Following the publishing of the research paper entitled ‘Household Finance and Consumption Survey in Malta: Results from the Fourth Wave,’ three Central Bank of Malta Economists wrote an article, focusing on the impact of COVID-19 pandemic on income and employment

The article was penned by Warren Deguara – Principal Economist, Economic Projections and Conjectural Analysis Office, Valentina Antonaroli – Senior Expert, Economic Projections and Conjectural Analysis Office and Aleandra Muscat – Economist, Economic Projections and Conjectural Analysis Office

The Central Bank of Malta is actively involved in the Household Finance and Consumption Survey (HFCS), a coordinated research project led by the ECB which involves national central banks of all euro area countries and selected non-euro area EU member states.

The HFCS focuses on various aspects of households’ finances and related economic and demographic variables, including income, private pensions, employment, and measures of consumption. The survey’s targeted reference population consists of all resident households in Malta, and is conducted every three years.

The fourth wave of the HFCS was marked by the outbreak of the COVID-19 pandemic. Consequently, questions targeted at capturing the impact of the pandemic on households’ financial situation were added to the questionnaire.

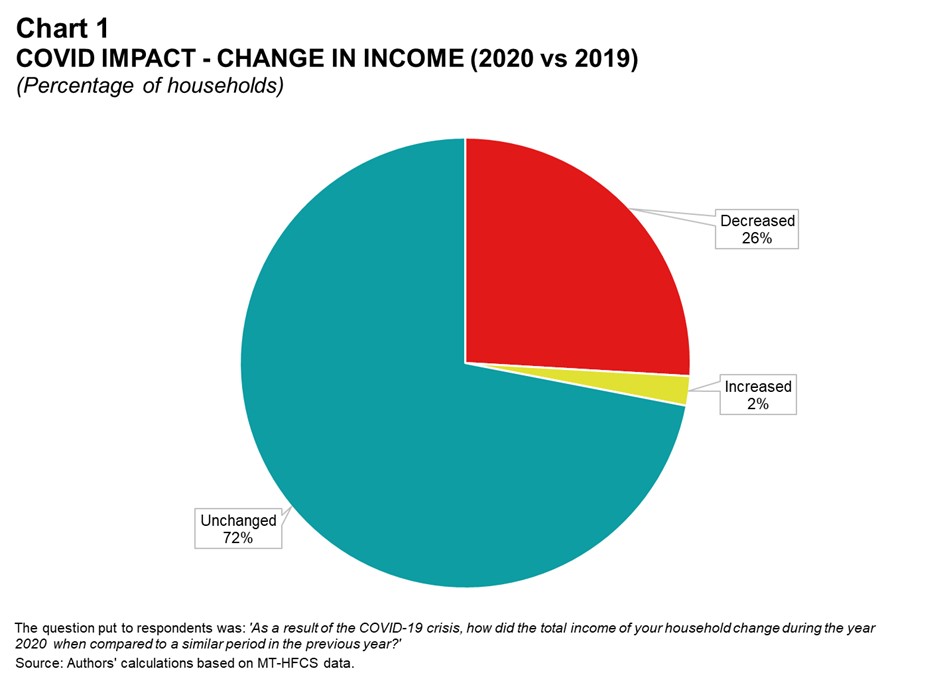

Households were asked to compare their 2020 income with that of 2019 to identify whether the pandemic or the associated restrictions which were in place had any impact on their income levels.

Almost three-fourths of Maltese households stated that their income was not impacted significantly by the pandemic (see Chart 1). Meanwhile, one quarter of households reported a lower income, most of whom indicated a loss ranging from 5% to 25% of their previous income. Only 2.1% of households stated they had a higher income in 2020 when compared to a year earlier.

The vast majority of respondents who reported a decrease in income stated that they lowered their expenditure on food, clothes, travelling, and other consumer goods and services to cope with the reduction in earnings. Other ways to compensate for the decrease in income included dissaving and the sale of financial assets (34.2%). None of the respondents took additional loans to make up for their income losses, while some (2.1%) were able to renegotiate their loan or mortgage terms.

