Malta’s pandemic spending has almost entirely been financed by financial corporations and foreign holdings, with the amount of Government debt owned by non-locals overtaking that owned by Maltese households for the first time.

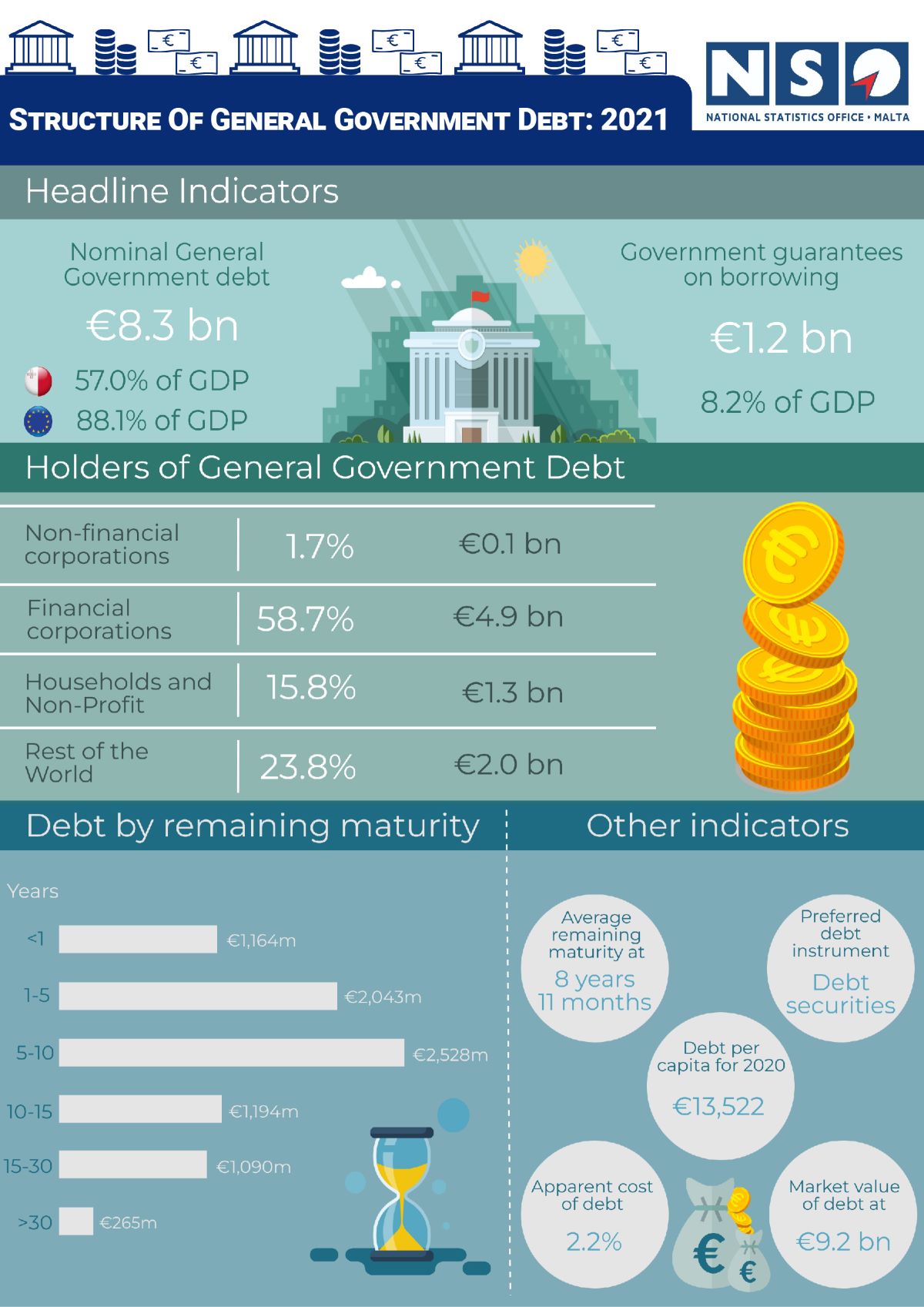

A recent release from the National Statistics Office (NSO) shows that Malta’s sovereign debt stood at 57 per cent of GDP at the end of 2021.

