President Putin signed a decree on Tuesday banning oil sales to countries and companies that comply with a price cap. Earlier in December 2022, Malta along with the European Union implemented a $60 (€56.4) price cap per barrel for Russian oil.

Since Malta’s energy prices are heavily subsidised, households won’t feel the impact directly, however, this could increase pressure on public finances as the country may have to find alternative, more expensive sources of petroleum products.

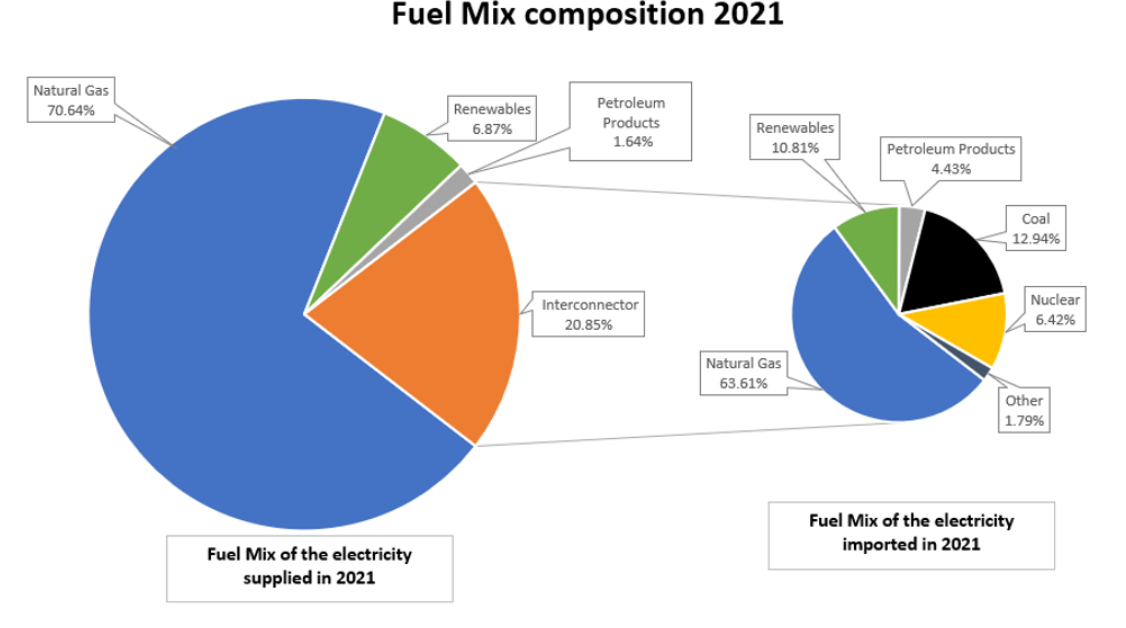

Petroleum products represent under two per cent of the country’s energy mix, and under five per cent of the interconnector’s energy mix according to most recent data made available by Enemalta.

The decree published on the Kremlin’s website read as follows, “Deliveries of Russian oil and oil products to foreign entities and individuals are banned, on the condition that in the contracts for these supplies, the use of a maximum price fixing mechanism is directly or indirectly envisaged,”

Despite the ban, Russia’s decree includes a clause that allows for Putin to overrule the ban in special cases, according to Reuters.

The cap on Russian oil exports is a G7 initiative which was adopted in November, and put into effect on 5th December 2022. It is intended to limit Russia’s revenues from oil exports. Despite trading below the cap at $56 (€52.7), this move was anticipated, with Russia’s Deputy Prime Minister threatening the ban following the price cap’s implementation.

Malta’s inflation edges up to 2.7% in October as food and services lead price pressures

The October RPI reading indicates some re-acceleration in consumer-facing sectors after a period of summer stabilisation

db Group reports turnover of almost €100 million and record profit as it opens bond issue to public investors

This coincides with the launch of a €60 million bond programme to support the Group’s continued expansion

Celebrating success: stories from the team behind Finco Trust

The stories of Lee-Anne Abela, Kris Vella, and Maria Mamo reflect the values that continue to guide the firm forward