During November, the S&P 500 index gained 5.7 per cent which ranks as its best monthly performance during 2024. Following the sharp upturn last month, the S&P 500 index is now up 24.7 per cent in 2024 and on track for its second consecutive year with a gain of more than 20 per cent which is quite a rare occurrence.

Last Friday, the S&P 500 index hit another fresh record high during the final trading session in November which was a shortened one due to the thanksgiving festivities. Friday’s all-time high for the S&P 500 was the 52nd record close for the year. Once again, it is not common for the main benchmark to register such a large number of record levels during a calendar year. The highest number was in 1995 with 77 record highs followed by 70 highs in 2021.

The victory by Donald Trump in the US presidential election in early November, along with the Republican Party winning the majority in both houses of Congress provided the latest boost to the US equity market. Investor sentiment has becoming increasingly positive as a result of the favourable policies by the incoming administration including tax cuts and deregulation which could lead to continued strong economic growth and corporate profits. President-elect Donald Trump is also a firm believer in the stock market which is a very positive signal for investors.

During the course of the final week of November, geopolitical factors also weighed positively on investor sentiment apart from Donald Trump’s nomination as Treasury secretary. News of a cease-fire agreement between Israel and Hezbollah was viewed positively and this overshadowed indications that the President-elect plans to quickly impose 25 per cent tariffs on imports from Mexico and Canada, along with an additional 10 per cent tariff on imports from China. Moreover, investors seemed to have welcomed the nomination of a renowned veteran hedge fund manager as upcoming Treasury secretary replacing Janet Yellen.

In an interview the day after Trump’s victory, and before the announcement that he would be nominated, the incoming Treasury secretary Scott Bessent said he expected the agenda of the President-elect to help bring down inflation while simultaneously stimulating growth. The incoming Treasury secretary is in favour of a three-pronged approach that addresses worries over the ballooning national debt and deficits. The strategy revolves around growing the economy at a three per cent rate, reducing the budget deficit to three per cent of Gross Domestic Product (GDP) which is less than half where it stands now, and adding 3 million barrels a day in oil production.

