Last week PG plc published its interim financial results for the six-month period ended 31st October 2023. It was yet another record performance for the group on the back of double-digit growth across both business units. Revenue from the PAVI and PAMA supermarkets and retail operations grew by 20.3 per cent to €80.8 million while the Zara® and Zara Home® franchise operations generated an increase of 13.3 per cent in revenue to €15.4 million.

Overall, Group revenues surged by 19.1 per cent to €96.3 million during the six-month period ended 31st October 2023. The strong growth in revenue filtered to the bottom line with operating profit (EBIT) rising by 17 per cent to €10.9 million, pre-tax profits increasing by 18.6 per cent to €10.1 million and profits after tax increasing by 18.2 per cent to €7.2 million.

This time last year I had made reference to the compression in the operating profit margins which had been a strategic decision by the company especially within the supermarkets business as it opted to absorb an element of the cost price increases to maintain its competitiveness. This paid off handsomely as we saw a material increase in revenue during the second half of the 2022/23 financial year (between 1st November 2022 and 30 April 2023) and this continued in the subsequent six months.

More importantly, however, when analysing the latest financial statements published last week, it is evident that the company has managed to improve its operating margins when compared to the second half of the last financial year. This is a very important observation which should be welcomed by shareholders. The operating profit margin from the ‘Supermarkets & Associated Retail Operations’, the main revenue and profit contributor of the group, improved from 9.7 per cent in the second half of last year to 10.9 per cent in the past six months. Meanwhile, the operating profit margin of the ‘Franchise Operations’ remained stable at 13.3 per cent.

The double-digit growth in revenue from the PAVI and PAMA supermarkets coupled with the improved profit margins is an important signal ahead of the added competition within the sector expected in the coming months with the entry of another new hard discounter penetrating the Maltese market. The PAVI and PAMA supermarkets and shopping villages are clearly proving to be increasingly popular among the community as the Group’s growth in income is a result of higher footfall and more sales volumes, rather than an increase in unit prices.

In the light of this, the eventual extensions being planned on both sites could prove to be very important for the PG Group to continue to generate handsome returns for shareholders.

