An online company formation company based in the UK called Rapid Formations has “recently” taken the decision to cease providing address services to clients with companies “where one of the parties is from Malta”.

Rapid Formations is a leading online company formation private entity that serves clients, including non-resident clients, aiming to register a company in the UK. In order to own and maintain a company based in the UK, a registered address in the country is required by law.

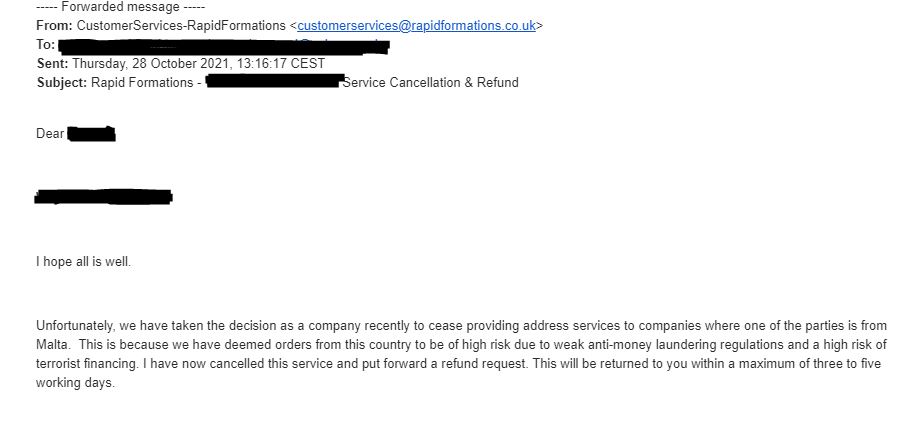

A reader of BusinessNow.mt who is also a Maltese resident forwarded correspondence received from the company last week informing the individual that Rapid Formations can no longer provide address services for his UK-registered limited liability company:

“Unfortunately, we have taken the decision as a company recently to cease providing address services to companies where one of the parties is from Malta.

“This is because we have deemed orders from this country to be of high risk due to weak anti-money laundering regulations and a high risk of terrorist financing.”

Finding himself outside of the law without a UK address for his UK-registered company, the reader had to turn to friends residing in the country for an alternative address to be used as the company’s registered office, a solution not everybody in a similar situation will be able to resort to.

Greylisting continues to bite

The move by Rapid Formations follow’s Malta’s undesirable status as part of the grey list, a categorisation that places the country under increased monitoring.

With the increased monitoring, money transfers in and out of the country have become more problematic. International financial institutions are requiring greater regulatory and compliance checks, while some may choose not to do business with Malta from the perceived risk alone.

Following the greylisting in June 2021, the UK took the decision to place Malta under its own list of high-risk countries for money laundering and the financing of terrorism.

This came of particular concern to Malta’s business community in view of the strong ties between the two countries – with the shared use of English especially translating into greater business ties.

This is not the first company to cease providing services to clients based in Malta, with one of the world’s widely-used digital investment platforms, Praemium, announcing in August that it will not accept new business for Malta-based relationships and transactions, due to the island’s Financial Action Task Force (FATF) greylisting.

A recent survey by EY Malta, called the EY Attractiveness Survey, concerningly found that 46 per cent of foreign investors believe Malta is not attractive for investment.

This figure represents a rather dramatic increase on the 25 per cent recorded in 2020, and gives a damning indictment of the reputational damage suffered by Malta with its greylisting by the Financial Action Task Force (FATF) this year.

Worse still, only 37 per cent of investors view Malta as attractive, down from 62 per cent in 2020.

Other reports have come in of delays for the processing of transactions by banks and of international payment companies reluctant to set up accounts for new businesses based out of Malta.

255 third-country nationals ordered to leave Malta in first quarter of 2025

Returns across EU rise, but Malta’s numbers remain modest

Inbound sea tourism dips by 2.3% in early 2025

The overall outlook for Malta’s tourism sector still remains optimistic

Transport Malta tight-lipped on enforcement plans for white taxis and coaches

Uncertainty also remains over the technology used and how enforcement will be applied