In the conclusion to last week’s article on the performance of equity markets in 2022, I mentioned the difficulty in predicting the outcome of stock markets in the short-term. Nonetheless, most investment banks still publish their annual projected level for the S&P 500 index in the US.

When reviewing the various forecasts published by 23 investment analysts over recent weeks, it is evident that the large majority of analysts predict that the S&P 500 index will end 2023 in positive territory following the near 20 per cent decline suffered in 2022. Statistically, it is worth highlighting the low probability of consecutive declines for the US equity market. In fact, between 1928 and 2022, there were only four instances (1929-1932, 1939-1942, 1973-1974 and 2000-2002) when there were consecutive years of losses for US equities.

The most optimistic target for the S&P 500 in 2023 is of 4,750 points indicating upside of 24 per cent from the 2022 year-end level of 3,839.50 points. Meanwhile, the most pessimistic analyst indicates a year-end forecast of 3,400 points which would represent a decline of 11.45 per cent. On average, the 23 investment analysts predict that the S&P 500 Index will deliver a positive performance of plus six per cent to 4,079 points.

In recent weeks I documented in my articles that all asset classes performed negatively in 2022 as inflation and interest rates soared. As such, the main factors that are likely to impinge largely on the performance of stock markets this year are the inflation readings in the US, Europe and elsewhere and how these will likely impact the monetary policy decisions by the major central banks apart from the financial results of the major companies.

The most recent inflation readings have indicated a strong possibility that inflation has indeed peaked in both the US and Europe. As expected, this led to a positive performance across both equity and bond markets during the start of the new year. The Bloomberg Global Aggregate Index, which is a broad gauge of global fixed income markets, climbed 3.1 per cent so far this month following the 16 per cent decline last year. The 10-year US treasury yield dropped to below 3.5 per cent last week from 3.83 per cent at the end of 2022 and the Germany 10-year yield, a benchmark for the euro area, dropped from 2.56 per cent to below 2.20 per cent.

