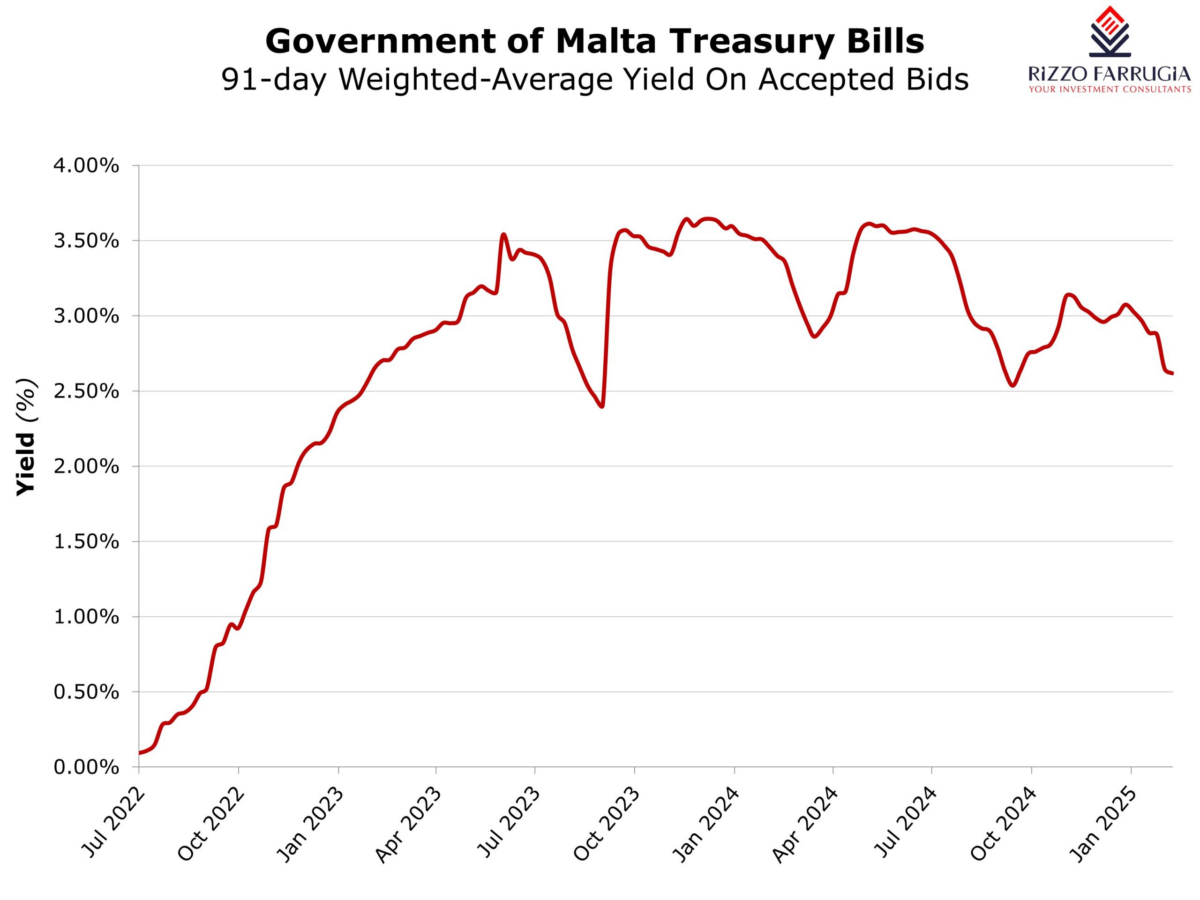

There was an evident change in investment appetite by retail and corporate investors in Malta for short-term financial market instruments following the surge in interest rates within the euro area since the second half of 2022 compared to the previous decade of much lower yields. With most of the local retail banks offering very low interest rates on savings and fixed deposits, participation in the Malta Government Treasury Bill auctions and short-dated Malta Government Stocks became an attractive alternative with yields at times exceeding the 3 per cent level.

