Over the past two years inflation has been extraordinarily and persistently high. Until July 2023, the Harmonised Index of Consumer Prices (HICP) inflation, which is used to measure consumer price inflation, that is the change over time in the prices of consumer goods and services purchased by households, has exceeded its long-term average of around 2.3 per cent for 21 consecutive months. A similar occurrence since EU membership was only observed during the period 2007-2009, where inflation exceeded its long-term average for 20 consecutive months.

Inflation persistence (or sticky inflation) is defined as the speed with which inflation returns to its long-term average following a shock. In the current context, inflation persistence could be loosely described as the time it will take for inflation to return to normal rates of around two per cent.

The Central Bank of Malta’s latest forecast publication updates the estimates of inflation persistence using the methodology applied in Ellul and Micallef (2020). When including the post-2019 period ending June 2023, to that since 1997, overall inflation persistence increases from 0.66 to 0.76. This means that the speed with which inflation returns to its average is longer when compared to that during the pre-pandemic period.

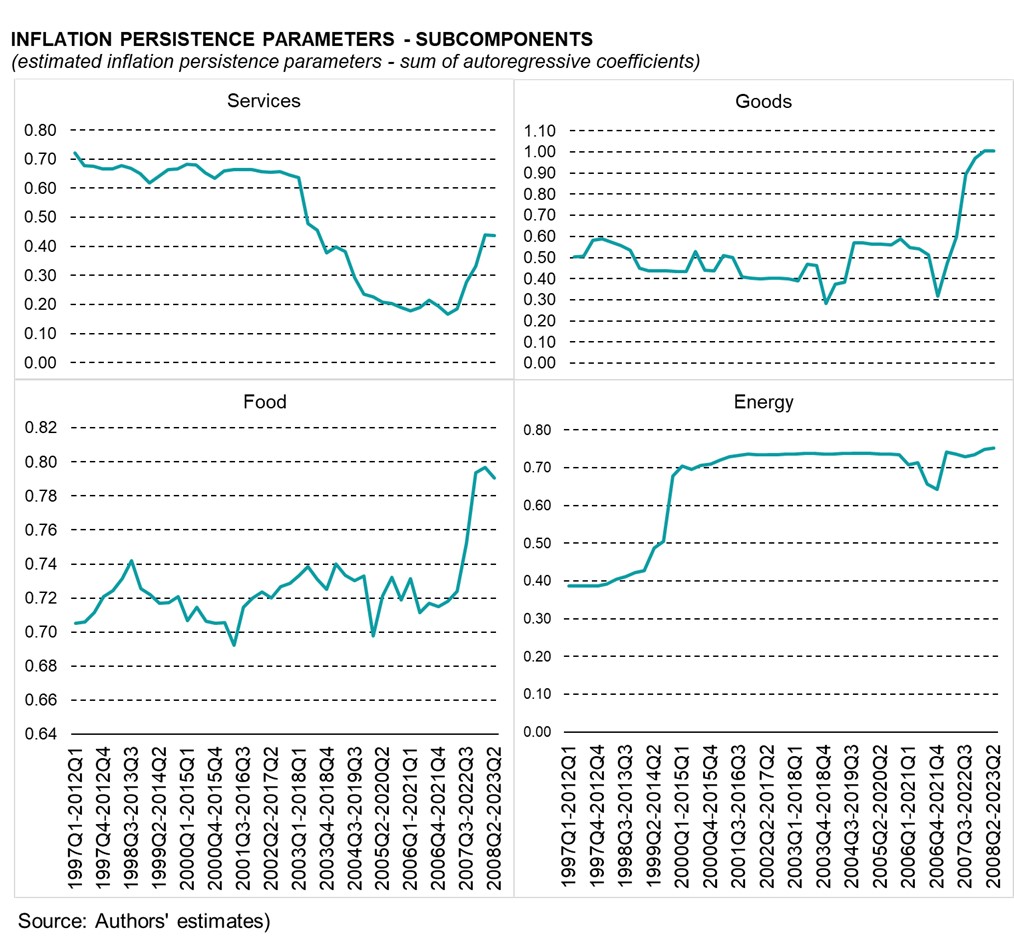

In determining what is behind the rise in such persistence, a model using smaller rolling time-window estimates (see charts below) is used. These estimates show a clear sharp increase since 2021Q4, which would suggest that the sharp rise in stickiness is a very recent phenomenon.

Additionally, when decomposing overall inflation into its subcomponents, the largest increases in persistence were attributed to food and goods. These two subcomponents have a large import content, which indicates that current inflation stickiness in Malta may be mainly driven by stickiness in imported inflation.

This is not surprising for a few reasons. Firstly, even though the Maltese Government has frozen energy prices to shield consumers from the sharp increases in international commodity prices, imported inflation has been a prime driver of domestic inflation. Secondly, international shocks that affected prices have happened successively, and in a short period of time. For example: inflation-inducing shocks such as the pandemic-related recovery, the ensuing global supply-chain disruptions, as well as the Russia-Ukraine war happened successively within a relatively short time horizon. All this may keep headline and underlying inflation high for a prolonged period. Thirdly, market power of importers and highly price inelastic demand, especially in the case of food, support higher profit margins.

However, services inflation – which has a much lower imported element – has also been very strong and highly persistent even though higher wage claims occur with some lag. In part this reflects indirect effects from imported inflation (for example higher food inflation has a marked impact on restaurant prices). But the sharp increase in services inflation can also be partly attributed to strong domestic and tourism demand, which has been very supportive to the pickup in profit margins.

Indeed, the latest CBM forecast publication also expands on the evolution of profits. Both indicators of aggregate profitability (unit profits and profit margins) have increased sharply in 2021 and 2022. This in part reflects some normalisation following the pandemic. Profit margins in 2020 had taken a large hit as a result of a collapse in turnover of several sectors. However, firms have generally been able to pass on more than fully the recent increases in costs to consumer prices and have thus regained their margins by end of last year and even exceeded pre-pandemic profit margins.

The key question now is whether inflation will remain as sticky as it has been in recent months.

This is a difficult question, and one should always be cognizant of the fact that other unforecastable shocks might be on the horizon. In the absence of unexpected shocks, the information available today suggests that inflationary pressures should start easing as imported inflation has recently come down. For example, euro area inflation declined to 5.3 per cent in July. Although it is still very high, it is half as much as the peak of 10.6 per cent in October of last year.

However, inflation may still be expected to remain higher than its long-term average for some time, mainly because wage pressures have picked up and are envisaged to impact services inflation. Wages typically respond with a lag due to the nature of wage contracts. Given the increase in profit margins during the past two years, firms should be able to absorb this increase in wages without triggering a further round of price increases as they have no room to adjust their profit margin. If firms seek to pass on higher wage claims on consumers, inflation will take longer to return to more normal rates, and risks of a wage-price spiral increase.

However, with a weaker international economic scenario, also as a result of tighter monetary policy, and more fiscal prudence with the lifting of the suspension of the Stability and Growth Pact, Maltese firms would need to be more price competitive, and thus absorb part of the rise in labour costs. Productivity levels have yet to return to pre-pandemic levels. Only then would firms be able to sustainably improve profit margins.

Hospitality sector review

With updated FAS now available, investors are turning to credit metrics to assess the financial resilience of Malta’s bond issuers

Mobilising savings into investments

Malta’s equity market needs to grow in size and depth if it is to embrace the EU’s Savings and Investments ...

Reduction in free float

Lowering Malta’s minimum free float requirement to 10% could unlock new opportunities for the local capital market