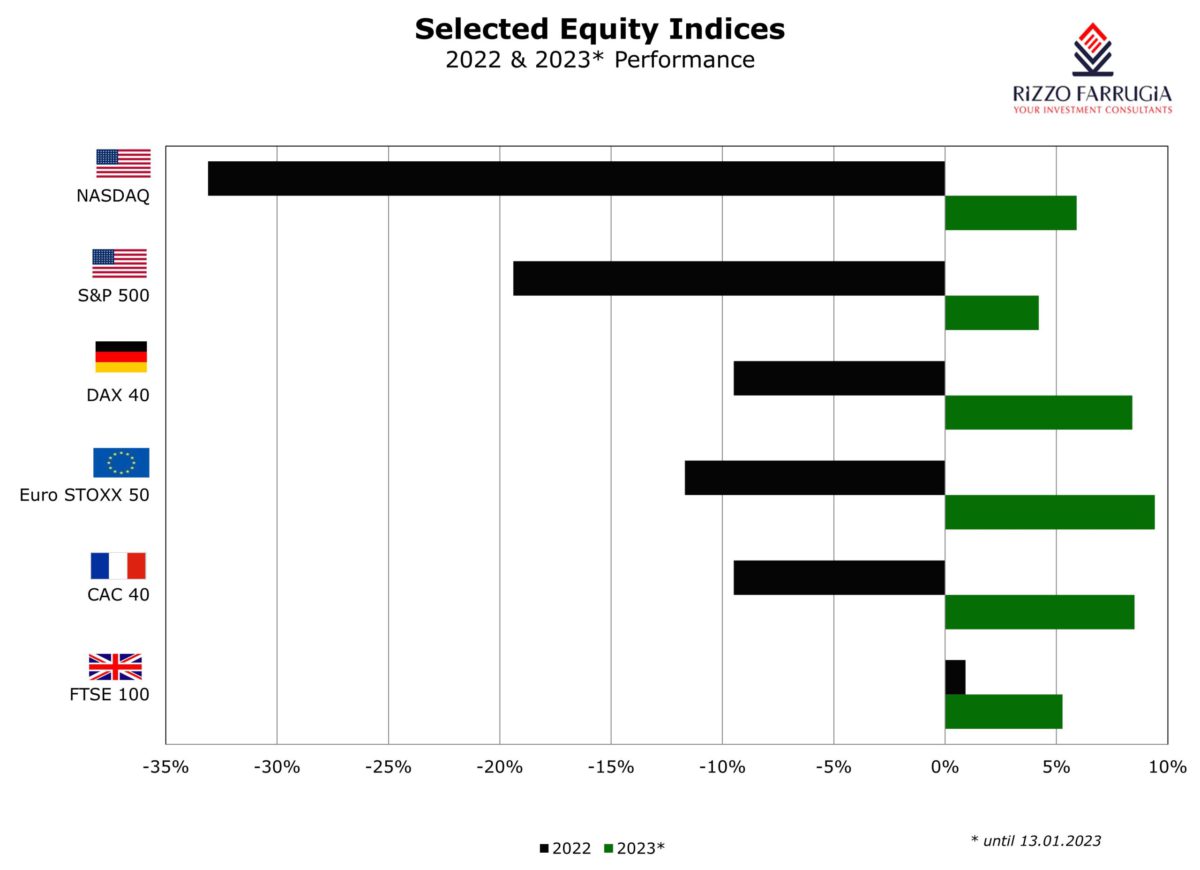

The main equity markets also got off to a bright start to the year. The S&P 500 Index is up 4.2 per cent so far in 2023 while the Nasdaq compositive has performed better at +5.85 per cent.

European equity markets outperformed those in the US with the German DAX 40 climbing by 8.5 per cent and the French CAC 40 at +8.5 per cent. The UK’s FTSE 100 index continued its positive run with a gain of a further 5.3 per cent since the start of the new year to its highest level since 2018.

One of the largest US investment banks last week upgraded their eurozone GDP forecast which essentially implies that, in their view, the single currency bloc will escape a recession. The favourably warm weather suppressed demand for natural gas with the result that gas prices have now fallen to levels before the start of the war in Ukraine.

Moreover, the reopening of China (the world’s second-largest economy and a big trading partner of the EU) should support exports and thus economic growth across the eurozone. This US-based investment bank also indicated that inflation will ease faster than previously expected to about 3.25 per cent by the end-2023 although core inflation is likely to remain relatively high.

Despite the positive start to the year, the S&P 500 Index is still 16.6 per cent below the record high reached on 3rd January 2022. Some renowned market strategists continue to opine that the low level of 3,577.03 points reached on 12th October 2022 signifies the end of the bear market. Since then, the S&P 500 index has risen by almost 10 per cent and all companies within the index are now above their 52-week low.

Over the past three months and six months however, the main European equity markets show a major outperformance compared to the US. One of the reasons is that the European indices have a far lower weighting towards technology stocks compared to the US indices. In fact, the six largest US tech stocks (namely Apple, Microsoft, Amazon, Alphabet, Tesla and Meta) have a combined weighting of almost 20 per cent of a typical US index and the combined value of these companies has dropped by circa 11 per cent in the past three months thereby contributing to the underperformance of US markets.

Despite the reassuring start to the new year, it is again worth highlighting that short-term movements in share prices are entirely unpredictable and should not matter much to long-term investors. According to an analysis by another major US-based investment bank, although 2023 will be a difficult year in terms of economic performances, given the decline already seen across bond and equity markets in 2022, stock market valuations are looking increasingly attractive. This same investment bank also remarked that historically good buying opportunities emerge at times of low consumer confidence similar to the period currently being witnessed.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers)

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Quarter of first-time buyer homes cost over €300,000

Single buyers spend on average €212,454 on their properties

Liquidity across Malta’s bond market

During the past five years, average annual activity across the bond market amounted to €100 million

Europe outperforming the US

Stockbroker Edward Rizzo delves into why equity markets have surprised so many investors and analysts