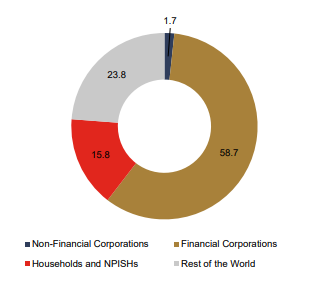

Financial corporations held the biggest share of Governments debt with 58.7 per cent, followed by the rest of world with 23.8 per cent, meaning that close to a quarter of Malta’s Government debt is now owned by foreign interests.

The share of households and non-profit institutions serving households (NPISH) was 15.8 per cent, a decrease of 8.4 percentage points over the debt held in 2018, while the non-financial corporations sector held 1.7 per cent of the debt.

Between 2018 and 2021, the rest of the world sector experienced the highest growth in the holding of Government’s debt, an increase of 10.8 percentage points.

Over 2020 and 2021, two years affected by the COVID-19 pandemic, total Government debt grew by €2.5 billion. Around €1.4 billion of this increase was bought by financial corporations, while the rest, €1.1 billion, was purchased by the rest of the world.

Debt securities, which include Malta Government Stocks and Treasury Bills, are by far the preferred debt instrument, with 82.6 per cent of the total debt in 2021. Other debt instruments are loans and currency, with 10.5 per cent and 6.9 per cent, respectively.

The increase in debt securities (€897 million) mainly relates to the continued financing of the Government’s COVID-19 measures, while the increases in loans (€311.4 million) and currency (€97.6 million) mainly represent additional EU loans from the temporary Support to mitigate Unemployment Risks in an Emergency (SURE) instrument and an issuance of the 62+ Malta Government Savings Bonds, respectively.

Almost all the debt owed by the General Government sector is in national currency. The stock of debt in foreign currencies has decreased considerably over the years.

The apparent cost of debt, which is the interest rate applicable to the whole nominal debt, continued to decrease, reaching 2.2 per cent in 2021, compared to 2.7 per cent in 2020 and 3.5 per cent in 2018.

This measure of the cost of debt reflects the interest rates prevailing at the issuance date and, given that the composition of debt is predominantly long-term, the indicator is not very sensitive to the more recent low interest rate scenario.

For 2021, the market value of the total General Government debt is estimated at €9,186.5 million, compared to the nominal value of €8,284.4 million. Market debt increased by €998.1 million over 2020, significantly lower when compared to the increase of €1,305.9 million in nominal debt.

For the year under review, the time structure of the debt by initial maturity shows that €3,069.8 million, or 37.1 per cent, was issued with a maturity of 15 to 30 years. This was followed by debt issued for 1 to 5 years (16.4 per cent), 5 to 7 years (13.7 per cent), 10 to 15 years (11.2 per cent), 7 to 10 years (9.2 per cent), less than one year (8.5 per cent) and more than 30 years (3.9 per cent).

The average remaining maturity of total debt for 2021 was 8 years 11 months, 10 months longer than in 2020. In 2021, the biggest share of debt by remaining maturity was in the 1 to 5-year category with €2,043.1 million, followed by the 7 to 10-year (€1,664.2 million) and 10 to 15-year (€1,194.3 million) categories.

Government guarantees on borrowing amounted to €1,197.9 million in 2021, or 8.2 per cent of GDP, an increase of €30.3 million over 2020. The majority of Government guarantees are issued towards the non-financial corporations sector, which accounts for 60.5 per cent of the total guarantees.

The financial corporations, rest of the world and households and NPISH sectors benefitted from 36.9, 1.9 and 0.7 per cent of Government guarantees, respectively. The Government guarantees are contingent liabilities, contingent on the actual call of the guarantee, and therefore these do not form part of General Government debt.

Government shells out close to €70 million to national bus operator Malta Public Transport in 2023

Buses became free for residents in late 2022, leading to a hefty increase in the public subsidy

Opera Cloud PMS: The cost-effective property management system for any hotel size

Smart Technologies Ltd provides leading hotel PMS system, starting from just €6 per room per month

Inflation rate in Malta drops from 3.7% in January to 2.7% in March, nearing EU average – Government

The Government attributed the decrease in inflation to its initiative ‘Stabbiltà’