The eurozone’s service sector has continued to suffer in recent months, with manufacturing also lagging behind in terms of performance, major bank HSBC has found.

The results were presented on Tuesday (today) during HSBC’s Q423 and 2024 European Economic Outlook, where a number of HSBC’s European economists and strategists provided insight into the future for the eurozone and European countries. Panellists included Chief European Economist Simon Wells, Chief Economist (Germany) Stefan Schilbe, Senior European Economist (Spain and Italy) Fabio Balboni, and Head of European FX Research Dominic Bunning.

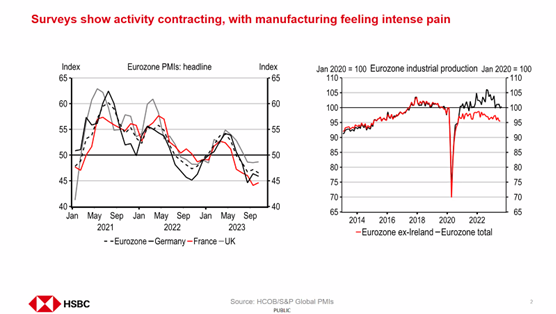

Speaking about the eurozone as a whole, Mr Wells noted that some of the area’s most widely watched and leading indicators of activity have “really slumped”, stating that the resilience that characterised the earlier parts of the year, particularly driven by the services sector, has “wind down quite a bit”.

“Services have deteriorated, but the manufacturing sector is still feeling a lot of pain as well,” he explained.

In terms of industrial production, the feeling is that the situation has improved slightly due to the recovery from the COVID-19 pandemic, yet this has remained “generally flattish”. Mr Wells remarked that a lot of the data has been helped by the results of the Republic of Ireland, and if they are removed, then there is a clearer red line (shown in the eurozone industrial production diagram below) indicating lower levels of industrial production.

Mr Wells pointed out that trade remains “extremely weak” within the eurozone, and although there have been signs of recovery, these are “very, very few”.

“It is looking like it is going to be a few more quarters before we see a more sustained recovery in the trade cycle,” he affirmed.

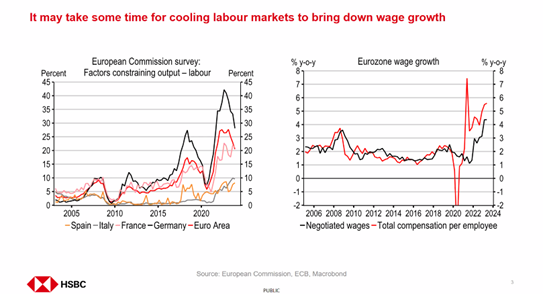

Turning to unemployment, Mr Wells explained that HSBC forecasts a “small cyclical rise” in unemployment due to the monetary tightening that has taken place, yet this may take some time due to inflation. He highlighted that there are a number of signs that companies want to “hold on to labour as much as possible”.

Despite this, the forecast states that it may be some time until pay growth starts to come down in Europe, with eurozone year-on-year wage growth reaching highs of more than seven per cent post the pandemic. While this has slowed down, it is still steadily rising, with year-on-year wage growth remaining just below six per cent.

Eurozone inflation has dropped quite significantly in recent months, with annual inflation coming in at 2.9 per cent during October 2023, lower than September’s 4.3 per cent.

Mr Wells explained that the momentum is slowing down, yet it is still “quite elevated”. “From where we stand at the moment, inflation rates are expected to hold on for a little longer,” he continued.

Euro outlook

Mr Bunning took a closer look at the situation of the euro, stressing that the currency is expected to “remain weak” going into 2024.

“When we look at the backdrop, the growth story in Europe remains persistently weaker when compared to the United States,” he explained.

He pointed out that without the presence of a bouncing global growth dynamic, it is “hard to see an upside” in terms of the euro perspective.

The big picture presented is that Europe is “still struggling” in relation to the United States in terms of foreign exchange markets.

Germany

Mr Schilbe then took over the discussion to focus more specifically on the situation in Germany, the country with the largest economy in Europe, stating that it is the “laggard” within the eurozone.

He remarked that there has been “little development” within the economy so far, with the “main culprit” being the manufacturing sector.

A primary reason for this drop of manufacturing sector is the struggles of the German car industry, which accounts for around five per cent of the country’s economy. Its struggles particularly come due to the pandemic and uncertainty within supply chains.

As for the country’s labour market, he explained that there has been a “clear deterioration in unemployment”, with the peak rate expected to reach around six per cent, until the economy starts to pick up again.

France

Mr Wells remarked that France’s story over the past few years indicates that it has been “pretty resilient”.

Even though there has been a slowdown in GDP, the underlying details surrounding France’s economy are “more encouraging,” he noted.

“Consumer spending held up a little bit, and there has been a slight increase in food consumption. Food inflation has come down, and more people are now spending on food,” he continued.

France’s primary positives come in terms of its labour market, Mr Wells explained, stating that France has experienced a relatively “sluggish” recession recovery, yet employment has been “very strong”.

Italy

Italy’s economy has experienced a “significant slowdown” during Q3 when compared to the “surprising” performance in Q1, Dr Balboni said.

He pointed out that a large part of this is due to the removal of the superbonus, a tax advantage available for those individuals who are willing to make property upgrades that qualify as energy renovation. This tax credit was removed when Giorgia Meloni’s government came into power, due to it being very expensive. Hence, the stimulus that this provided to the economy will “likely fade”.

Spain

Dr Balboni stated that Spain has experienced a stronger growth scenario than the rest of the eurozone.

After a number of years of negative real wage growth, this figure has become positive, and is “expected to remain so in the coming quarters”, he explained.

Inflation risk re-surging as tensions heat up between Israel and Iran

Oil and gold prices jumped after the latest strike by Israel

WATCH: Rare torrential rain in Dubai wreaks havoc and causes major disruption

Flooding hits shopping malls, destroying stock

Spain to end ‘golden visa’ scheme over property market impacts

While countries are slowly banning the practice, Malta remains firm in keeping the scheme alive