In my articles over the years, I wrote about Warren Buffett and Berkshire Hathaway Inc on various occasions. In recent weeks, both Mr Buffett and the company which he manages hit the headlines several times and in today’s article, it would be timely to highlight these recent developments and milestones.

Only last week, just a few days before Warren Buffett celebrated his 94th birthday, Berkshire Hathaway surpassed a market capitalisation of USD1 trillion for the first time ever. This milestone was given wide publicity internationally since it is the first company in the US, with the exception of most of the so-called ‘Magnificent 7’, to reach such a remarkable valuation. Berkshire Hathaway now ranks as the 7th largest publicly traded company in the US after Apple, Nvidia, Microsoft, Alphabet, Amazon and Meta.

Warren Buffett began managing Berkshire Hathaway in 1965 and the company’s Class A shares began trading in 1980. It therefore took 44 years since the public share listing for the company to achieve such an important milestone. In May 1996, Berkshire Hathaway introduced Class B shares in order to make the company more accessible to a broader range of investors since the original Class A shares were already trading at a high absolute price per share. Mr Buffett still owns more than 14 per cent of the issued share capital of Berkshire despite having donated more than half his shares to charity since 2006. His fortune is estimated at over USD145 billion ranking him among the richest persons worldwide.

Earlier last month, Warren Buffett and Berkshire Hathaway Inc also hit the headlines due to some notable sales of the sizeable holding of Apple shares and other securities within the company’s investment portfolio. Given Mr Buffett’s status as one of the world’s most renowned stockpickers, the changes in the portfolio of Berkshire Hathaway are greatly scrutinised by several market commentators. Warren Buffett is known for his “buy and hold” philosophy, investing in solid businesses and maintaining his stakes for years or even decades. One of Mr Buffett’s famous phrases is that “the stock market is a machine that transfers money from the inpatient to the patient” and “in the short term, the market is a voting machine, but in the long term it is a weighing machine”.

Although the changes in the portfolio of investments in publicly-traded shares are given most publicity across the media, it is also fair to highlight that Berkshire Hathaway also has a portfolio of over 60 wholly-owned subsidiaries across industries such as insurance (GEICO), railroads (BNSF), utilities, and consumer goods (Kraft Heinz) among others. During the first half of 2024, these businesses generated a profit of USD22.8 billion representing an increase of 26 per cent from the previous comparative period indicating the company’s ability to generate a strong income stream from these subsidiaries.

The second quarter financial statements issued on 3rd August also showed that during the three-month period until 30th June, Berkshire Hathaway had sold several equities amounting to a staggering USD77.2 billion (and during the same period purchasing other equities for a value of ‘only’ USD1.6 billion) with the resultant effect that the company’s cash position surged to a record of almost USD277 billion.

Berkshire Hathaway almost halved its sizeable stake in Apple Inc. The company had started investing in the iPhone manufacturer in 2016 and until recently it accounted for almost half of its USD360 billion portfolio of investments. The overall cost of the investment in Apple over the years reportedly amounted to circa USD36 billion. As at 31st December 2023, Berkshire’s stake in Apple was valued at USD174.3 billion (almost five times its initial cost). The investment in Apple was reduced to USD135.4 billion during the first quarter of 2024 and to USD84.2 billion as at 30th June 2024. Some market commentators have recently also speculated that Berkshire’s stake in Apple continued to reduce since then although nothing has been made official and this information will only be reported once Berkshire publishes its Q3 results which are due on 4th November.

Warren Buffett has not publicly disclosed the reason for the surprising and aggressive stance towards the sizeable decline in the stake in Apple. Possibly, the most plausible is that the investment in Apple was too dominant within Berkshire’s portfolio. Other commentators speculated that the sharp reduction in the equity portfolio which generated handsome capital gains was done in view of the possibility of the introduction of higher capital gains taxes in the years ahead.

Separately, it was recently reported that Berkshire Hathaway also reduced its stake in Bank of America which ranked as Berkshire’s second-largest holding within its investment portfolio. Most recent data indicates that Berkshire sold over USD5 billion worth of Bank of America shares but despite this, Mr Buffett’s investment vehicle remains the bank’s largest shareholder.

Most of the cash reserves held by Berkshire are invested in short-term treasury bills issued by the US Government. During the company’s latest annual meeting in May, Mr Buffett described them as “the safest investment there is”. The CEO of Berkshire stated that the company would “love to spend” its cash but would not do so unless it could find “something that has very little risk and can make us a lot of money”.

