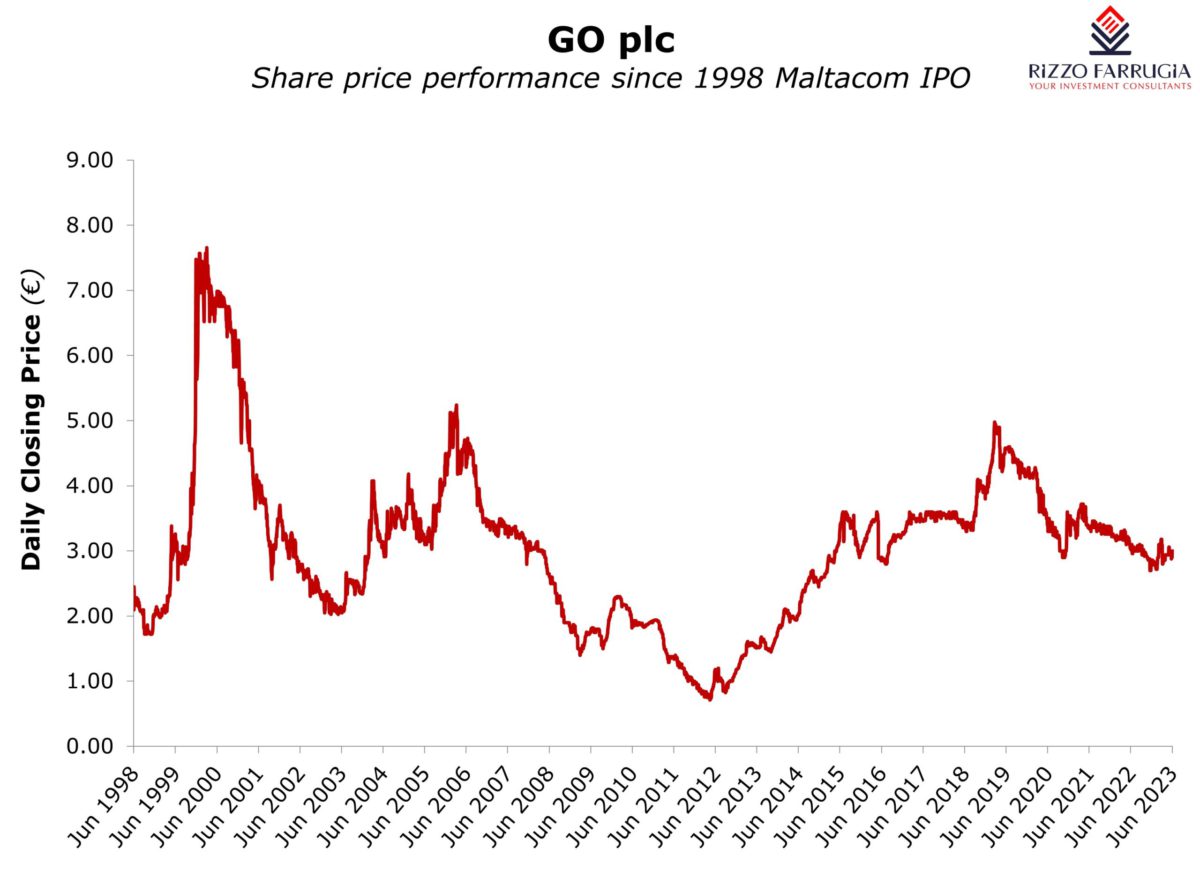

It was on 22nd June 1998 when Maltacom plc (which was then rebranded as GO plc in 2007) was originally listed on the Official List of the Malta Stock Exchange following the partial privatisation when the Government of Malta offered 40 per cent of the issued share capital at a price of Lm0.90, which is equivalent to €2.096 per share.

As one of the larger capitalised companies on the MSE and given the various changes that took place in the overall structure of the group, it is interesting to review some of the main developments that took place and also calculate the overall returns to shareholders over the past 25 years.

