In the midst of the hectic reporting period across the US, UK and European stockmarkets, the three largest retail banks in Malta (APS Bank plc, Bank of Valletta plc and HSBC Bank Malta plc) also published their Q3 financial figures.

The level of reporting by the three banks was somewhat different since quarterly updates are not a regulatory obligation unlike the situation across the larger and more developed capital markets overseas. While APS and BOV issued their entire income statement as well as the statement of financial position (balance sheet), on the other hand, HSBC Malta provided a detailed commentary on the main performance indicators. Nonetheless, there was sufficient detail within the HSBC Malta company announcement to arrive at some of the key figures to report on the trends during the course of the year and compare these to prior year levels.

HSBC Malta announced that revenue increased by €19 million (11 per cent) during the first nine months of the year when compared to the same period last year. This translates into a total operating income of around €190 million during January to September 2024 and indicates that HSBC Malta achieved an operating income of over €62 million in each the first three quarters 2024.

The financial performance of HSBC Malta was also boosted by the improvement in the credit quality of its loan book, resulting in a release in expected credit losses of €10.8 million in the first nine months of 2024, which is higher than the release of €3.7 million in the same period last year.

HSBC Malta reported a profit before tax for the first nine months of 2024 amounting to €118 million, an increase of 17 per cent over the €100.8 million in pre-tax profits reported in the same period last year. When excluding the release in expected credit losses of €10.8 million, the pre-tax profit in the first nine months of the year amounts to €107.2 million.

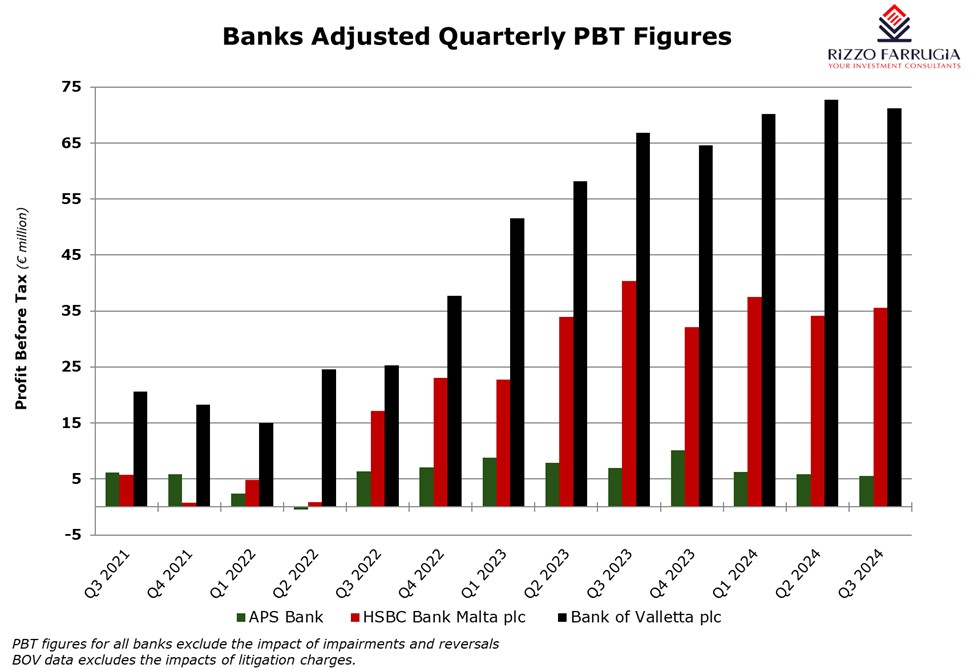

On a quarterly basis, HSBC Malta generated average pre-tax profits (excluding the release of expected credit losses) of just over €35.7 million in each of the first three quarters of 2024. To place this into perspective, pre-tax profits for HSBC Malta in Q3 2022 were €17.2 million at the time when interest rates had started to rise from the prolonged period of very low interest rates across the eurozone for several years and which dented profitability across the banking sector.

BOV’s net interest income surged by 14.5 per cent to €290.5 million during the first nine months of 2024 through the continued growth in gross interest income (+14 per cent to €329.5 million) primarily driven by an increase in the investment portfolio. Meanwhile, interest expenses increased by 10 per cent to €38.9 million. Net interest income in Q3 2024 increased marginally to €97 million from the previous quarter and was just below the peak of €98 million registered in both Q4 2023 and in Q1 2024.

