After reviewing the disappointing year for Malta Government Stocks and Maltese corporate bonds over the past two weeks, today’s article provides an overview of the performances of equity markets in 2022.

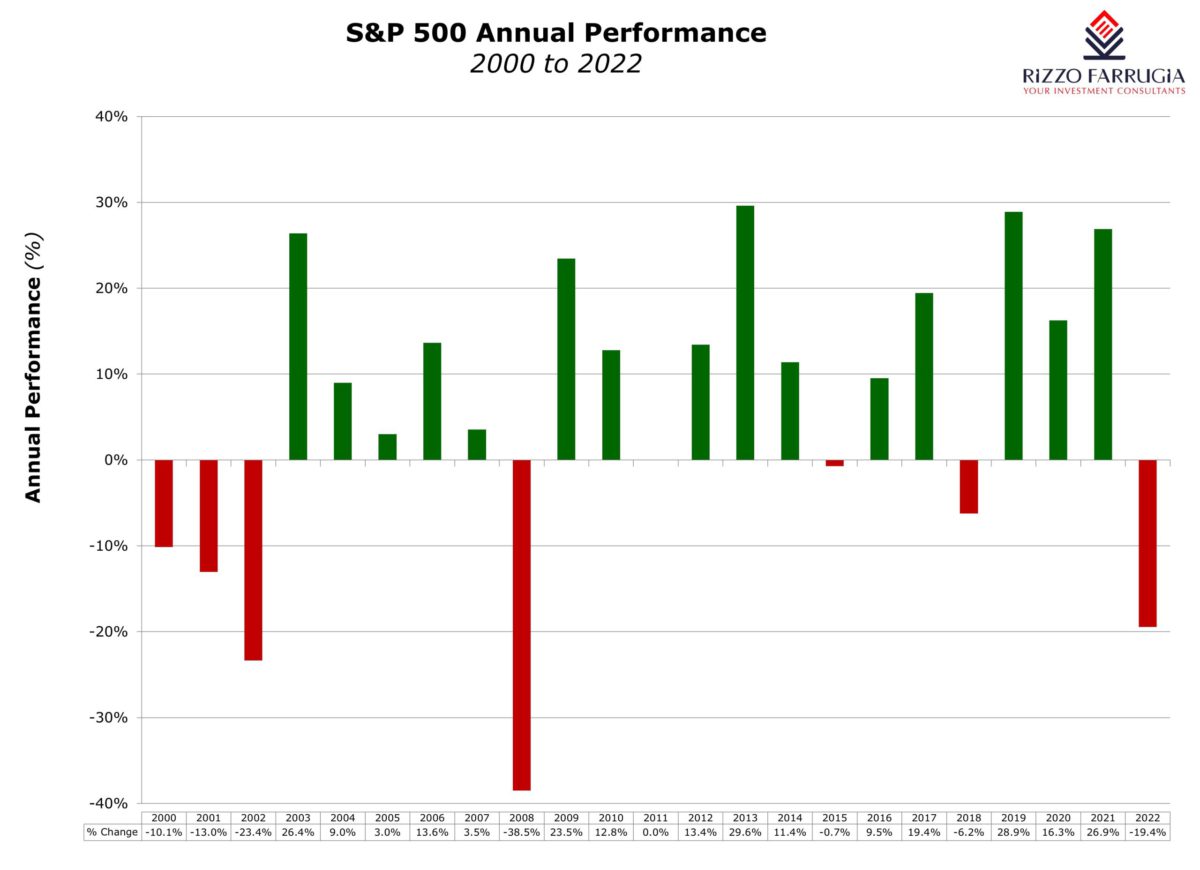

The S&P 500 index in the US ended the year with a decline of 19.4 per cent as a result of the persistently high levels of inflation exacerbated by the Russian invasion of Ukraine in February 2022 and the very aggressive hike in interest rates which shifted the investment landscape after a prolonged period of ‘cheap money’. When analysing the monthly performances of the S&P 500 index, there were seven months during 2022 when the index ended negatively. Moreover, the index declined by at least five per cent in five separate months during the year.