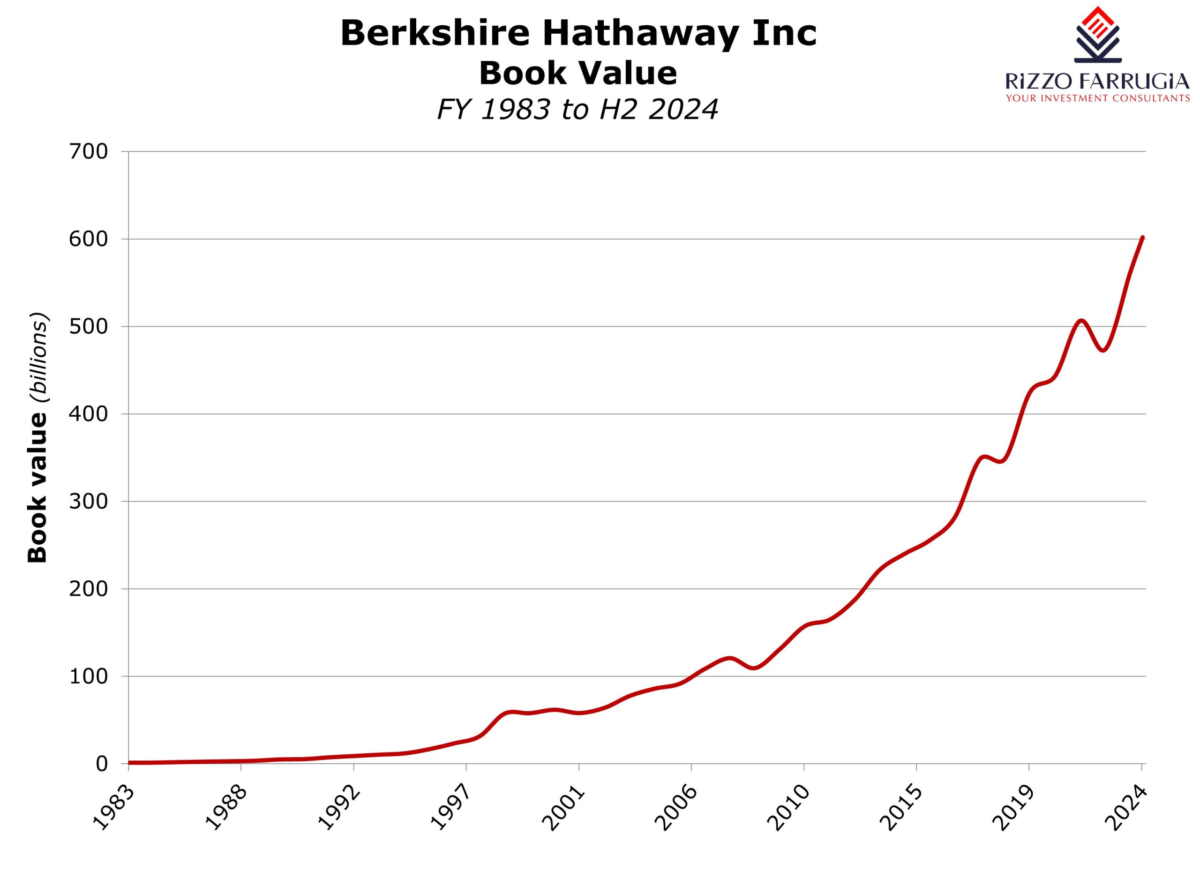

The outstanding success of Berkshire over the past 60 years underscores Mr Buffett’s wisdom and patience in investing demonstrating the remarkable power of compounding. Since Warren Buffett took over Berkshire in 1965, the company’s book value per share, which is a good proxy for measuring changes in Berkshire’s intrinsic value, increased at a compound annual growth rate (CAGR) of almost 20 per cent which is well-above that of the S&P 500 index during the same period. Essentially, an investment of USD100 into Berkshire in 1965 would have grown to a current value of over USD4.3 million.

This achievement cements Buffett’s legacy as one of the greatest investors in history. The company’s success is built on fundamental principles that Warren Buffett has championed for decades — investing with discipline, understanding what you own, and focusing on long-term growth rather than short-term speculation.

Compounding (which Albert Einstein had described as the eighth wonder of the world) is a powerful tool that can help investors build significant wealth over time, regardless of the amount of money one starts off with. The key is to start investing at an early age, remain consistent, and let time work in your favour. This is the biggest advantage of having an allocation to equities within a long-term portfolio as opposed to one solely based on fixed-income securities. The compounding effect over a long period of time from the equity component is generally what enables investors achieve growth in an investment portfolio since inflation erodes the value of bonds as an investor gets back the capital value upon maturity.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers).

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Vision 2030 & 2050: A strategic lens on Malta’s tourism, hospitality, and leisure industries

Malta’s next challenge is not growth – but quality

From stability to strategy – The 2025 banking reset and the 2026 roadmap

Global markets closed 2025 on a strong note as AI-led equity gains

Strong year for European equities

European equity markets capped off 2025 with strong double-digit gains