In a knowledge-based society, it’s hard to keep up with all research and reports that come out almost on a daily basis. But there are some that caught my eye in recent weeks and I believe they are interlinked:

- The fourth annual State of the Nation survey

- The annual report of Bank of International Settlements

- Global Emotions 2024 report from Gallup

Results of the State of Nation survey show people want the government to move away from a model based solely on economic growth towards one that improves their quality of life, making the Prime Minister to state “we don’t even remember what it means to have economic growth under 3 per cent”.

The Bank of International Settlements is the oldest international financial institution, founded in 1930 by central banks around the world. Their 2023-2024 annual report warns that the increased debt of many countries would create turbulence in international markets. The fact that this year there are elections in countries that sum up half the world population doesn’t help either, as one knows that in election years governments splurge to stay in office. US, UK, and France, with a snap election, are all mentioned in the report. World governments owe €91 trillion to investors. Malta’s share is €9.8 billion.

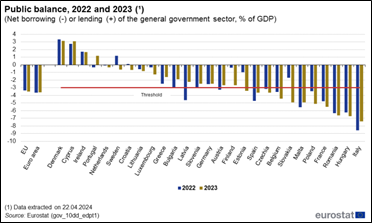

On 19th June we found that Malta faces an excessive deficit procedure, as of 2023 government spending was 4.9 per cent of GDP, way above the three per cent mark. The general government debt fell from 51.6 per cent of GDP at the end of 2022 to 50.4 per cent at the end of 2023. Malta is still below the 60 per cent threshold, that would raise eyebrows of investors.

The Global Emotions 2024 report from polling company Gallup placed Maltese fourth highest in levels of worry and 10th highest in levels of stress. Commenting the results, Professor David Zammit from UoM said Maltese became more consumerist, more capitalist, and highly competitive. He described Malta as being in mimetic conflict, that is we want things because other people want them. Or as Americans put it: we like to keep up with “the Joneses”, where “the Joneses” are our imaginary neighbour that has everything and serve as a benchmark for social class or the accumulation of material goods. Capitalism and competition lead to economic inequality. Economic inequality, we can all agree and statistics confirm it, has increased in Malta. It’s this economic inequality that makes people feel that they live in a society where they are constantly concerned and competing with each other for their socioeconomic status and position on the social ladder.

Next, let me explain how all these are linked together. Within a generation – one may count from accession to the EU – Malta has opened for business in tourism, igaming, banking & finance, and aviation. Some have witnessed growth and accumulation of wealth that led to consumerism and competition that led to economic inequality that makes people stressed and worried. Because of more stress and worry, we demand an economic model that relies less on growth and more on quality of life.

This quality-of-life desire needs investments from government into smart transport infrastructure, more parks and leisure activities, better integration of TCNs. But, for the short term, government will be limited in investments by the excessive deficit procedure. If debt will be around three per cent, to adhere to EU rules, but GDP will be less than three per cent, as we move from growth to quality of life, we increase the debt to GDP ratio, which means more interest paid to holders of debt. Luckily, 78 per cent of interest goes to Maltese banks and individuals. But this fuels economic inequality that makes us worry. Through all our taxes we pay the interest that goes to few of us.

It is a thin line we are all walking on. Government must find a balance between economic growth and the expressed desires of its people, its spending while keeping investors content, all under close supervision of EU watchdogs. One can only wonder about the stress and worry levels in Castille.

S&P 500: Another year of strong gains

The S&P 500 index has rallied nearly 17% so far in 2025

The bond market in 2026

In 2025, €717 million were issued on the Regulated Main Market of the Malta Stock Exchange

Institute of Directors training now available in Malta through ThinkTalent

By offering IoD’s globally respected curriculum, ThinkTalent is fulfilling its mission to be the definitive partner in strategic talent optimisation