The negative performance in the S&P 500 index followed a period of very strong gains for investors when the index posted double-digit gains in the previous three years between 2019 and 2021 despite the devastating impact of the pandemic from early 2020.

The near 20 per cent decline in the index in 2022 must therefore be analysed within the context of the extraordinarily strong gains in prior years as well as the unprecedented hike in inflation and the subsequent sharp increases in interest rates which negatively impact company valuations.

The very sharp hikes in interest rates by the Federal Reserve impacted technology shares severely and it is therefore not surprising that the Nasdaq composite suffered the worst performance among the most commonly tracked US equity markets. The Nasdaq shed 33.1 per cent while the Dow Jones Industrial Average outperformed with a decline of 8.8 per cent.

The US equity markets suffered their worst year since the global financial crisis in 2008. Statistics indicate that 2022 was the seventh worst year ever for the S&P 500. The sharpest decline in the index took place in 1931 (-43.8 per cent), while in more recent years the index performed particularly badly in 2008 (-38.5 per cent) at the time of the global financial crises and in 2002 (-23.4 per cent) with the bursting of the ‘dot.com bubble’.

It is also pertinent to note that across the S&P 500, all sectors performed negatively last year with the exception of the energy sector which was the star performer at +59 per cent. In fact, when reviewing the best and worst individual equity movements across the S&P 500 index, eight of the top 10 performers were in the energy sector led by Occidental Petroleum at 117.3 per cent. This is the company in which the legendary investor Warren Buffett built up a sizeable stake within the investment portfolio of Berkshire Hathaway Inc.

Among the weakest performers, there were two notable names that are popular among retail investors namely Tesla at -65 per cent and Meta Platforms at -64.2 per cent. The latter company is classified within the ‘communication services’ sector which led to this being the worst-performing sector of 2022 with a decline of just over 40 per cent.

The turbulent year for equity investors was not solely limited to the US market. Across Europe, the Euro STOXX 50 shed 11.7 per cent while the STOXX Europe 600 declined by 12.9 per cent.

Similar to the trend in the US, the sectoral performances of the STOXX Europe 600 indicate that the only two sectors that performed positively were ‘Oil & Gas’ at 24.4 per cent and ‘Basic Resources’ at 4.3 per cent. As a result of the high weightings of these two sectors in the UK’s FTSE 100 index, this benchmark was among the few large equity markets to perform positively with a mild gain of 0.9 per cent following a number of years of underperformance.

The Maltese equity market also performed negatively (for the third consecutive year) with a decline of 9.7 per cent in the MSE Equity Total Return Index. Most equities declined as investor sentiment remained particularly weak as a result of the severe headwinds over the past three years starting off with the political crisis in November 2019 followed by the COVID-19 pandemic in early 2020, Malta’s FATF greylisting between June 2021 and June 2022 and the impact of the Ukraine war at the start of 2022. On the other hand, the Maltese economy recovered particularly strongly with the tourism sector among the most prominent thereby helping the profitability of a number of companies listed on the MSE which would hopefully lead to improved investor sentiment spurred by the confirmation and likely resumption of dividends to shareholders in some cases.

At this time of the year, many international financial analysts and investment banks publish their outlook for the year ahead. As evidenced once again in 2022, it is practically impossible to predict how the equity market will perform in the near term. However, as advocated in many articles over the years, equity markets tend to produce positive returns for investors over the long-term. Statistics indicate that the S&P 500 index in the US has produced an average annual return of circa 10 per cent since 1926 and positive returns 74 per cent of the time. Let’s hope for a more rewarding 2023 despite the difficult backdrop arising from the geopolitical and economic landscape.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers)

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Mobilising savings into investments

Malta’s equity market needs to grow in size and depth if it is to embrace the EU’s Savings and Investments ...

Reduction in free float

Lowering Malta’s minimum free float requirement to 10% could unlock new opportunities for the local capital market

A golden age for GO plc

GO plc’s Annual General Meeting revealed a bold shift beyond traditional telecoms, stronger-than-ever financials, and possible share buy-backs