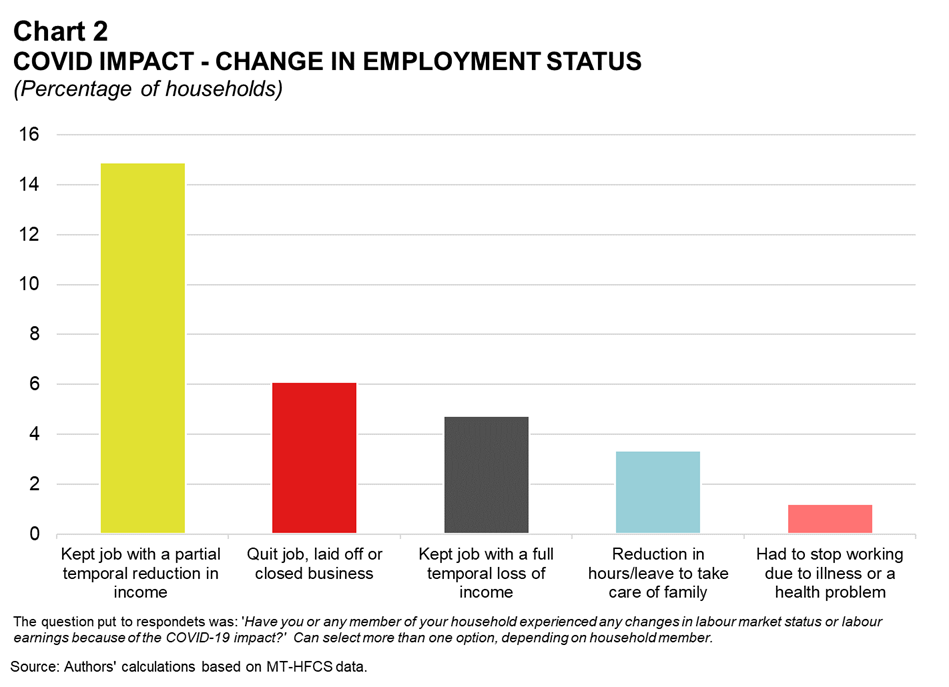

Respondents were also asked to comment how COVID-19 affected their employment situation. The share of households who became inactive was relatively low, as only 6.1% reported to have either quit their job, closed their business, or had been laid off (see Chart 2).

Additionally, 4.7% of all respondents were able to keep their job but had a full reduction in wages or earnings, probably due to the temporary mitigation measures in place that restricted the operation of non-essential services. Almost half of those whose labour status was impacted were able to keep their job but had a partial reduction in wages or earnings.

Around 3.3% of households were forced to ask for a reduction in working hours or leave. This might reflect health-related concerns during the pandemic, as well as the need for parents with young children to care for their dependants during the shift to online schooling. Moreover, 1.2% of respondents were forced to stop working due to sickness or other health problems.

The high proportion of households that were able to keep their job (over 70%) likely reflects the effectiveness of state support such as the wage supplement scheme, which was specifically intended to safeguard employment of those who were mostly impacted by lockdowns or pandemic-related containment measures.

In the private sector, households employed in the wholesale and retail, and transport and storage sectors were more likely to state that they were negatively affected by the pandemic.

Only a small proportion of households, mostly self-employed or employees in the private sector, have experienced full or temporary loss in income, but those who were affected mostly opted to lower consumption or draw on past savings.

Overall, the results of this Survey confirm that even though COVID-19 had repercussions on economic activity, the Maltese labour market remained resilient, and in large part households’ income was safeguarded. This reflects the substantial support measures offered by Government, notably through the wage supplement scheme.

Mobilising savings into investments

Malta’s equity market needs to grow in size and depth if it is to embrace the EU’s Savings and Investments ...

Reduction in free float

Lowering Malta’s minimum free float requirement to 10% could unlock new opportunities for the local capital market

A golden age for GO plc

GO plc’s Annual General Meeting revealed a bold shift beyond traditional telecoms, stronger-than-ever financials, and possible share buy-backs