Earlier this week, Malta International Airport plc published its monthly traffic results showing a growth rate of 10.4 per cent in September. This was largely expected given the equally strong upturn in recent months especially in the peak summer period with 12 per cent growth in both July and August.

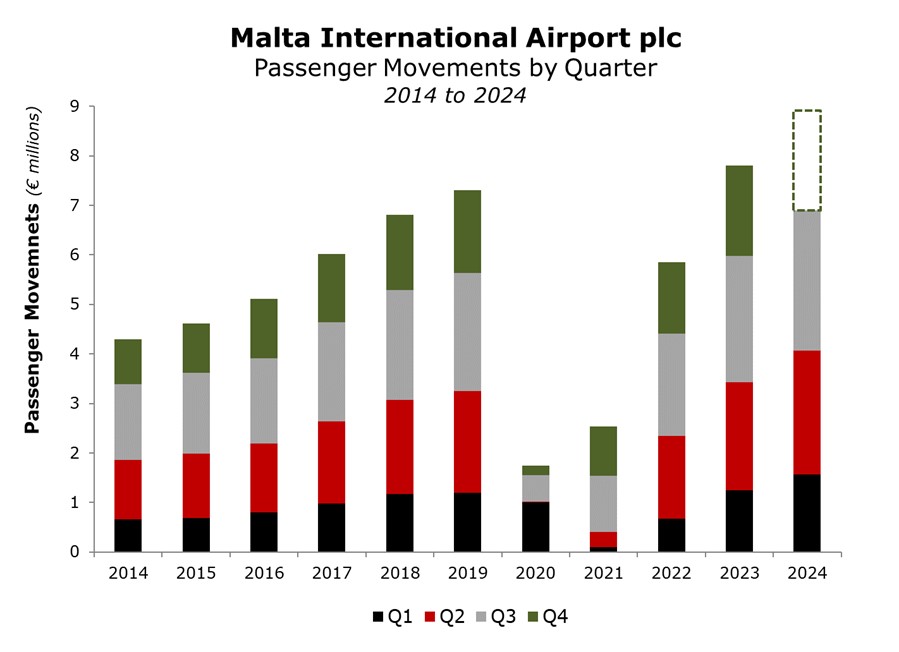

The publication of the September figures earlier this week completes the data for the third quarter of the year with passenger movements totalling 2.83 million. To place this into perspective, the passenger traffic in Q3 2024 is equivalent to the passenger movements registered during the entire year in 2006. Meanwhile, for a better comparison to more recent years, passenger traffic during Q3 2024 shows growth of 11.5 per cent over the previous record of 2.54 million last year and 18.7 per cent above the pre-COVID record of 2.38 million in summer 2019. These statistics portray the extent of passenger growth over the years with the exception when travel restrictions were in place during the pandemic between 2020 and 2022.

During the period from January to September 2024, total passenger movements amounted to 6.9 million, representing an increase of 15.5 per cent from the 5.97 million movements recorded in the same period last year. Here again, it is worth comparing this to previous years. The nine-month passenger traffic in 2024 of 6.9 million is superior to the annual passenger traffic of 2018 at 6.81 million.

Given the seasonality of the tourism season and the importance of the summer months to the entire calendar year, the data available to date gives sufficient comfort to draw revised conclusions on the outcome for the year and comparing this to the most recent guidance published by the airport operator in May 2024 when the company said it expected passenger movements in 2024 of 8.45 million.

With total passenger movements of 6.9 million during January to September 2024, an assumption of 10 per cent growth in passengers during each of the last three months of the year compared to the same months last year would result in overall traffic of 8.9 million passengers in 2024. This would equate to growth of 5.4 per cent from the May 2024 guidance and over 14 per cent above last year’s record of 7.8 million. Even if one were to assume no growth from last year in the final three months of the year, passenger movements in 2024 would equate to 8.73 million, which is above the May 2024 guidance of 8.45 million and representing an increase of 11.9 per cent over 2023.

Although the performance this year has been much better than expected following the very strong passenger growth in the third quarter of the year and the new milestone of nine million is firmly in sight as explained above, Ryanair’s announcement at the start of this year was a good eye-opener and a strong indication of the extent of the travel demand that they were experiencing.

In February 2024, the airline indicated that its foot traffic in Malta can potentially reach 4.5 million passengers between April 2024 and March 2025 representing a 25 per cent increase when compared to their passenger traffic in 2023. Given Ryanair’s market share in Malta at 46 per cent last year and rising further over recent months to above 50 per cent, this statement provided ample evidence that the nine million passenger forecast for MIA was indeed achievable during 2025.

Meanwhile, in recent days, in an interview with the local media in conjunction with the launch of additional routes to the island and increased frequencies on existing routes, the CEO of Ryanair provided updated information on the current traffic results. Ryanair is anticipating that it would be carrying 4.4 million passengers to and from Malta by the end of this year which would represent a remarkable increase of 24 per cent from last year.

Ryanair has been MIA’s largest carrier since 2016 and its passenger growth rate has been at a much faster pace than other airlines thereby increasing its market share very strongly. In 2023, Ryanair’s market share was 46 per cent which increased to 51 per cent in H1 2024.

While the nine million milestone is a remarkable achievement especially so soon after the sharp downturn in traffic due to the pandemic, other details provided in the recent media interview with the CEO of Ryanair indicate much brighter skies ahead for MIA. In fact, Ryanair’s CEO spoke very highly on travel demand to Malta “particularly in the shoulder, off-peak periods”. The CEO indicated that Ryanair aims to achieve eight million passenger movements to Malta by the early 2030’s. This would represent double-digit annual growth from Ryanair also in the years ahead.

As has become customary for the airport operator as part of its regular communication policy with the financial community, MIA will be publishing its Q3 financial results next month which will also give added insight into the record financial performance this year based on the passenger traffic until September. The company may also be issuing revised traffic and financial guidance once again to the market given the strong evidence of outperformance.

Although it is very difficult to estimate the overall passenger movements for the airport in the coming years, given Ryanair’s dominance across the European airline sector, it would be fair to assume that their market share will be increasing beyond the present level of 50 per cent. With Ryanair’s ambitious target of eight million passengers by 2030, it is also fair to say that the airport operator is well-placed to exceed the milestone of over 11 million passengers within this same time period.

The significant air terminal expansion project that was announced by the company would be necessary to support the continued growth in passenger movements.

While the positive impact from increased passenger volumes on the MIA’s financial performance is evident to all as a result of the company’s track record since its IPO in 2002, the additional financial benefit from the much larger rentable areas being created as part of the terminal expansion should be one of the main focal points by the investor community in the years ahead. Hopefully, during the course of 2025, MIA will provide further details on the overall terminal expansion project to gauge the revenue generating capabilities of the company beyond the contribution from passenger throughput.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers).

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Funding national projects

How can capital markets be used to diversify the funding sources of long-term national development projects

Malta’s earnings season

The importance of enhanced transparency, shareholder developments at HSBC Bank Malta, and broader capital market reforms

A chaotic start to 2026

Steady gains in January, but unprecedented swings in commodities, currencies and tech stocks