In 2023, the weekly average nominal amount tendered for in the 91-day T-Bill auction stood at close to €200 million, but this fell to around €80 million in 2024 since the average weekly accepted amounts during 2023 were at just €30 million. As such, during the course of last year, most tenders were not accepted with investors having to consider some other investment alternatives including short-term bonds across the international financial markets. Furthermore, as highlighted in the past, the combination of the strong demand for T-Bills by the investing public together with the frequent changes in financing requirements of the Treasury Department, resulted in substantial volatility of the weighted-average accepted yield on T-Bills.

For example, outstanding T-Bills more than doubled to €735 million as at last week compared to the €350 million level in mid-October 2024 following the most recent issuance of Malta Government Stocks. This may also have contributed to the sharp volatility in accepted bids during the past few months.

Furthermore, since the European Central Bank started reducing its interest rates as from June 2024, banks who participate in the weekly auction are likely to be satisfied with lower yields since their idle funds with the Central Bank of Malta are now generating lower yields compared to the time when the ECB deposit rate stood at a multi-year high of 4 per cent. The current ECB deposit facility rate stands at 2.75 per cent following five reductions of 25 basis points each since June 2024.

The reduction in interest rates can also be observed in the Euro Interbank Offered Rate, known as Euribor, which is typically also used as a benchmark reference for variable-rate loans. This week, the three-month Euribor reached a two-year low of 2.52 per cent, reflecting the easing of monetary conditions within the euro area in line with the latest ECB policy decisions.

Lower interest rates can also be noted from the corresponding bid prices for Malta Government Stocks. The bids by Central Bank of Malta for all MGS issues maturing in the next five years are below the 3 per cent level, which contrasts with bids from two years ago where the yields to maturity on short-dated MGS were practically all above the 3 per cent level.

The shift towards lower yields for short-term instruments could also be observed in the five-year MGS that was on offer this week, namely the 3.00 per cent MGS 2030 (IV) at a price of 101.00 per cent for every €100 nominal giving a yield-to-maturity of 2.8082 per cent per annum.

For comparative purposes, the five-year MGS that was offered in February 2023 had a corresponding yield of 3.24 per cent, while the five-year MGS that was offered in February last year yielded 3.15 per cent.

In this context, investors should keep in mind the reinvestment risk when buying short-term instruments in a declining interest rate environment. In simple terms, one needs to consider what the prevailing yield would be when the short-term instrument is due for redemption and the proceeds would then need to be reinvested. As such, if an investor is looking for longer-term income, one needs to consider securities with a longer maturity that could offer better yields and a more stable income.

These changes in interest rates are also important for investors in local equities since they also have implications on the fundamentals of companies. In particular, when looking at the financial position of banks, one need to assess how they are positioned to mitigate the effect of lower short-term yields. In recent reporting periods, Bank of Valletta plc had explained in extensive detail how it is optimising its balance sheet to enhance financial stability and performance by shifting cash and short-term funds into a treasury portfolio made up of longer-term investment-grade instruments.

Another consideration for equity investors would be to assess the opportunities for companies that had borrowings impacted by the surge in interest rates over the past two years but may have prospects to benefit from lower finance costs in the years ahead.

Notwithstanding the consistent reduction in interest rates by the ECB since June 2024, there are clear indications that further declines in interest rates will take place across the euro area in the weeks and months ahead. This will likely lead to continued changes across various asset classes which investors need to keep monitoring to optimise their investment portfolios in line with their objectives.

Read more of Mr Falzon’s insights at Rizzo Farrugia (Stockbrokers).

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Funding national projects

How can capital markets be used to diversify the funding sources of long-term national development projects

Malta’s earnings season

The importance of enhanced transparency, shareholder developments at HSBC Bank Malta, and broader capital market reforms

A chaotic start to 2026

Steady gains in January, but unprecedented swings in commodities, currencies and tech stocks