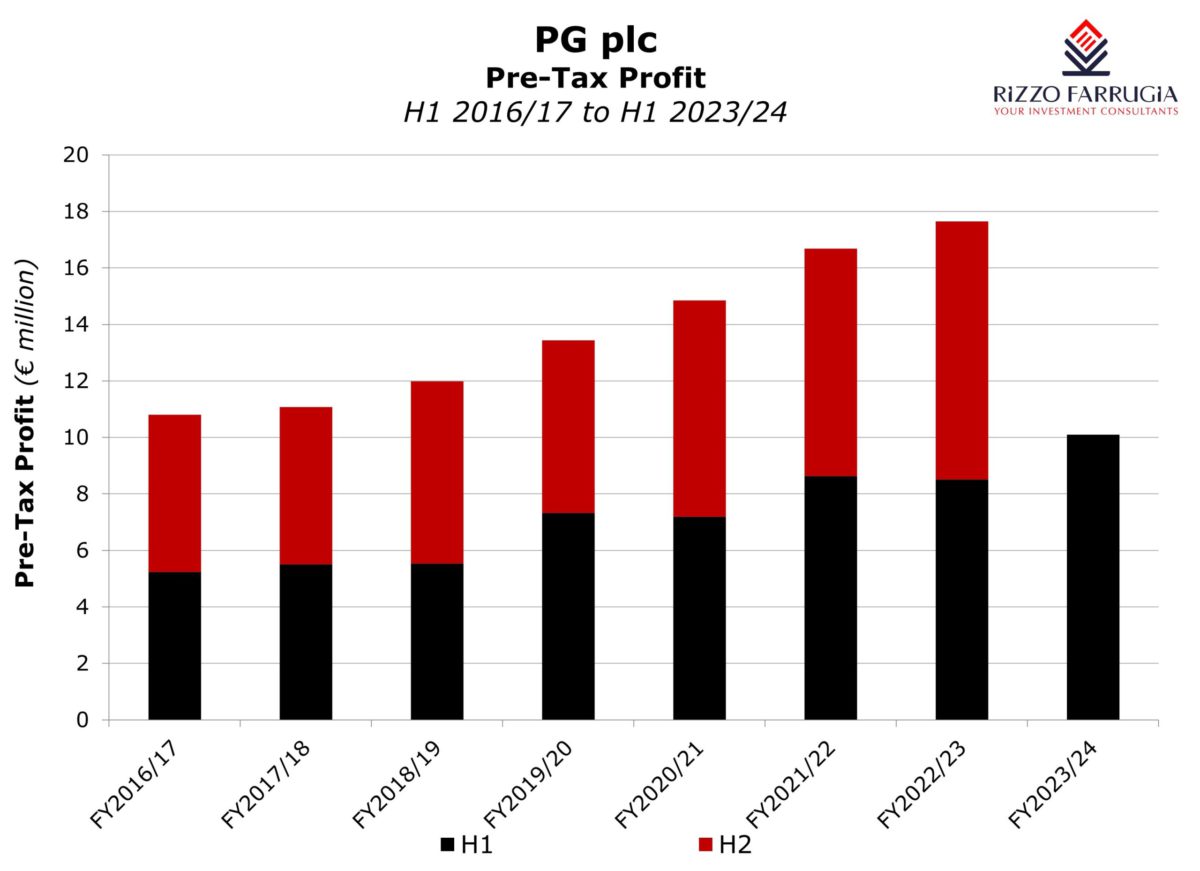

The return on equity has consistently remained above the 20 per cent level ever since the Initial Public Offering in the first half of 2017. PG’s profitability has almost doubled since the share offering almost seven years ago.

In fact, it is remarkable to note that the pre-tax profit of €10.1 million generated in the past six months (1st May to 31st October 2023) is almost equivalent to the full-year profit of €10.8 million in the 2016/17 financial year.

The strong annual cash generation also enabled the group to repay all bank borrowings despite also paying semi-annual dividends to shareholders.

In fact, PG Group repaid over €20 million in bank borrowings since the IPO in early 2017 despite some hefty investments including the large extension of the Zara® and Zara Home® flagship store in Sliema, the recent purchase of the concession for the land next to PAVI as well as the acquisition of the ex-pasta factory in close proximity to PAVI.

Since the IPO, PG’s policy has been to distribute dividends to shareholders semi-annually in July and December. However, differently to other companies listed on the Malta Stock Exchange, such dividends are announced separately to the publication of the semi-annual financial statements. The most recent dividend in respect of the first half of the 2023/24 financial year was declared on 29th November and paid on 11th December 2023. This amounted to €2.75 million (equivalent to a net dividend of €0.025463 per share), which is 22.2 per cent higher than the corresponding interim dividend paid out for the first half of the 2022/23 financial year.

In last week’s company announcement, PG’s Directors noted that it would be more challenging to improve on the performance of the second half of 2022/23 since this was a very strong period. However, they did concede that ‘early indications are positive’ and during a meeting for financial analysts held immediately after the publication of the financial statements, PG’s CEO remarked that the double-digit growth in revenue across the group has been maintained during the month of November and December. In fact, the recent dividend declaration showing a 22 per cent increase in the interim dividend is a clear sign of confidence on the upcoming reporting period.

Following the €10.1 million pre-tax profits generated during the first six months of the year and the general improvement in the second half of the financial year due to seasonality factors, one can easily conclude that PG will have another record performance during the current financial year ending 30th April 2024. In the meantime, hopefully PG can also report of further progress on added growth initiatives beyond the PAMA and PAVI extensions being envisaged. The debt-free balance sheet and consistently growing level of profits enables the group to expand beyond its current three operating assets.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers).

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Reinventing the single market: Strategic vision and bold reforms for Malta and Europe

Proposed reforms present significant opportunities and formidable challenges for our small island nation

The equity market in pre-COVID times

Investor sentiment has evidently failed to recover from the series of shocks since the start of 2020

Interest rate divergence ahead?

Inflation is falling faster than forecast in Europe, while exceeding expectations in the US