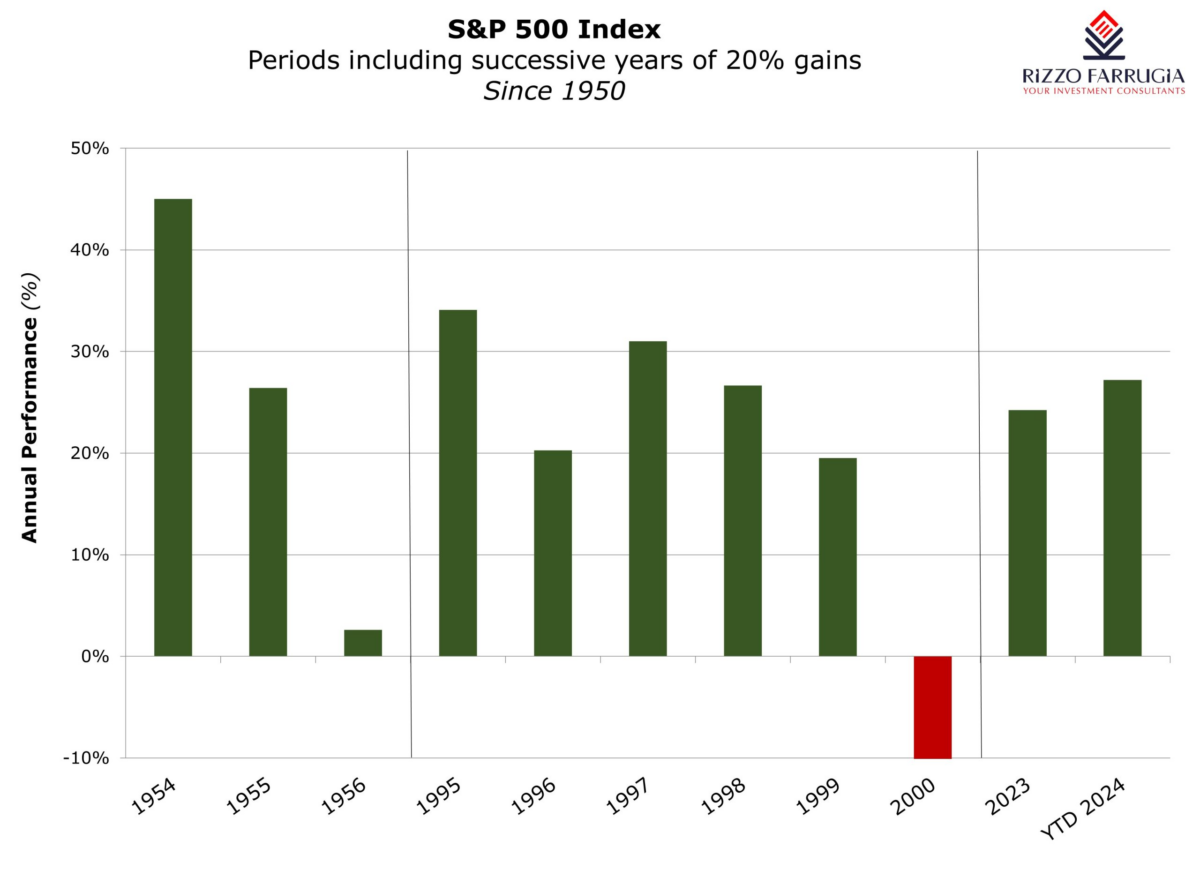

As indicated earlier, the S&P 500 is currently on pace for successive years with annual gains of above 20 per cent. This happened only a few times since 1950. In most of the cases when the US equity market generated gains in excess of 20 per cent per annum for two consecutive years, the market rally continued into the third year, generating average returns of 12 per cent.

The last time that the benchmark index had annual gains of above 20 per cent was in the mid-to-late 1990s as the index had soared 34 per cent in 1995 and 20 per cent in 1996. Those gains were followed by consistently strongly rallies also of 31 per cent in 1997, 27 per cent in 1998 and 20 per cent in 1999. After this very strong run in these five years, the index registered double-digit declines in the subsequent three years.

In view of the current strong momentum across the US equity market, many investors are questioning whether this upturn is likely to last as it did in the mid-1990’s or whether a period of subdued returns is on the horizon.

It is also worth noting that the current bull market which commenced in October 2022 is now in its 25th month. Statistically, on average, bull markets last much longer (over 5 years). In fact, over the last 40 years, the average annual return of the S&P 500 index was 11 per cent. Since 1985, there were 33 years of positive returns and only 7 years when the index declined.

These trends suggest very strong possibilities for further upside ahead for the US equity market. In fact, over recent weeks, most of the main investment banks in the US and across the worldwide together with prominent market commentators have upgraded their outlook for the US equity market for next year and also for future years.

Most investment banks predict that the S&P 500 index is set for further positive returns next year. On average, the investment banks expected the index to increase by another 10 per cent to about 6,600 points by the end of 2025 from the current level of just above 6,000 points.

One particular bank believes that there will be a 5 per cent to 10 per cent correction in the near term before equities resume their march to fresh all-time highs.

Meanwhile, the most bullish of analysts with a 2025 year-end target of 7,000 points, believes that the market and economic developments that have led some to term the current decade so far as the ‘Roaring 20s,’ marked by high economic growth, strong market returns, and improving productivity could extend into 2025 “if lower taxes and deregulation under a Trump administration add to a bullish narrative built on solid growth and continued investment in artificial intelligence”.

Moreover, another renowned market commentator, not only predicted the S&P 500 index reaching 7,000 points by the end of 2025 but went as far as forecasting a continued uptrend in subsequent years reaching 8,000 points by the end of 2026 and 10,000 points by the end of the decade. Although the forecast until 2029 might be very surprising which would result in a return of over 60 per cent from current levels, this equites to an annual gain of 11 per cent which is very much in line with the long-term average annual return of the S&P 500 over the last 40 years.

As always, there are a number of concerns that have been highlighted by most investment banks that could derail the continued upward momentum in the US equity market. These include aggressive trade tariffs, a wider US government budget deficit and geopolitical developments, all of which could drive up inflation which in turn would slow the pace of interest rate cuts by the Federal Reserve thereby impacting global economic performance and increasing market volatility.

However, the prevailing view is that positive investor sentiment is likely to be sustained as a result of the continued strength of the US economy and rising corporate profits which should be helped by new policies by the incoming President. It is therefore very likely that 2025 will continue to show positive returns for investors exposed to the US equity market albeit with occasional periods of increased volatility as a result of a number of geopolitical concerns that will inevitably resurface.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers).

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Women-led startups secure just 12% of venture capital funding in EU

Data from a new study was announced recently at high-level event in Brussels

Debating spin-offs

Stockbroker Edward Rizzo discusses the announced sale of Trident Estates’ second-largest asset, Qormi’s Trident House

Malta’s growing debt servicing requirements

While the 2026 Budget outlines ambitious fiscal targets, its continued silence on capital market development poses a setback