Movements in sovereign bond yields across major economies have been particularly substantial in the last few weeks, especially for longer-dated securities. Since the direction of the yield is inversely related to the price of bonds, this means that bond prices dropped, with the sharper movements occurring on instruments having a higher duration. Various financial media outlets highlighted that sovereign bond investors are increasingly concerned about the sustainability of government finances across major economies as well as the implications of the re-election of Mr Donald Trump as US President which could lead to higher inflation.

Within the euro area, the German 10-year bund yield surpassed the 2.60 per cent level for the first time in eight months this week, which contrasts to the drop below the 2.10 per cent level towards the end of November 2024. Similarly, the 20-year bund yield surged to an over one-year high of 2.85 per cent. The German bonds provide the lowest yields among the euro area sovereign bonds and are considered as the benchmark risk-free rate, with other eurozone government bonds having yields at a spread above the relative German bund.

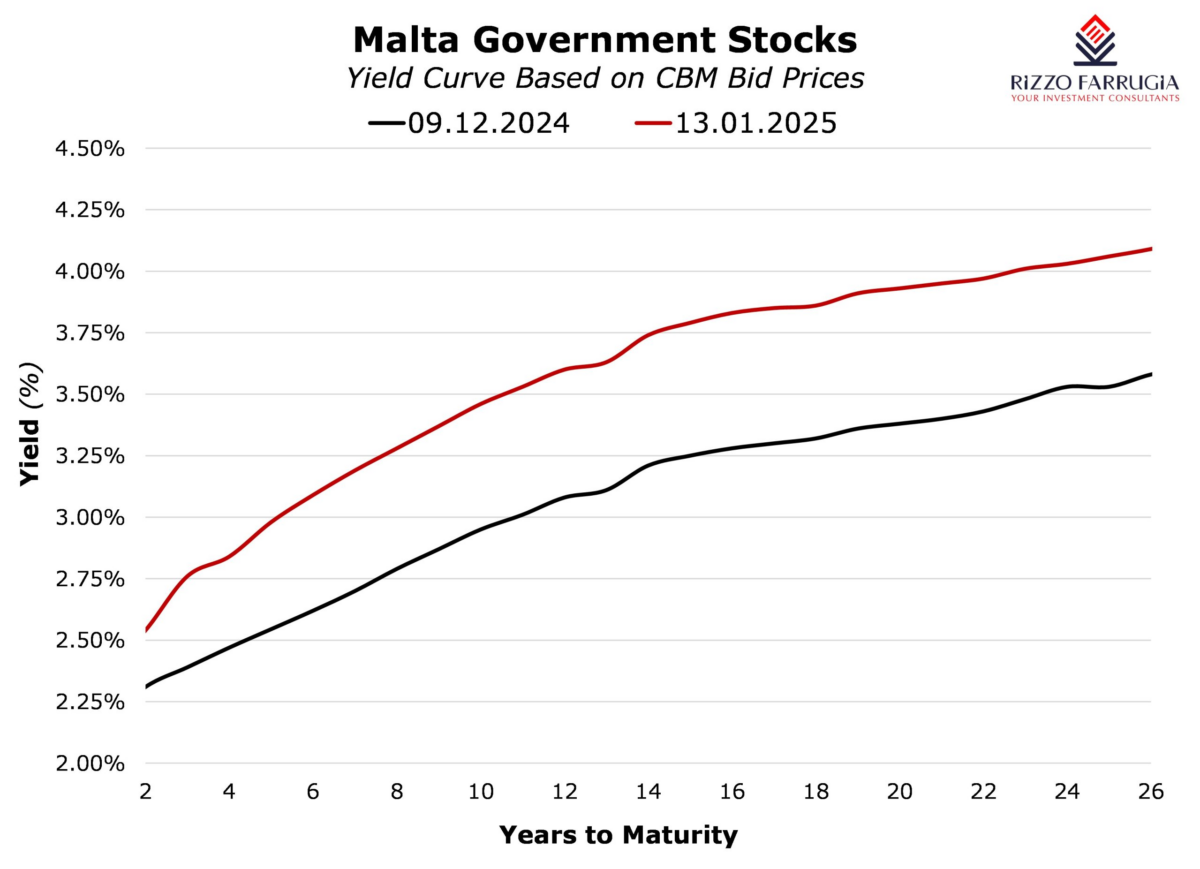

In this respect, it is worth noting that French government bond yields increased at a faster pace, reflecting not only the global macroeconomic environment, but also the specific political issues within the country. As a result, the French 10-year yield stands close to the 3.45 per cent level, the highest since 2011. Interestingly, French sovereign bonds are being priced at yields very similar levels to Malta Government Stocks (MGS) despite France having a superior credit rating to that of Malta. A year ago, the French 10-year yielded around 60 basis points less than the corresponding MGS.

The surge in sovereign bond yields was even more pronounced in the US with the 10-year treasury yield moving close to the 4.80 per cent level, which is the highest since October 2023. This also means that the spread of the US 10-year bond yield relative to the German 10-year bond yield reached 220 basis points, the highest since 2019. The longer-dated US 20-year bond yield surpassed the 5 per cent level for the first time since November 2023.

Some financial markets observers may be surprised to see such an upward movement in yields over the past few weeks following last year’s interest rate cuts by multiple central banks and their clear signal of a softer monetary policy stance in the months ahead. In this respect, it’s important to highlight that the effectiveness of the rates set by central banks is much more towards the shorter dated securities since they relate to overnight deposit rates and rates charged between banks. In fact, shorter-dated sovereign bond yields are lower when compared to the first half of 2024. Meanwhile, the longer-term bond yields are more influenced by market expectations. It is evident that bond investors are demanding higher yields on government bonds amid expectations of rising fiscal deficits and risks of a rebound in inflation which in turn may cause the major central banks to be less likely to reduce interest rates further.

Furthermore, the latest employment report published last week showed that the US labour market continues to be much more resilient than earlier projections. As such, with stable unemployment levels and an economic growth that is expected to exceed that of other major economies, the rate setters at the Federal Reserve might not consider any further interest rate cuts in the near term.

The sharp movements in yields over recent weeks were also accompanied by the strengthening of the US dollar against other major currencies. The EUR/USD exchange rate weakened to near parity, which was last seen in November 2022. This contrasts sharply to the peak of USD1.12 as at the end of September 2024, which effectively means that the euro lost around 12 per cent of its value relative to the US dollar in less than four months. Likewise, the British pound also weakened by about 10 per cent relative to the US dollar during the same period. The weakening of the euro and the British pound was largely attributed to the weaker economic prospects in Europe and the UK amid geopolitical conflicts, higher vulnerability to changes in energy prices, and the threat of new US tariffs being proposed by the incoming President.

The recent developments across the financial markets are another important reminder of the importance of understanding and implementing key financial principles when investing. For example, the surge in bond yields is a stark reminder of the time value of money and the opportunity cost of having idle money not yielding any interest or other form of cash flow. Likewise, the notable divergences across geographies and currencies demonstrate the need for a diversified portfolio with exposures to various sectors, economies, and currencies.

Read more of Mr Falzon’s insights at Rizzo Farrugia (Stockbrokers).

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Will the rally last?

This week marks the 3rd anniversary of the current bull market in US equities

More than 70,000 active rental contracts with the Housing Authority in the first half of 2025

This figure marks an increase of 7.5% compared to the same period in 2024

Unprecedented issuance in Q4

Malta’s bond market is seeing record issuance in the final quarter of the year