At the start of the year, investment sentiment across the equity markets, particularly in the US, which is by far the largest capital market, was highly positive as a result of expectations of favourable policies by the incoming administration including tax cuts and deregulation which were expected to support further economic growth and corporate profits. The victory by Donald Trump in the US presidential election in early November 2024, along with the Republican Party winning the majority in both houses of Congress supported the market’s momentum at the time, in which the S&P 500 index registered gains of over 20 per cent in 2023 and also in 2024.

Towards the end of 2024, most investment banks predicted that the S&P 500 index would continue its positive streak in 2025, with expectations of another 10 per cent increase to about 6,600 points by the end of 2025.

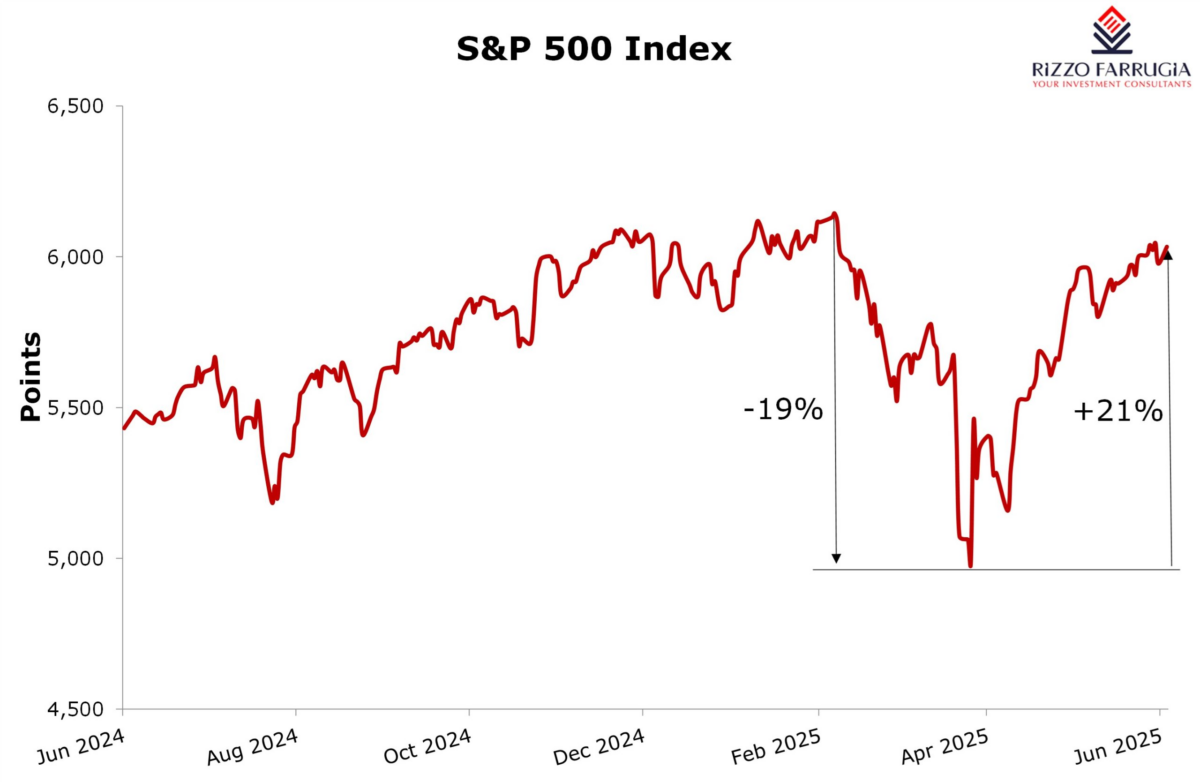

The S&P 500 index registered a positive start to the year and peaked at a new record of 6,144.15 points on 19th February 2025. However, as the US President provided indications of harsh tariffs and the US fiscal position showed deteriorating signs, the S&P 500 index ended in negative territory during February and also March. Furthermore, following the announcement of the new tariff policy during ‘Liberation Day’ on 2 April, the S&P 500 index plunged to the lowest level of the year of 4,982.77 points by 8 April. This represented a decline of nearly 19 per cent from the high of 6,144.15 points only a few weeks earlier on 19 February.

Nonetheless, despite multiple sources of uncertainty arising from both the macro-economic environment as well as the multiple geopolitical conflicts, most international equity markets have been performing remarkably well since then and the S&P 500 index is once again within proximity of a new all-time high.

Indeed, during the first week of June, the S&P 500 index surpassed the 6,000-point level once again and continued to move higher during the early part of this week, which marks a recovery of over 21 per cent from the low of 8th April.

The v-shaped recovery in the equity market, which is similar to that experience at the start of COVID in the first half of 2020, is largely attributed to expectations that trade tensions between the US and China will eventually ease. It is evident that both economies cannot maintain harsh tariffs because China is highly dependent on manufacturing and exports, while the US is being challenged by a high budget deficit, record debt levels and interest costs on the swelling debt levels that cannot be sustained if the economy slows.

Furthermore, the US labour market remained particularly resilient, supporting the belief that corporate activity remained strong even during the uncertainties caused by the multiple tariff policy changes during the month of April.

It is also pertinent to note that although the S&P 500 index stands close to February’s all-time high, the underlying performance of the constituents shows quite a divergence.

In fact, nearly 300 of the 500 constituents are still below their mid-February level, with UnitedHealth Group Inc being the worst performer of the period as the share price lost 40 per cent. Consumer discretionary companies Lululemon Athletica Inc, Norwegian Cruise Line Holdings Ltd, and Caesars Entertainment Inc all lost more than 30 per cent in market value since February.

Meanwhile, among the ‘Magnificent 7’ stocks, Apple Inc. is also still 19 per cent below its value as at 19 February, while Amazon Inc. and Alphabet Inc. are nearly five per cent below the mid-February levels after each recovering by more than 20% from the lows of early April.

In contrast, Microsoft Corporation, which currently ranks as the world’s largest company by market capitalization with a value of USD3.56 trillion, increased by more than 15 per cent since 19 February to a fresh all-time high. Likewise, NVIDIA Corporation stands four per cent above the 19 February level after it staged an remarkable recovery of 50 per cent from the lows of early April. The market cap of Nvidia of USD3.53 trillion is only marginally below that of Microsoft.

The information technology sector was the clear driver of the recovery with other firms within the sector such as Broadcom Inc, Oracle Corporation, and Palantir Technologies Inc all registering double-digit growth in their share prices since February and a recovery of over 50 per cent since 8th April.

Despite the outstanding recovery of the S&P 500 index over the past two months, it is worth highlighting that between 19 February and mid-June, the US Dollar weakened by around 10 per cent when compared to the euro. As such, although the S&P 500 index has virtually fully recovered in US Dollar terms, for those investors who view their holdings in the US equity market in a portfolio based in euro, are still seeing a decline of circa 10 per cent. At times, currency movements can alter the performance of investment portfolios in meaningful ways.

Overall, the highly volatile performance witnessed in recent months is another clear reminder of the famous investing adage “time in the market beats timing the market.” While it is difficult to predict what will happen across financial markets within days or weeks, being invested for the long-term in a diversified portfolio has proven to provide positive returns over time.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers).

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Vision 2030 & 2050: A strategic lens on Malta’s tourism, hospitality, and leisure industries

Malta’s next challenge is not growth – but quality

From stability to strategy – The 2025 banking reset and the 2026 roadmap

Global markets closed 2025 on a strong note as AI-led equity gains

Strong year for European equities

European equity markets capped off 2025 with strong double-digit gains