The Government of Malta held its majority stake in the company until 2006 when it sold its 60 per cent shareholding to Emirates International Telecommunications Limited (a member of Dubai Holding) at a price of €3.6198 per share.

Soon after the completion of the entire privatisation process a number of important changes took place. Maltacom acquired Multiplus Ltd in February 2007 and entered the TV market thereby becoming Malta’s first quadruple-play telecoms operator offering fixed-line and mobile telephony as well as internet and TV services.

Between April 2009 and July 2011, the company acquired the entire issued share capital of BM IT Ltd, BM Support Services Ltd and Bell Net Ltd for €17.5 million enabling the company to take full ownership of the data centre operator which was rebranded into BMIT. In late 2018, GO disposed of 49 per cent of its shareholding in BMIT Technologies plc (BMIT) through an initial public offering raising a total of €49 million in the process.

In September 2014, GO initially acquired a 25 per cent stake in the Cypriot company Cablenet Communications System Limited (Cablenet) and over the years achieved majority control. Currently, GO owns 70 per cent of Cablenet.

In May 2016, GO announced that it selected La Société Nationale des Télécommunications (Tunisie Telecom) as the final preferred bidder for the 60 per cent stake of EITL that had been placed for sale. Tunisie Telecom subsequently carried out a voluntary bid for the entire issued share capital of GO plc at the same price of €2.87 per share (which represented a sizeable discount from the share price at the time). Through the process, Tunisie Telecom increased its stake to the current 65.4 per cent.

In order to determine the total return achieved by shareholders over the years, one needs to calculate the appreciation of the share price as well as any dividends received.

The company did not carry out any share splits, bonus issues or rights issues since the IPO in 1998. As such, the current market price of €3.00 can be directly comparable to the original IPO price of €2.096 in 1998.

At face value, the 43 per cent growth in the share price over the past 25 years (equivalent to a compound annual growth rate of 1.7 per cent) is not attractive at all. Moreover, shareholders who would have retained their shares in the company over the past 25 years would have also experienced extreme volatility in share price movements with the share price peaking at a high of €7.65 on 24th May 2000 and dropping to a low of €0.712 on 4th May 2012.

Besides the capital appreciation aspect, one would also need to consider the dividends received over the years in order to calculate the total returned that accrued to GO plc shareholders. Over the past 25 years, shareholders would have received net cash dividends amounting to a total of €2.4912 per share first from Maltacom and then from GO. Moreover, in 2019, there was also an additional special dividend of €0.41 per share following the sale of 49 per cent of BMIT Technologies plc. As such, the total cash distribution amounted to €2.901 per share over the years compared to an original investment of €2.096 per share.

Additionally, shareholders also received an additional share in Malta Properties Company plc following the spin-off through a dividend in-kind of €0.331 per share (current market value of €0.37). Since the spin-off in 2015, MPC distributed cash dividends totalling €0.057 per share.

In total, this would imply that a shareholder of GO would have generated an average annual return of just over eight per cent from holding their shares over the past 25 years. This overall return was materially dampened by the unfortunate experience with the investment in the Greek company Forthnet which resulted in a material write-off of €120 million over the years.

Despite this ill-fated investment and the very challenging environment for the local capital market over the past few years, the return of eight per cent per annum from GO plc since 1998 still shows the benefits of holding equity for all categories of investors. GO shareholders undoubtedly look forward to the consistent dividend income in the future that was also maintained during the times of the pandemic and hopefully some more meaningful capital gains given the positive inroads being registered in the Cypriot telecoms market.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers)

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

A Liquidity Provider for the corporate bond market

Edward Rizzo suggests the Malta Development Bank could play an important role in revitalising the secondary market for corporate bonds

What if we blend iTunes, Uber & Netflix into banking?

Instant payments, T+1, and AI. Like iTunes, Uber and Netflix for finance!

Devising an Equity Market Development Programme

The equity market suffers from chronically thin trading volumes especially in the aftermath of the pandemic