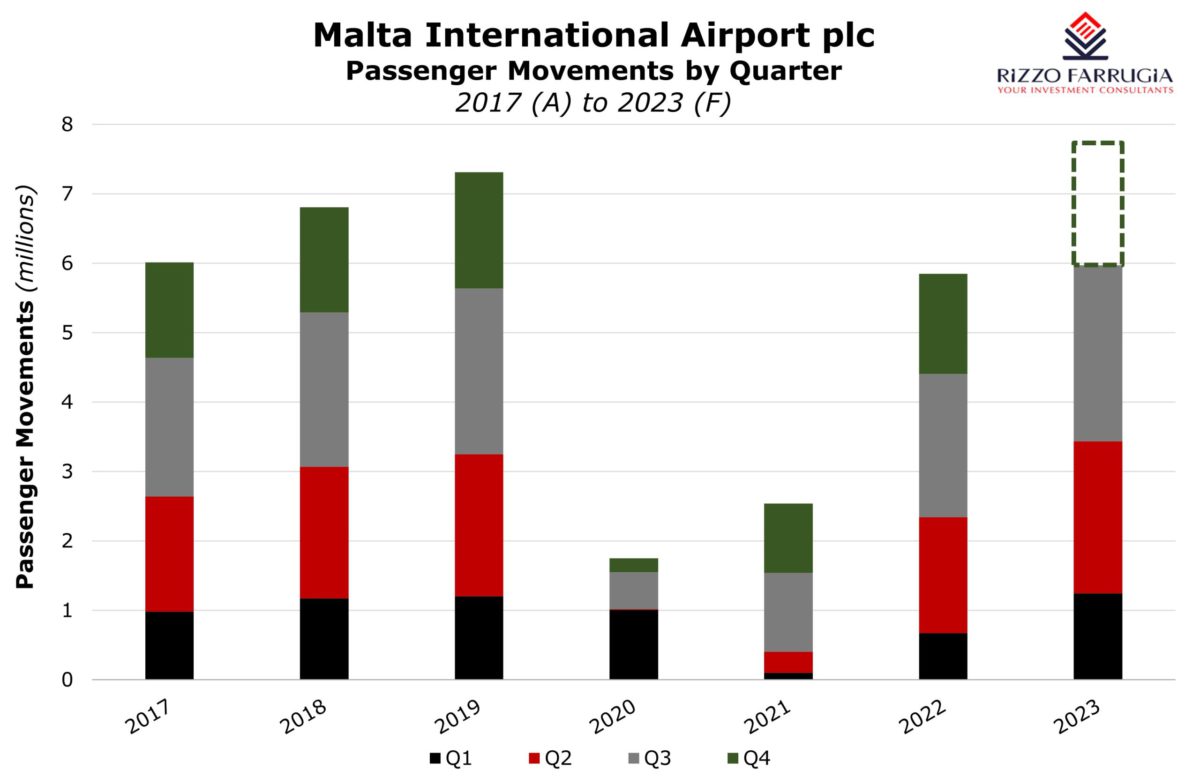

Earlier this month, Malta International Airport plc (MIA) published its traffic results for September 2023 showing in excess of 800,000 passenger movements for the third consecutive month. The third quarter of the year is always the most important for the airport operator due to the seasonality of Malta’s tourism sector generally accounting for over 30 per cent of annual passenger movements.

During September 2023, passenger movements amounted to 812,176 representing a growth of 6.5 per cent from the comparable figure of 762,361 registered in September 2019 and 23.3 per cent above the movements registered in the same month last year.

With over 800,000 passenger movements in each of the past three months, the total of 2.54 million during the third quarter of the year represents a growth of 6.7 per cent over the comparable figure of 2.38 million in Q3 2019.

Following the elevated number of passenger movements during the past three months and the importance of the Q3 figures to the annual figures of the airport operator, it is noteworthy to place this in the context of the projections provided by the company so far this year.

