Malta’s Minister for Finance and Employment, Clyde Caruana, began delivering his fourth Budget speech, but was shortly after interrupted by an impromptu protest calling out Government for representing the interests of property developers. Voices could be heard chanting: ‘You dance to the tune of the developers’. The speech, delivered to Parliament, is being broadcast live and is expected to last around two hours long.

At a press briefing with journalists, Minister Caruana shared that this year’s speech is around 15,000 words and is a little shorter than last year’s.

Main highlights

Tax cuts:

One of the main features of the 2025 budget are the widening of income tax brackets, which will leave €140 million in the pockets of tax payers in Malta:

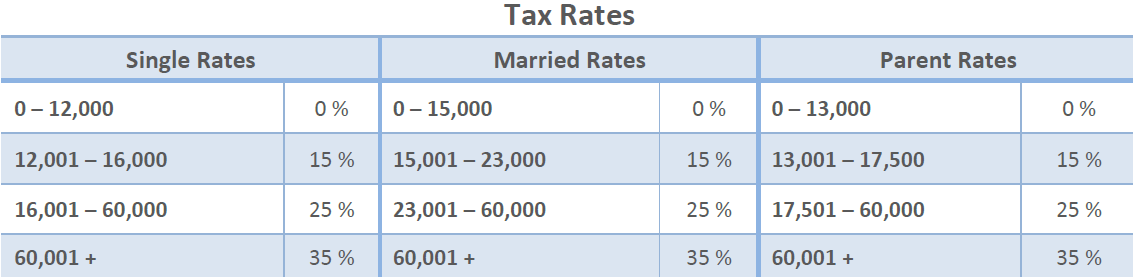

Single Computation

Starting next year, the threshold under which no tax is paid will increase from €9,100 to €12,000. This means that the first €12,000 will not be taxable. A rate of 15% will apply to income between €12,001 and €16,000. Income between €16,001 and €60,000 will be taxed at 25%, and income over €60,000 will remain at 35%.

This means that anyone taxed under this computation will see a tax reduction valued between €435 and €675 per year. The maximum reduction will benefit all those earning more than €19,500 annually. This benefits not only individual taxpayers but also married couples who choose to be taxed separately. In this case, the benefit for that household could be doubled.

Married Computation

Next year, the threshold under which no tax is paid will increase from €12,700 to €15,000. Therefore, the first €15,000 will not be taxable. A 15% rate will apply to income between €15,001 and €23,000, while income between €23,001 and €60,000 will be taxed at 25%. Income above €60,000 will remain taxed at 35%.

Anyone taxed under this computation will see a tax reduction valued between €345 and €645 per year. The maximum reduction will benefit all those with an annual income over €28,700.

Parent Computation

Starting next year, the threshold under which no tax is paid will increase from €10,500 to €13,000, meaning the first €13,000 will be non-taxable. A rate of 15% will apply to income between €13,001 and €17,500, while income between €17,501 and €60,000 will be taxed at 25%. Income above €60,000 remains taxed at 35%.

Anyone taxed under this computation will see a tax reduction valued between €375 and €650 per year. The maximum reduction will benefit all those with an annual income above €21,200.

Tax compliance

The percentage of tax returns submitted within the stipulated deadlines increased from 73% in 2023 to 93% in 2024.

In addition, Minister Caruana shared that in the first six months of 2024, €300 million in tax arrears were collected.

To date, 1,200 re-payment agreements were concluded between the tax authorities and taxpayers in default.

Cost of Living Adjustment

In line with lower inflation, COLA in 2025 has been slashed, going from €12.81 per week in 2024 to €5.24 per week in 2025.

Pensions

Pensions will increase by €8 per week, amounting to €416 per year,

Those who do not qualify for a pension will receive a bonus of €550 for those with one year of contributions and €1,000 for those with up to nine years of contributions.

Additionally, an increase in widow’s pensions by a median of €3 per week will take place next year.

Occupational pensions

The Government’s ultimate goal is for every employee entering the workforce or changing jobs to have the opportunity to invest in an occupational pension plan. While employers will not be obligated to contribute, they must offer their employees the chance to join a plan. It’s up to the employee to decline this option. On its part, Minister Caruana said the Government is committed to matching employee contributions up to a maximum of €100 per month for Government employees.

This plan will benefit from the same tax incentives available today, both for employers and employees. Those already enrolled in a private plan can also join an occupational plan and benefit from the same schedule of tax incentives. The next step is to finalise the details in consultation with the relevant sectors and social partners so that these schemes can be implemented in Malta by mid-next year.

Property

The first-time buyer scheme, where first-time buyers receive a grant of €10,000 over a 10-year period will be retained in 2025.

First-time buyers and second time buyers will also continue to benefit from reduced stamp duty in the coming year.

The Government is extending incentives on properties located in Urban Conservation Areas (UCAs) or those that have been vacant for at least seven years in both Malta – with a grant of €15,000 – and Gozo – with a grant of €40,000.

Finance Minister Clyde Caruana said there will be an extension of the capital gains tax exemption scheme on the first €750,000.

Additionally, VAT savings up to a maximum of 54,000 on the first €300,000 in restoration costs for such properties will be extended in 2025.

Electric vehicle grant

Government has announced that it will reduce the grant for the purchase of new electric vehicles from €11,000 to €8,000 in the case of cars and small vans. The grant will be €2,000 in the case of motorcycles.

Whoever, on or before 28th October 2024, has signed a contract – irrespective of whether the car is being delivered next year, will receive the full €11,000 grant established for 2024.

Moving forward, those purchasing new electric vehicles will benefit from the lower grant of €8,000.

At a press briefing prior to the budget, Minister Caruana stated that, given the recent momentum in electric car adoption, the Government sees greater value in reducing the grant amount to make it accessible to a wider pool of people.

Featured Image:

Finance Minister Clyde Caruana / DOI Photo by Jeremy Wonnacott

EU Funding Helpdesk launched as one-stop-shop for business opportunities

The Helpdesk aims to support businesses in their pursuit of local and EU funding opportunities

Final deeds of sale rise 8.4%, promise of sale agreements up 6.8% in November

Malta’s residential property market strengthened again last month

Employment rises 4.8% as labour market continues to expand

66.8% of the population aged 15 and above are employed