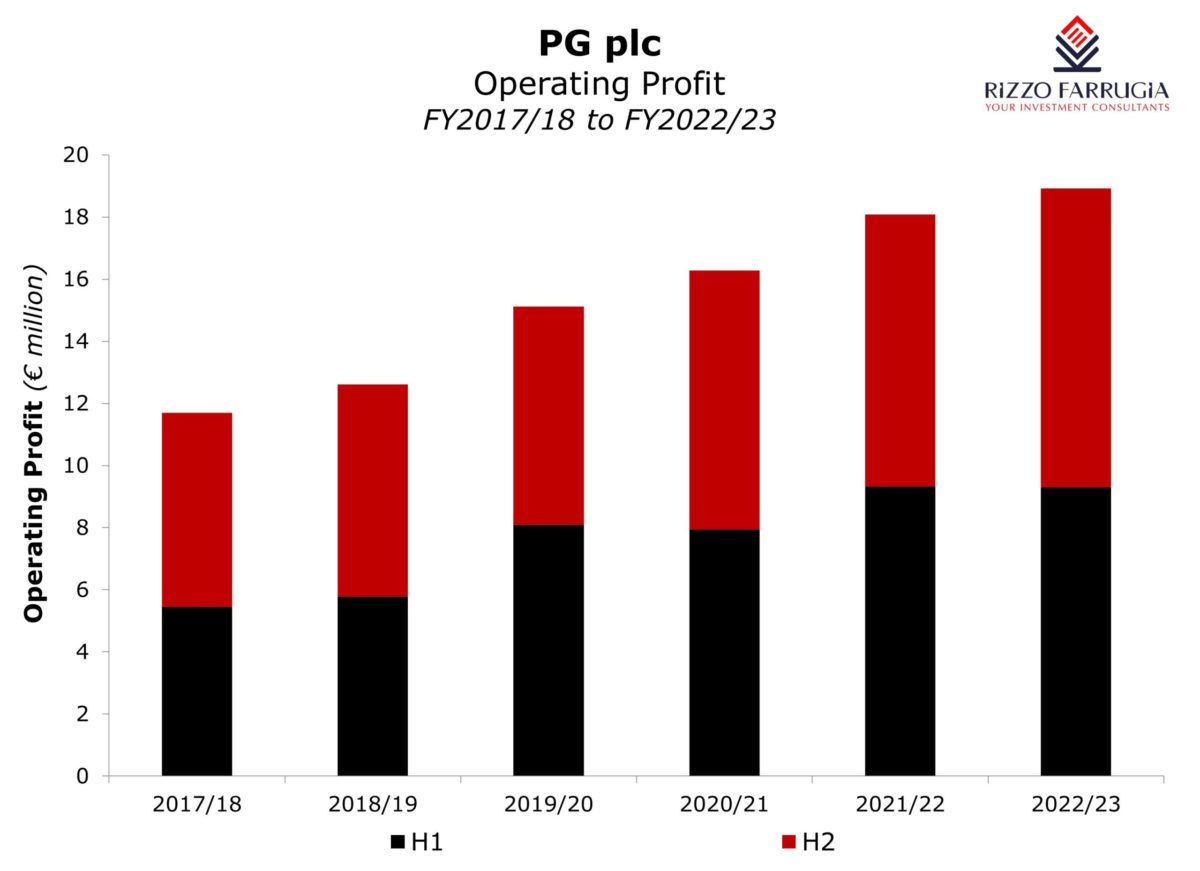

In the midst of the interim reporting season which comes to a close today, PG plc published its annual financial statements for the 2022/23 financial year that ended on 30th April 2023. PG registered another record financial performance with revenues surging by 18.3 per cent to just under €174 million, operating profit (EBIT) rising by 4.6 per cent to €18.9 million, pre-tax profits increasing by 5.7 per cent to €17.6 million and profits after tax increasing by 5.2 per cent to €12.7 million. PG’s CEO, Charles Borg, acknowledged in the Annual Report published last week that the financial performance exceeded the budgets set at the beginning of the year.

When the company had published its interim financial statements in December 2022, it was clearly evident that while revenue had increased in double-digit terms between May and October 2022, margins declined with the operating profit easing by 0.3 per cent to €9.30 million.