The latest guidance provided by MIA was on 1 August 2023 when they upgraded their 2023 forecast to 7.2 million passengers which was just below the previous record of 7.31 million in 2019 and 14 per cent higher than the 6.3 million original target set by MIA at the start of the 2023. However, given the performance to date with 5.97 million passenger movements during the first nine months of the year (6 per cent above the corresponding period in 2019 and 36 per cent above the passenger traffic recorded in the same period last year), it is highly likely that the airport operator will surpass their August guidance by a considerable margin and achieve a new record level of passenger movements.

In fact, if one assumes a five per cent growth above the passenger volumes of 1.67 million in Q4 2019, this would translate into 1.75 million passengers in the final three months of the year bringing the total to over 7.7 million. Naturally, if this figure is achieved, the financial forecasts published by the company also on 1 August would also be surpassed. At the time, MIA had projected that its total revenue would reach a new record level of €113 million; EBITDA was expected to rise to €70 million and net profit for 2023 was forecasted at €37 million.

In the coming weeks, MIA will also be publishing its financial performance for the first nine months of the year in line with the strategy of a number of companies to provide quarterly financial information to the market. One cannot exclude that the company will again upgrade their passenger and financial guidance following the very strong performance during the past few months.

The boom in passenger figures being recorded is excellent news for the thousands of MIA shareholders especially following the very challenging period during the pandemic when the company’s financial performance was naturally hit hard as passenger movements shrunk.

Earlier this year, the company restored dividends to shareholders with a distribution of €0.12 per share in respect of the 2022 financial year matching the record interim and financial dividend of 2019. Moreover, last month, MIA also resumed its semi-annual dividend policy as it distributed an interim dividend of €0.03 per share to all shareholders.

If the company maintains its dividend payout ratio at 60 per cent similar to the distribution for the 2022 financial year and in line with the policy of its parent company Flughafen Wien AG (Vienna Airport), MIA should distribute a total net dividend of €0.16 for the 2023 financial year based on the August 2023 projected net profit of €37 million. The profitability level could easily be exceeded in view of the stronger passenger movements registered more recently which could also lead to a higher final dividend early next year.

Despite the boom in passenger volumes and the resultant positive impact on the company’s financial performance, unfortunately the share price has failed to respond accordingly. In fact, while one would have expected the share price to move higher in recent months once the company restored dividends and also upgraded its passenger and financial forecast for this year, on the contrary the share price actually drifted lower to below €5.50 per share. The share price of MIA’s parent company listed on the Austrian Stock Exchange meanwhile has performed remarkably well over recent months and has jumped to fresh record levels on a regular basis thereby more than offsetting the sharp decline at the time of the pandemic.

Many investors in Maltese companies are continuously questioning the unresponsive nature across the local capital market by citing MIA as a prime example. The pricing anomaly is truly evident to most investors who rightly question the effectiveness of the market pricing mechanism in Malta. Although the economic environment has changed in a material manner over recent years, many observers correctly highlight that MIA’s share price in summer 2019 was firmly above €7.00 per share when passenger movements were rising to record levels of 7.3 million passengers. Meanwhile, there is ample evidence now that the company will surely exceed this passenger milestone, leading to an exceptionally strong financial performance for 2023. Despite these very positive indicators, MIA’s share price remains firmly anchored at around the €5.50 level leading to a material disappointment among the investment community.

I have yet to recall a time when investor sentiment across the Maltese capital market was at such a low level. Although many seasoned investors would rightly point out that the best time to enter the market is when sentiment is weak, it is also true that the very minimal trading activity and pricing anomalies across a number of companies is unfortunately alienating many investors towards Maltese companies. Stakeholders need to act fast to instil a dose of much-needed confidence across the capital market.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers).

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Pioneering the 5th freedom: Enhancing research, innovation, and education in the single market and Malta’s role

Malta stands to gain significantly from the establishment of the 5th Freedom

Beyond numbers: Understanding the significance of pricing multiples for informed investing

Market participants may calculate financial metrics to take investment decisions following the end of the reporting season

Reinventing the single market: Strategic vision and bold reforms for Malta and Europe

Proposed reforms present significant opportunities and formidable challenges for our small island nation