APS Bank plc commenced the Q3 reporting period earlier this week confirming its increasing market presence across the retail banking sector. The September 2025 results published on Monday coincide with the €45 million rights issue currently taking place and the most-recent financial performance and trends provide some important indicators to shareholders as they deliberate the take-up of their rights entitlement.

Ever since its Initial Public Offering (IPO) in the first half of 2022, APS always provided detailed quarterly results which go beyond the minimum reporting requirements stipulated by the MFSA Capital Markets Rules. The other large market caps in Malta namely Bank of Valletta plc, Malta International Airport plc and HSBC Bank Malta plc also publish these important quarterly updates. Among the other smaller capitalised companies only MedservRegis plc has been consistent in providing quarterly financial updates to the market.

In early July 2025, in a communication to the market by the MFSA in its ‘Dear CEO Letter’ series, the regulator encouraged “issuers to provide more frequent and comprehensive updates to the market”. The MFSA explained that “this proactive approach not only reinforces investor confidence but also aligns with the principles of timely and accurate market disclosure”.

Within the context of this clear request by the MFSA for more frequent announcements by issuers, it would be important to note which of the other equity issuers take on this suggestion or whether they would prefer to stick to the minimum requirement of semi-annual financial reporting and publish their next financials for the period ending December 2025 by the end of April 2026.

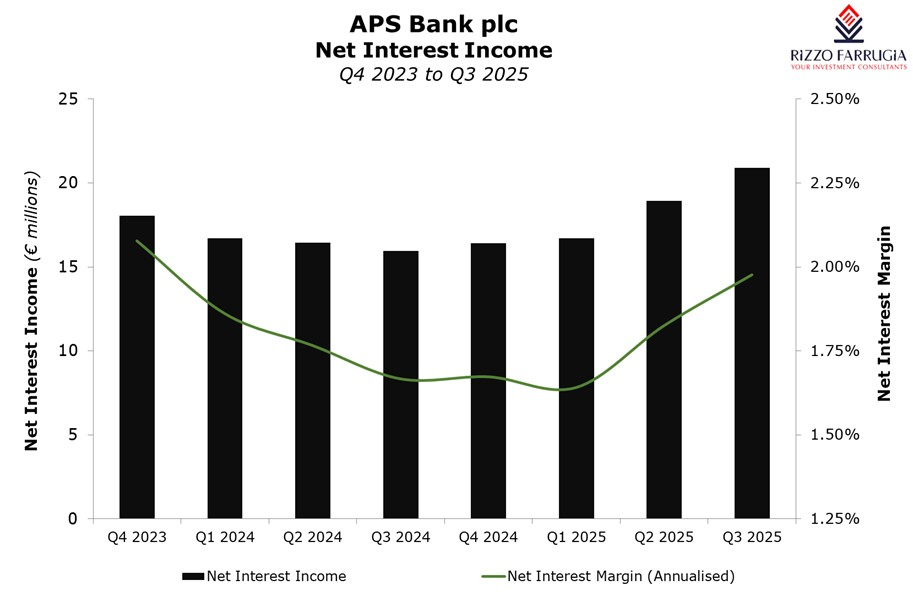

APS Bank reported that during the nine-month period ended 30 September 2025, net interest income rose by 15.1 per cent to €56.5 million with the net interest margin improving to just below the two per cent level compared to 1.65 per cent in September 2024. Moreover, net fees and commission income increased by 12.4 per cent to €7.2 million reflecting the general business growth across advances, investment services, cards, and transaction banking.

The APS Group registered a profit before tax of €17.8 million during the period from January to September 2025, which is 7.7 per cent higher than last year’s comparable figure of €16.5 million. More importantly, on a quarterly basis, the profit before tax in Q3 2025 of €8.65 million is 38 per cent above the previous quarter and the highest figure since Q2 2023 when it reached €8.8 million.

In a Market Briefing following the publication of the quarterly financial statements earlier this week, the CEO of APS Marcel Cassar expressed his confidence on the trajectory of profits in future reporting periods. In fact, he confirmed that the aim is to achieve quarterly profits before tax of between €9 million and €10 million. If this is achieved during the course of 2026, the return on equity would be in the region of 7.5 per cent to eight per cent which is very much in line with the return on average equity during Q3 2025 of 7.4 per cent.

Given the changes across the banking sector landscape, ongoing monitoring of the levels of loans and deposits across the main retail banks is important for all observers across the capital market.

Earlier this week, APS reported continued growth in its loan book with a market share of home loans edging higher to 25.5 per cent and an overall lending market share of 20 per cent. As at 30 September 2025, customer and syndicated loans grew to €3.42 billion.

Likewise, customer deposits grew to €3.91 billion translating into a loan-to-deposit ratio of 87.5 per cent. The CFO of APS Ronald Mizzi amplified on the deposit mix with ‘on-demand’ deposits amounting to €2.6 billion and accounting for 66 per cent of total deposits with the balance of 34 per cent representing term or fixed deposits. This is important since it lowers the cost of funding for the bank which leads to higher net interest income levels.

Similar to other very recent moves by GO plc and Bank of Valletta plc in the provision of non-life insurance, the CEO of APS also confirmed that the bank is close to announcing an agreement to provide general insurance solutions across its different platforms.

It is important to gauge the retail investor appetite for the APS rights issue following the evident fatigue in the bond market especially as a result of many media articles (including some factually incorrect iterations from some opinion writers) at a time of unprecedented bond issuance concurrently and ahead of some important bond redemptions in 2026 from companies faces very challenging times.

The demand for specific equity issuers from institutional and high net worth investors was very clear with the successful €29.8 million take-up in the placement exercise of APS’s rights issue. This augurs well for the bank’s evolving growth ambitions and possible consolidation efforts across the sector hopefully leading to a long-overdue wider recovery of equity market sentiment in Malta.

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Strengthening leadership for BNF Bank’s next phase of growth

Two senior Executive Committee appointments signal BNF Bank’s commitment to building a strong leadership foundation for sustainable growth

Revisiting the idea of privatising the Malta Stock Exchange

The involvement of international institutional investors is likely to result in a more liquid secondary market, notes Edward Rizzo

Further growth ahead for MIA

2025 was another record year for MIA, and 2026 will have the same fate