This was part of PG’s strategy and was mentioned on various occasions by both the CEO and also Chairman John Zarb in the Annual Report. In fact, it was explained that “the group maintained its emphasis of containing selling prices, reducing margins on certain core branded products while placing added focus on direct procurement from more competitive sources”. The CEO confirmed that the group’s policy is “to retain low and competitive prices even at the expense of lower margins” in order to ensure increased footfall at the two supermarkets.

As such, once the annual financial statements were published last week, one of the key indicators that shareholders and analysts ought to have focused on was the operating profit margin. It is very positive to note that the strategy clearly paid off as overall revenue accelerated during the second half of the financial year (+22.4 per cent) and the operating profit increased by 9.9 per cent over the comparative period to €9.6 million. In total, the operating profit for the year of €18.9 million translates into a margin of 10.9 per cent compared to 12.3 per cent in the previous financial year.

The two supermarkets and ancillary retail operations remain the core businesses of the PG Group accounting for 83 per cent of overall revenue totalling €144.4 million, representing a 19 per cent increase over the previous year as PAMA and PAVI are clearly gaining market share with footfall increasing by 15 per cent. The supermarket segment accounted for 79.7 per cent of operating profit.

Meanwhile, the Zara and Zara Home franchise operations also had a successful year with revenue rising by 13.9 per cent to €29.5 million and online sales contributing 15.4 per cent of total sales.

The success of the group’s strategy to offer cheap prices at the supermarkets in order to increase footfall that became clear in the second half of the 2022/23 financial year has reportedly continued in the first quarter of the current financial year. In fact, the group reported that between May and July 2023, revenue increased by 23 per cent clearly indicating that the momentum is still very evident. Although the rate of growth will inevitably reduce in view of the tough comparative set in the months ahead, the strong growth being seen at the moment will surely lead to another record level of profits for the 2023/24 financial year.

Despite the group’s success at generating higher revenues and profits from the PAMA and PAVI operations over recent years, shareholders are clearly eager to see the group expand further and reduce the dependency on the two supermarkets. During last week’s meeting with financial analysts, Chairman Mr John Zarb highlighted the challenge to find the right location in order to replicate the PAMA and PAVI shopping centres.

However, the Chairman indicated that they are analysing a couple of opportunities for growth. In the Annual Report the Chairman claims that the “burgeoning clientele and a successful business model” provides the confidence that a new site should also translate into a successful venture also taking into consideration the benefits from economies of scale that further growth could provide.

Apart from the appetite to consider additional investment opportunities, the group is also working on the expansion of both its present operations. During the past financial year, PG acquired a site in Qormi in close proximity to the PAVI Shopping Complex with the initial intention to relocate the warehousing and storage facility from the ex-pasta factory which can then be disposed of or redeveloped accordingly. Moreover, the group applied for a change of use on this large 8,000 sqm site and if planning permits are approved, it will result in a significant expansion to the PAVI shopping village and enable the group to offer a diverse commercial offering similar to the PAMA set-up.

With respect to the PAMA shopping complex, PG had also signed an agreement for a 50-year concession over a parcel of land adjacent to the present site. Subject to planning permission, it will enable the company to extend its retail space and parking facilities. However, this will be a much smaller enhancement compared to the major extension being envisaged at PAVI.

In line with its semi-annual dividend policy, PG distributed two interim dividends in December 2022 and July 2023 totalling €6.8 million or €0.0625 per share. Dividends have increased consistently to shareholders ever since the IPO in 2017 highlighting the benefits of long-term investing in companies achieving positive results. The dividend in respect of the 2022/23 financial year equates to a net dividend yield of 6.25 per cent based on the 2017 IPO price of €1.00 per share.

PG is among the most successful IPO’s in Malta as detailed in my article last month with strong profitability and dividend growth since the share offering took place in early 2017. Hopefully, companies with similar ambitions and strong financials understand the various benefits of a public listing. The Maltese capital market evidently needs additional listings of this nature in order to provide the impetus for renewed enthusiasm for the equity market as was common practice prior to November 2019.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers)

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

New legal notice grants employees right to pay transparency – of a sort

Employers are encouraged to seek legal advice to ensure compliance and to prepare for future legislative updates

A golden age for GO plc

GO plc’s Annual General Meeting revealed a bold shift beyond traditional telecoms, stronger-than-ever financials, and possible share buy-backs

Another v-shaped recovery

Towards the end of 2024, most investment banks predicted that the S&P 500 index would continue its positive streak