Profit before tax amounted to €223.7 million during the first nine months of the year which is 36.9 per cent higher than the €163.4 million generated in the same period last year. When excluding the release in expected credit losses of €9.5 million, the pre-tax profit in the first nine months of the year amounts to €214.2 million.

On a quarterly basis, BOV generated average pre-tax profits of €71.4 million in each of the first three quarters of 2024 (excluding the release of expected credit losses) which is above the average profitability generated in 2023. Moreover, it is interesting to highlight that prior to the increase in interest rates by the European Central Bank in the second half of 2022 quarterly profits were below €25 million.

As at 30th September 2024, BOV’s loans to customers reached a record €6.69 billion, which make up nearly half the interest-earning assets of the bank. Furthermore, BOV’s asset base also included nearly €6 billion of fixed-income investments currently at a Net Interest Margin of 2.13 per cent compared to 1.35 per cent in Q3 2023. This investment portfolio is generating income of over €30 million per quarter. Shareholders’ funds as at 30th September 2024 of €1.39 billion translates into a net asset value per share of €2.373.

APS Bank noted that despite the continued growth in gross interest income (+9.7 per cent to €84.7 million), net interest income dropped by 11.6 per cent to €49.1 million. This reflects the surge in interest expenses (+64.5 per cent to €13.9 million) due to new bonds issued towards the end of 2023 to boost capital, together with the policy of passing through the interest rate benefits to its depositors. In essence, quarterly net interest income declined for the fifth consecutive quarter in Q3 2024 to €15.9 million from the peak of €18.8 million in Q2 2023.

Profit before tax amounted to €16.5 million, which is 29.2 per cent below last year’s comparable figure of €23.3 million. On a quarterly basis, the pre-tax profit of €6.4 million registered in Q3 2024 is higher than the €5 million generated in each of the previous two quarters, due to a reversal in expected credit losses in Q3 compared to charges incurred in the first two quarters of 2024.

APS sustained its growth momentum in loans and deposits, both reaching record levels. As at 30th September 2024, customer and syndicated loans reached €3.11 billion, while customer deposits surpassed the €3.44 billion level. Shareholders’ funds as at 30th September 2024 of €280.1 million translates into a net asset value per share of €0.738.

While the performance figures by the banks were important to review, naturally, the main item of interest was on the strategic review being undertaken by the parent company of HSBC Malta. Last week, the Directors of HSBC Malta remarked that the focus remains on running its business and further updates will be provided as required. On his part, the CEO of APS remarked during the Q&A session of their presentation to the market that the bank is “continuously analysing opportunities that may arise in our natural market”. APS’s CEO also stated that “We believe that there is a lot of potential in the bank that is yet to be unleashed, so we owe it to our stakeholders to explore possibilities to gain scale”.

The other important focal point for the investor community was the study being undertaken by BOV to optimise shareholder value. During the meeting with financial analysts, the bank remarked that given the potential implications of the various measures, a comprehensive study conducted by a ‘Big4 firm’ is currently under way and due for completion in early November. The objectives of the study include an assessment of the financial and strategic rationale for a share buyback; improving the liquidity of BOV shares on the market and providing recommendations on the optimal implementation and timing of the programme. The bank noted that it will deliberate on the outcome of this study by the end of the year.

The outcome of this study and any initiatives to be undertaken by BOV could be a very important milestone for Malta’s capital market as it can instigate some of the other larger companies to also consider similar measures in order to provide added trading activity across the equity market. Such initiatives are greatly needed given the continued weak volumes across most equities in Malta (with the exception of BOV) and the absence of any measures or proposals by the Government during last week’s Budget Speech to grow the local capital market.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers).

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

A golden age for GO plc

GO plc’s Annual General Meeting revealed a bold shift beyond traditional telecoms, stronger-than-ever financials, and possible share buy-backs

Another v-shaped recovery

Towards the end of 2024, most investment banks predicted that the S&P 500 index would continue its positive streak

Central Bank of Malta turns to green securities to meet climate objectives

Investment strategy shifts further toward Paris-Aligned Benchmarks and sustainable bonds