The Maltese banking sector was the main focal point of the important developments that dominated the capital market over recent weeks.

Among the three new bond issues that in the main represented exchange offers by two hospitality companies (namely AX Group plc and International Hotel Investments plc), there was also the initial tranche of €50 million in subordinated bonds by APS Bank plc that was very well received by the investing public. Moreover, there was an important corporate action by Lombard Bank Malta plc that had been planned for over a year since not all the required resolutions had been approved by shareholders at the Extraordinary General Meeting that took place in November 2022. Finally, there were three credit institutions among the five companies that issued updates on their financial performance during the third quarter of the year. These events shed light on important trends across the banking sector that are worth highlighting for the benefit of the investing public.

The information provided as part of the Q3 updates by the two largest credit institutions in Malta, namely Bank of Valletta plc and HSBC Bank Malta plc, continued to confirm the hugely beneficial impact of the rising interest rate environment on the profitability of these banks in particular. As indicated in some of my articles in the past, both these banks have high levels of liquidity with low loan to deposit ratios (BOV at 47.6 per cent and HSBC at 53 per cent as at 30 June 2023) thereby benefiting from a material increase in net interest income following the sharp rise in interest rates by the European Central Bank since the second half of 2022.

Mainly as a result of the elevated interest rate environment, BOV generated pre-tax profits of €163.5 million during the first nine months of 2023 which is significantly higher than the adjusted comparable pre-tax profits of €54.8 million in the same period last year. Likewise, HSBC Malta’s pre-tax profits surged to €100.8 million in the first nine months of 2023 compared to €32.9 million in the same period in 2022. In view of this material upturn in the profitability of both these banks, the return on equity (an important KPI for all companies) has moved back to double-digit levels after several years of very low returns generated by the banks during the prolonged period of low to negative interest rates across the eurozone.

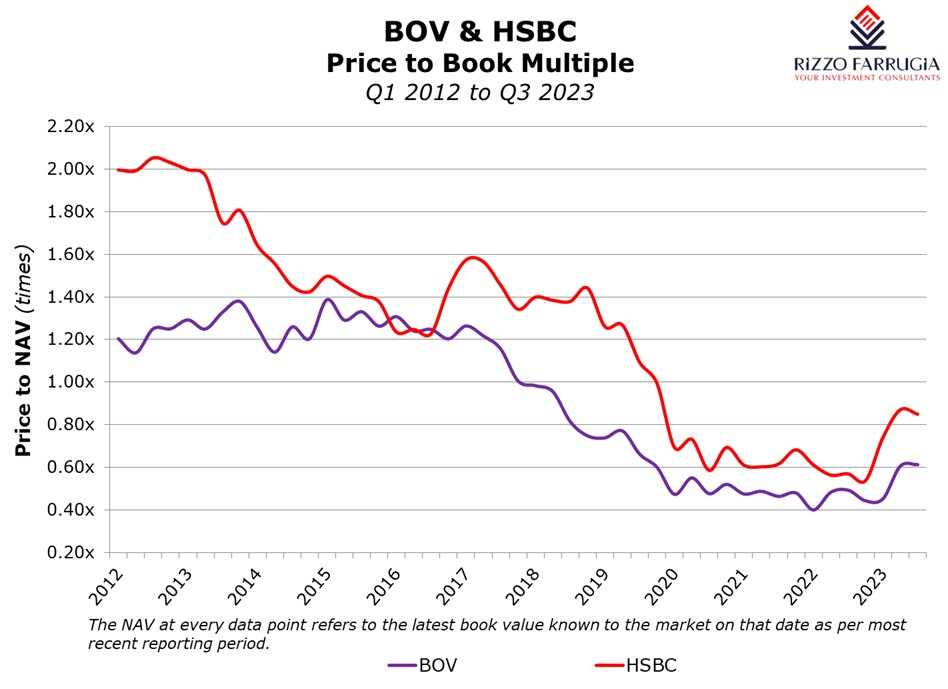

In view of the direct link between the interest rate environment and the profitability of these banks, one can easily predict with a good degree of certainty the full-year financial performance. With BOV’s pre-tax profits anticipated at circa €220 million for the year and HSBC Malta at circa €130 million, both banks are trading at a price to earnings multiple of circa 5 times – the lowest level in several years. Moreover, from a price to book value multiple, which is another important metric used across the capital markets, BOV is trading at a 40 per cent discount to its net asset value and HSBC Malta at a 16 per cent discount. The share prices of both BOV and HSBC are the clear outperformers so far this year with gains of over 50 per cent for BOV and over 60 per cent for HSBC. Their future performance would be largely dependent on whether the ECB maintains the current interest rate environment at such elevated levels also in the months ahead.

The clear strategy of APS Bank plc over recent years was that of gaining market share at a time of a very low interest rate environment that was detrimental to those banks maintaining high levels of liquidity. APS successfully increased its market share in the home loan market and corporate sector with the result that its loan to deposit ratio climbed towards the 90 per cent level very recently.

Although the current elevated interest rate environment is not as beneficial to APS when compared to its larger competitors due to the low level of liquidity and the higher pass-through of interest rate increases to depositors, the financial performance this year remains positive with pre-tax profits of €23.3 million during the first nine months of the year.

In view of the strong growth trajectory of APS and as a result of the continued need for additional capital, APS issued the first tranche of €50 million subordinated bonds as part of the debt issuance programme of a maximum of €150 million over a 12-month period. This bond issue at a coupon of 5.8 per cent was very positively received by the investing public and was closed well-before the end of the offer period.

The other major development across the banking sector was the long-awaited rights issue by Lombard Bank Malta plc. This had been the first issuance by the bank in a long number of years and the response by shareholders with respect to the sizeable capital injection of just over €46 million was eagerly anticipated. The result of the rights issue published on 30th October clearly indicates the weak response by numerous retail investors on the one hand but a strong response by the larger investors on the other hand possibly given the attractive rights issue price at a 50 per cent discount to the bank’s net asset value per share prior to the capital injection. The results indicated that out of the total entitlement of 61.8 million new ordinary shares that were being issued, just under 49.4 million (representing 80 per cent of the new shares on offer) were taken up by existing shareholders.

As contemplated in the prospectus, the resultant balance of 12.4 million shares (representing eight per cent of the overall total issued share capital of the bank after the rights issue) were offered to preferred applicants and new investors at the same price of 75c. While several existing shareholders shied away from the corporate action and let the rights lapse, this important shortfall totalling €9.3 million was quickly absorbed by new investors. In fact, last week the bank reported that this offering was oversubscribed with total demand reaching 17.2 million shares representing an oversubscription of 4.8 million shares (€3.6 million)

The banking sector is likely to continue to dominate the headlines in the months ahead in view of these recent developments and ahead of the full-year dividend announcements by the largest banks in March 2024.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers).

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Pioneering the 5th freedom: Enhancing research, innovation, and education in the single market and Malta’s role

Malta stands to gain significantly from the establishment of the 5th Freedom

Beyond numbers: Understanding the significance of pricing multiples for informed investing

Market participants may calculate financial metrics to take investment decisions following the end of the reporting season

Reinventing the single market: Strategic vision and bold reforms for Malta and Europe

Proposed reforms present significant opportunities and formidable challenges for our small island nation